- South Africa

- /

- Diversified Financial

- /

- JSE:SBP

Is Now The Time To Put Sabvest Capital (JSE:SBP) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sabvest Capital (JSE:SBP). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Sabvest Capital

Sabvest Capital's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Sabvest Capital's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Sabvest Capital's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Sabvest Capital shareholders can take confidence from the fact that EBIT margins are up from 86% to 88%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

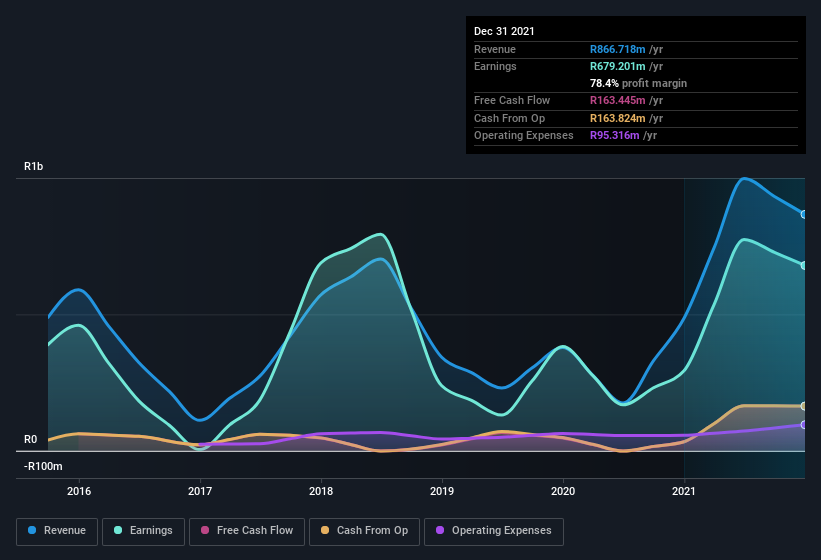

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Sabvest Capital isn't a huge company, given its market capitalisation of R3.2b. That makes it extra important to check on its balance sheet strength.

Are Sabvest Capital Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Sabvest Capital insiders spent R3.0m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Executive Director Leon Rood who made the biggest single purchase, worth R2.5m, paying R69.49 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Sabvest Capital will reveal that insiders own a significant piece of the pie. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at R1.4b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Sabvest Capital To Your Watchlist?

Sabvest Capital's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Sabvest Capital deserves timely attention. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Sabvest Capital shapes up to industry peers, when it comes to ROE.

The good news is that Sabvest Capital is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:SBP

Sabvest Capital

A private equity and venture capital firm specializing in early venture, mid venture, late venture, emerging growth, growth capital, special situation and management buyouts.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives