Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bell Equipment (JSE:BEL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Bell Equipment

Bell Equipment's Improving Profits

In the last three years Bell Equipment's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Bell Equipment's EPS shot from R4.78 to R7.99, over the last year. It's a rarity to see 67% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

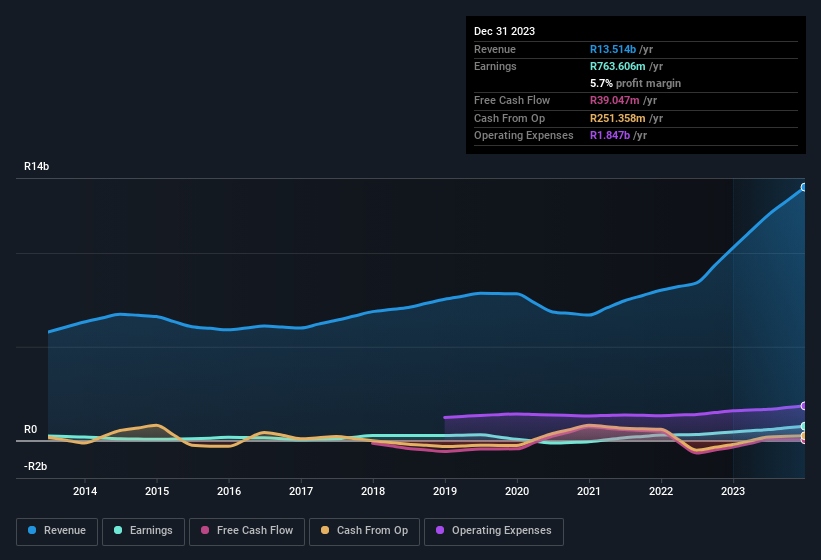

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Bell Equipment maintained stable EBIT margins over the last year, all while growing revenue 32% to R14b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Bell Equipment isn't a huge company, given its market capitalisation of R2.6b. That makes it extra important to check on its balance sheet strength.

Are Bell Equipment Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Bell Equipment in the previous 12 months. Add in the fact that Leon Goosen, the company insider of the company, paid R198k for shares at around R17.57 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Bell Equipment.

Recent insider purchases of Bell Equipment stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Bell Equipment with market caps under R3.8b is about R6.3m.

The CEO of Bell Equipment was paid just R559k in total compensation for the year ending December 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Bell Equipment To Your Watchlist?

Bell Equipment's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Bell Equipment may be at an inflection point. If so, then its potential for further gains probably merit a spot on your watchlist. Of course, profit growth is one thing but it's even better if Bell Equipment is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Keen growth investors love to see insider buying. Thankfully, Bell Equipment isn't the only one. You can see a a curated list of South African companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bell Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BEL

Bell Equipment

Manufactures, distributes, and supports a range of materials handling equipment in South Africa, Rest of Africa and Europe.

Flawless balance sheet and good value.

Market Insights

Community Narratives