- South Africa

- /

- Diversified Financial

- /

- JSE:FSR

Is Now The Time To Put FirstRand (JSE:FSR) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like FirstRand (JSE:FSR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is FirstRand Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years FirstRand grew its EPS by 8.2% per year. That growth rate is fairly good, assuming the company can keep it up.

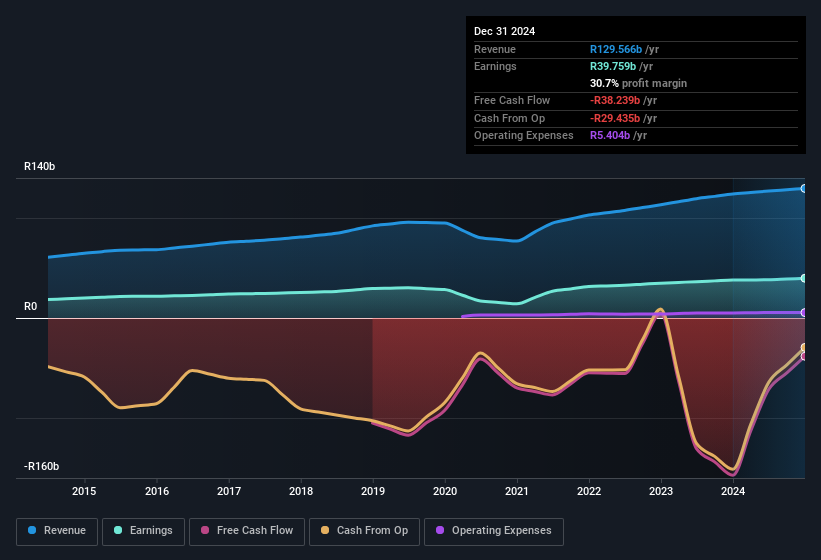

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that FirstRand's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. FirstRand maintained stable EBIT margins over the last year, all while growing revenue 4.6% to R130b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

See our latest analysis for FirstRand

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of FirstRand's forecast profits ?

Are FirstRand Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the R2.3m that Chief Executive Officer Aldermore Stephen Cooper spent buying shares (at an average price of about R66.50). Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, it's good to see that FirstRand insiders have a valuable investment in the business. With a whopping R1.3b worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Does FirstRand Deserve A Spot On Your Watchlist?

One positive for FirstRand is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. However, before you get too excited we've discovered 1 warning sign for FirstRand that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of FirstRand, you'll probably love this curated collection of companies in ZA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:FSR

FirstRand

Provides transactional, lending, investment, and insurance products and services in South Africa, rest of Africa, the United Kingdom, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives