- South Africa

- /

- Consumer Services

- /

- JSE:ADH

Undiscovered Gems These 3 Small Caps with Strong Potential

Reviewed by Simply Wall St

As global markets celebrate the anticipated rate cuts by the Federal Reserve, small-cap stocks have notably outperformed their larger counterparts, reflecting a renewed investor confidence. Amid this positive sentiment, identifying promising small-cap stocks becomes crucial for investors looking to capitalize on potential growth opportunities. In the current market environment, a good stock is often characterized by strong fundamentals and resilience in economic downturns. With this backdrop, let's explore three small-cap companies that exhibit these qualities and hold significant potential for future growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Nofoth Food Products | NA | 32.10% | 35.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Fawry for Banking Technology and Electronic PaymentsE (CASE:FWRY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fawry for Banking Technology and Electronic Payments S.A.E. (ticker: CASE:FWRY) is a leading provider of electronic payment solutions and banking technology in Egypt, with a market cap of EGP25.96 billion.

Operations: Fawry generates revenue primarily from its Banking Technology and E-Payment Sector (EGP3.59 billion) and the Micro-Finance and Consumer Sector (EGP539.66 million).

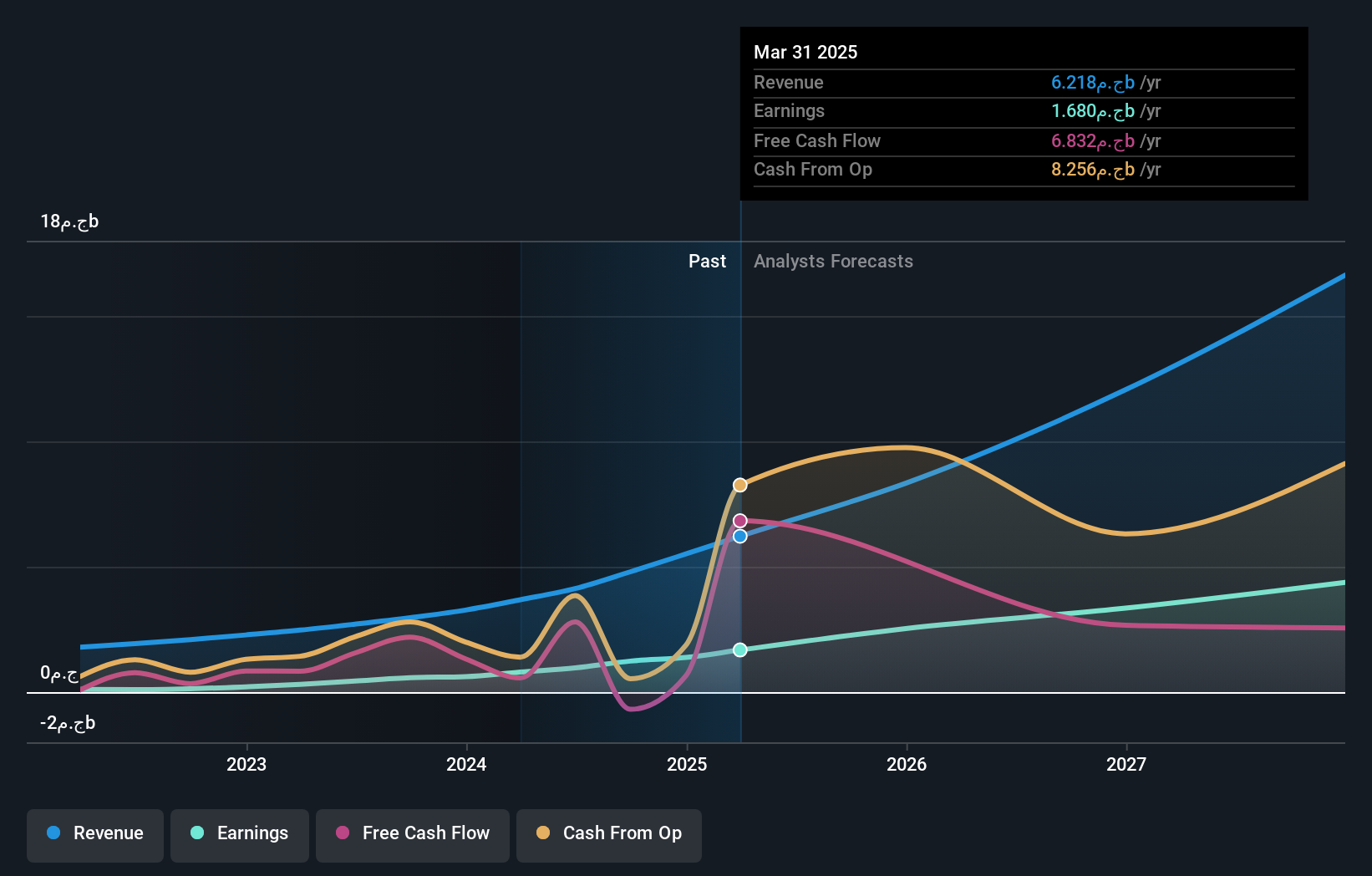

Fawry's earnings grew by 117.8% over the past year, surpassing the Diversified Financial industry’s 82.2%. The company reported second-quarter sales of EGP 1.21 billion and net income of EGP 321.68 million, up from EGP 768.47 million and EGP 159.77 million respectively a year ago. Over five years, its debt to equity ratio increased from 19.7% to 23.1%, while it remains free cash flow positive with more cash than total debt, suggesting strong financial health and growth potential.

- Click to explore a detailed breakdown of our findings in Fawry for Banking Technology and Electronic PaymentsE's health report.

Learn about Fawry for Banking Technology and Electronic PaymentsE's historical performance.

ADvTECH (JSE:ADH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADvTECH Limited operates in the education, training, and staff placement sectors across South Africa, other African countries, and internationally with a market cap of ZAR18.26 billion.

Operations: ADvTECH generates revenue primarily from its Tertiary segment (ZAR2.99 billion) and Schools in South Africa (ZAR2.81 billion), with additional contributions from Schools in the Rest of Africa (ZAR380.90 million) and Resourcing services within South Africa (ZAR228.90 million) and the Rest of Africa (ZAR1.45 billion).

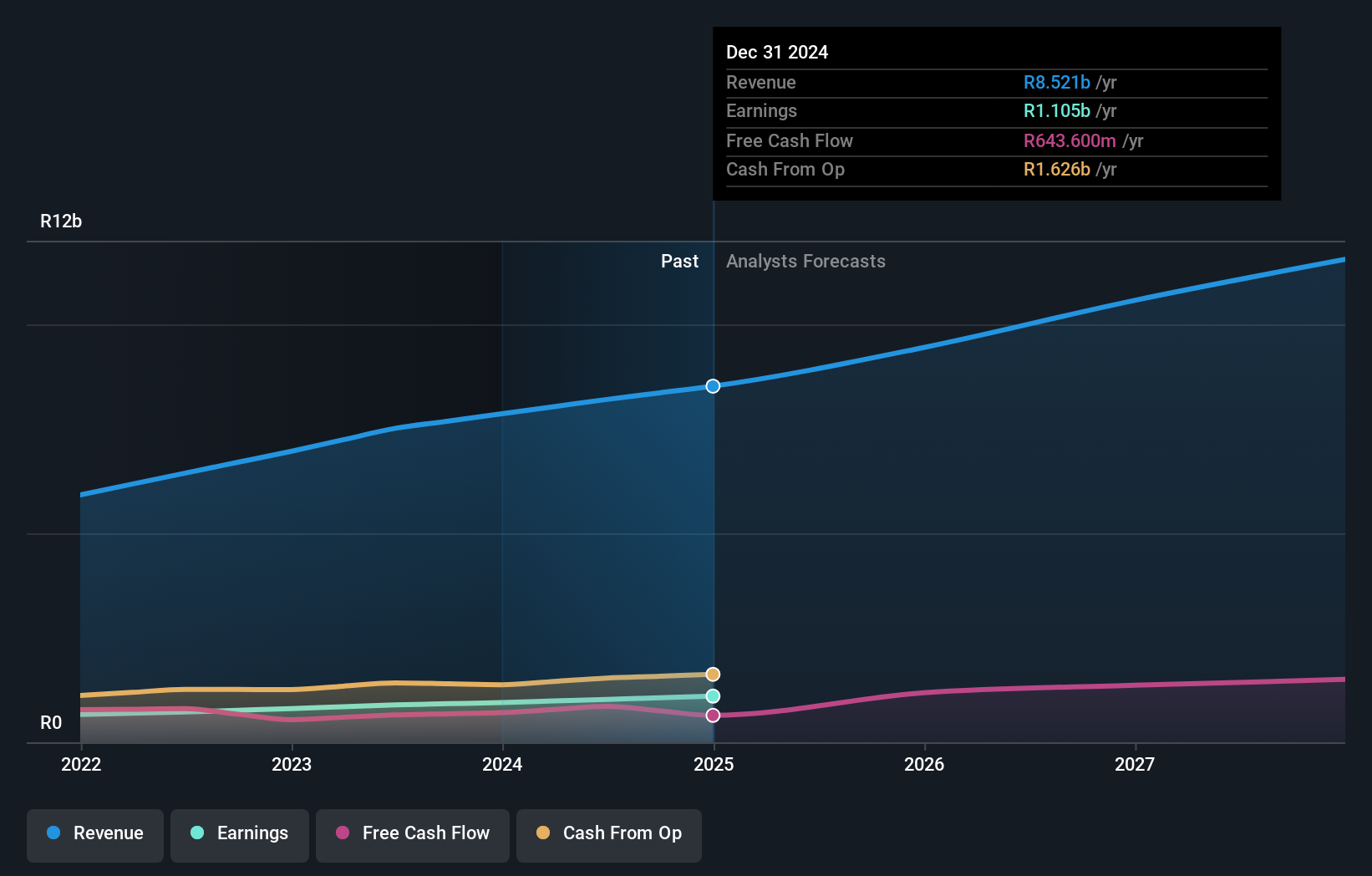

ADvTECH's recent half-year earnings report shows sales increased to ZAR 4.27 billion from ZAR 3.93 billion, while net income rose to ZAR 534.7 million from ZAR 459.5 million last year. The company declared an interim dividend of 38 cents per share, up from 30 cents previously. ADvTECH's net debt to equity ratio stands at a satisfactory 20.8%, and its EBIT covers interest payments by a comfortable margin of 8.1 times, reflecting robust financial health and growth potential in the education sector.

- Take a closer look at ADvTECH's potential here in our health report.

Gain insights into ADvTECH's historical performance by reviewing our past performance report.

Standard Bank (MAL:STANDARD)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Bank PLC offers banking and related financial services in Malawi, with a market cap of MWK1.13 billion.

Operations: Standard Bank PLC generates revenue primarily from interest income, fees, and commissions. The company reported a net profit margin of 25.7% in the most recent fiscal year.

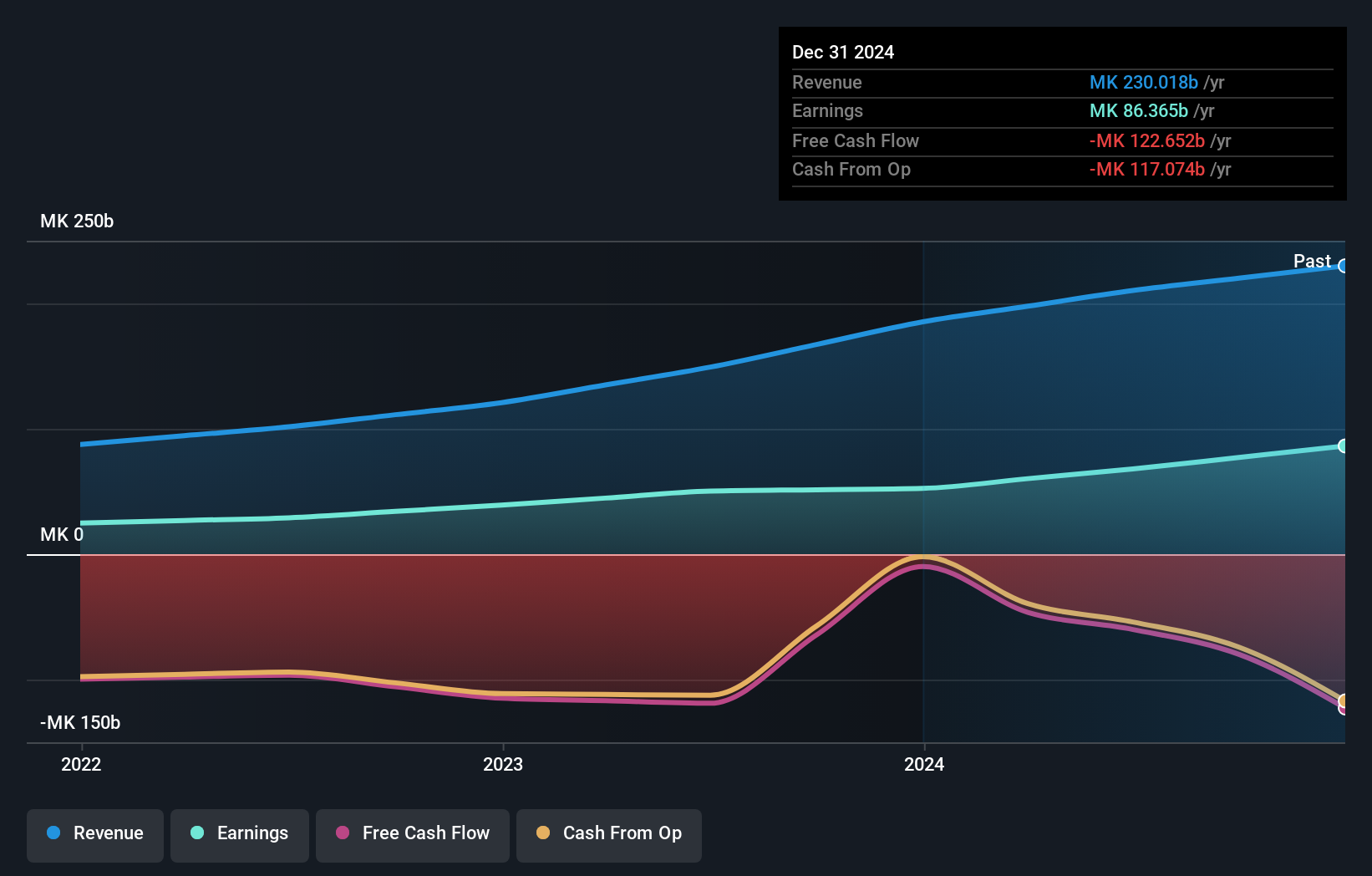

Standard Bank, with total assets of MWK1,228.4B and equity of MWK210.8B, has shown impressive earnings growth of 35.2% over the past year. The bank's bad loans are at an appropriate level (1.8%), supported by a sufficient allowance for bad loans (175%). Primarily funded through low-risk customer deposits (89% of liabilities), Standard Bank's shares remain highly illiquid despite its robust financial health and strong performance in the industry.

- Click here and access our complete health analysis report to understand the dynamics of Standard Bank.

Assess Standard Bank's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 4900 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:ADH

ADvTECH

Provides education, training, and staff placement services in South Africa and other African countries.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion