- South Africa

- /

- Professional Services

- /

- JSE:NTU

Shareholders in Nutun (JSE:NTU) have lost 89%, as stock drops 11% this past week

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Nutun Limited (JSE:NTU); the share price is down a whopping 96% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 79% in the last year. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Nutun has shed R180m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

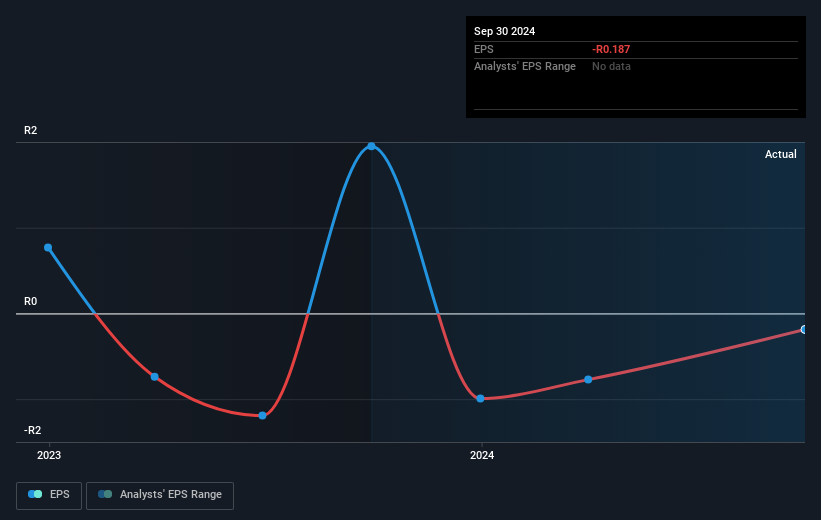

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Nutun saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Nutun's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Nutun's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Nutun shareholders, and that cash payout explains why its total shareholder loss of 89%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Nutun had a tough year, with a total loss of 40%, against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Nutun (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nutun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:NTU

Nutun

Through its subsidiary, Nutun Holdings Proprietary Limited, provides business process outsourcing solutions (BPO) in South Africa, Australia, the United Kingdom, and the United States.

Low risk and slightly overvalued.

Market Insights

Community Narratives