- South Africa

- /

- Food

- /

- JSE:CKS

These 4 Measures Indicate That Crookes Brothers (JSE:CKS) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Crookes Brothers Limited (JSE:CKS) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Crookes Brothers

How Much Debt Does Crookes Brothers Carry?

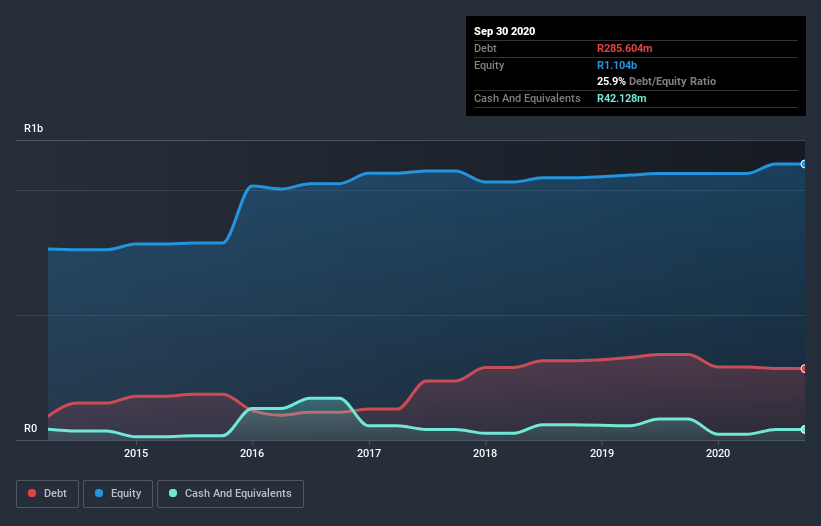

The image below, which you can click on for greater detail, shows that Crookes Brothers had debt of R285.6m at the end of September 2020, a reduction from R341.8m over a year. On the flip side, it has R42.1m in cash leading to net debt of about R243.5m.

How Strong Is Crookes Brothers' Balance Sheet?

According to the last reported balance sheet, Crookes Brothers had liabilities of R283.3m due within 12 months, and liabilities of R425.7m due beyond 12 months. Offsetting this, it had R42.1m in cash and R187.9m in receivables that were due within 12 months. So it has liabilities totalling R478.9m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of R686.7m, so it does suggest shareholders should keep an eye on Crookes Brothers' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Crookes Brothers has a quite reasonable net debt to EBITDA multiple of 1.7, its interest cover seems weak, at 2.3. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. Also relevant is that Crookes Brothers has grown its EBIT by a very respectable 24% in the last year, thus enhancing its ability to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Crookes Brothers will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Crookes Brothers saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say Crookes Brothers's conversion of EBIT to free cash flow was disappointing. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Crookes Brothers's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Crookes Brothers you should be aware of, and 1 of them is a bit unpleasant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Crookes Brothers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:CKS

Crookes Brothers

An investment holding company, engages in the agricultural business in South Africa, Eswatini, Zambia, and Mozambique.

Flawless balance sheet slight.

Market Insights

Community Narratives