- South Africa

- /

- Industrials

- /

- JSE:HCI

Here's What To Make Of Hosken Consolidated Investments' (JSE:HCI) Decelerating Rates Of Return

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating Hosken Consolidated Investments (JSE:HCI), we don't think it's current trends fit the mold of a multi-bagger.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Hosken Consolidated Investments is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.093 = R4.5b ÷ (R52b - R3.9b) (Based on the trailing twelve months to March 2023).

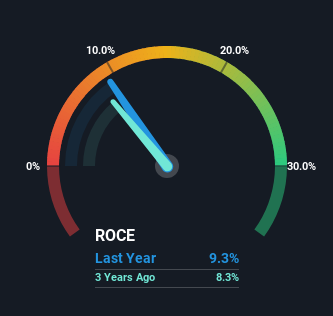

Therefore, Hosken Consolidated Investments has an ROCE of 9.3%. Ultimately, that's a low return and it under-performs the Industrials industry average of 15%.

View our latest analysis for Hosken Consolidated Investments

Historical performance is a great place to start when researching a stock so above you can see the gauge for Hosken Consolidated Investments' ROCE against it's prior returns. If you're interested in investigating Hosken Consolidated Investments' past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Hosken Consolidated Investments Tell Us?

We've noticed that although returns on capital are flat over the last five years, the amount of capital employed in the business has fallen 21% in that same period. This indicates to us that assets are being sold and thus the business is likely shrinking, which you'll remember isn't the typical ingredients for an up-and-coming multi-bagger. In addition to that, since the ROCE doesn't scream "quality" at 9.3%, it's hard to get excited about these developments.

What We Can Learn From Hosken Consolidated Investments' ROCE

Overall, we're not ecstatic to see Hosken Consolidated Investments reducing the amount of capital it employs in the business. Since the stock has gained an impressive 91% over the last five years, investors must think there's better things to come. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

If you want to continue researching Hosken Consolidated Investments, you might be interested to know about the 2 warning signs that our analysis has discovered.

While Hosken Consolidated Investments may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Hosken Consolidated Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:HCI

Hosken Consolidated Investments

An investment holding company, operates media and broadcasting, gaming, transport, properties, coal mining, and branded products and manufacturing businesses in South Africa, Other African countries, the Middle East, Europe, and the United Kingdom.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026