- South Africa

- /

- Insurance

- /

- JSE:OMU

Benign Growth For Old Mutual Limited (JSE:OMU) Underpins Its Share Price

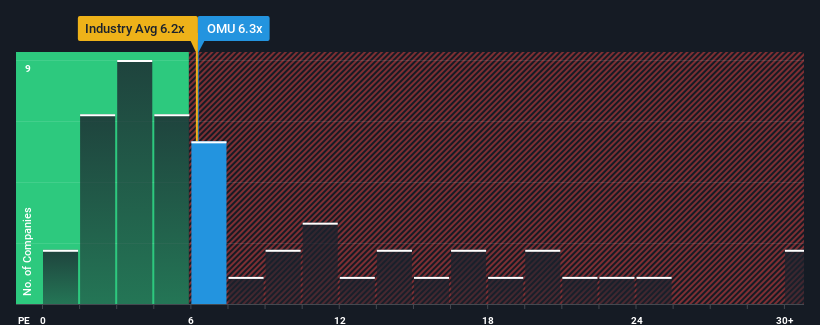

Old Mutual Limited's (JSE:OMU) price-to-earnings (or "P/E") ratio of 6.3x might make it look like a buy right now compared to the market in South Africa, where around half of the companies have P/E ratios above 9x and even P/E's above 13x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Old Mutual certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Old Mutual

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Old Mutual's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The strong recent performance means it was also able to grow EPS by 133% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 1.2% per annum as estimated by the seven analysts watching the company. With the market predicted to deliver 13% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Old Mutual is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Old Mutual's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Old Mutual has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OMU

Old Mutual

Provides financial services primarily in South Africa and rest of Africa.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success