- South Africa

- /

- Machinery

- /

- JSE:BEL

We Ran A Stock Scan For Earnings Growth And Bell Equipment (JSE:BEL) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bell Equipment (JSE:BEL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Bell Equipment

Bell Equipment's Improving Profits

Over the last three years, Bell Equipment has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Bell Equipment's EPS soared from R3.00 to R4.78, over the last year. That's a commendable gain of 59%.

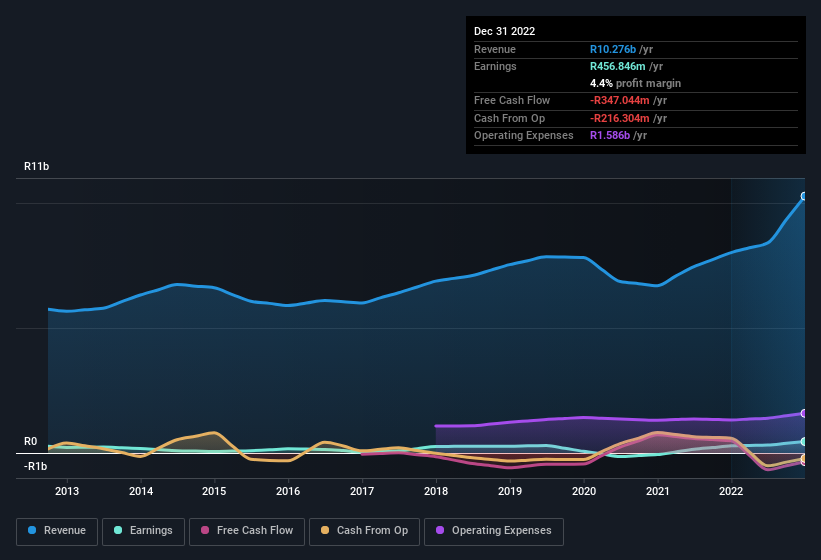

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Bell Equipment achieved similar EBIT margins to last year, revenue grew by a solid 28% to R10b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Bell Equipment is no giant, with a market capitalisation of R1.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Bell Equipment Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Bell Equipment shareholders is that no insiders reported selling shares in the last year. Add in the fact that Leon Goosen, the Group CEO & Executive Director of the company, paid R205k for shares at around R12.82 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Bell Equipment.

Does Bell Equipment Deserve A Spot On Your Watchlist?

You can't deny that Bell Equipment has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; Bell Equipment is a strong candidate for your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Bell Equipment that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bell Equipment, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Bell Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bell Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BEL

Bell Equipment

Manufactures, distributes, and supports a range of materials handling equipment in South Africa, Rest of Africa and Europe.

Flawless balance sheet and good value.

Market Insights

Community Narratives