- South Africa

- /

- Insurance

- /

- JSE:OUT

Here's Why We Think OUTsurance Group (JSE:OUT) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in OUTsurance Group (JSE:OUT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide OUTsurance Group with the means to add long-term value to shareholders.

See our latest analysis for OUTsurance Group

How Fast Is OUTsurance Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that OUTsurance Group has managed to grow EPS by 25% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that OUTsurance Group's revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. The music to the ears of OUTsurance Group shareholders is that EBIT margins have grown from 15% to 19% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

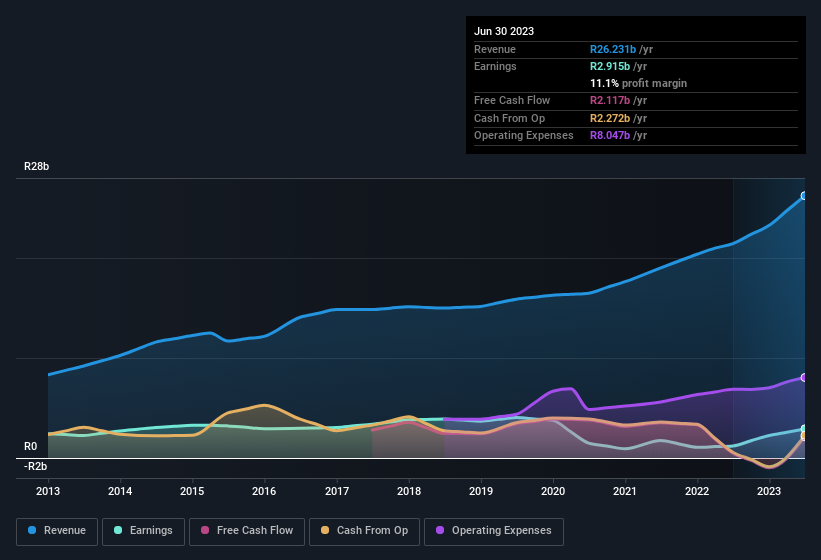

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for OUTsurance Group?

Are OUTsurance Group Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. OUTsurance Group followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have R289m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add OUTsurance Group To Your Watchlist?

For growth investors, OUTsurance Group's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Now, you could try to make up your mind on OUTsurance Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although OUTsurance Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Outstanding track record with excellent balance sheet.