- South Africa

- /

- Hospitality

- /

- JSE:SSU

Earnings Tell The Story For Southern Sun Limited (JSE:SSU) As Its Stock Soars 28%

Despite an already strong run, Southern Sun Limited (JSE:SSU) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 69% in the last year.

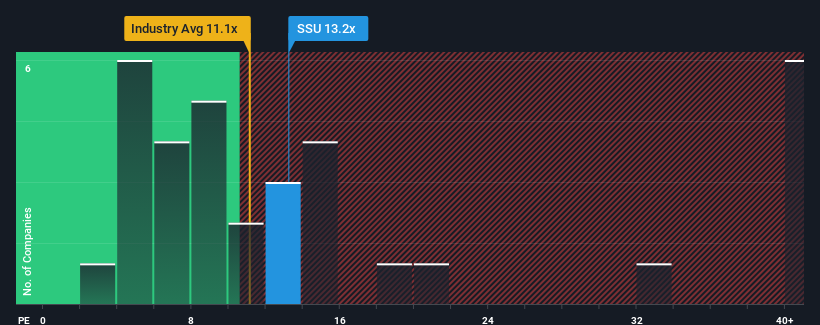

After such a large jump in price, Southern Sun's price-to-earnings (or "P/E") ratio of 13.2x might make it look like a sell right now compared to the market in South Africa, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Southern Sun certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Southern Sun

Does Growth Match The High P/E?

In order to justify its P/E ratio, Southern Sun would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 469% per annum as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we can see why Southern Sun is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Southern Sun's P/E?

The large bounce in Southern Sun's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Southern Sun's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Southern Sun with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:SSU

Southern Sun

Owns, leases, and manages hotels in South Africa, Mozambique, the Seychelles, Tanzania, the United Arab Emirates, and Zambia.

Proven track record with adequate balance sheet.