- United States

- /

- Water Utilities

- /

- NYSE:WTRG

Essential Utilities (NYSE:WTRG) Eyes Growth with AI and New Markets Despite Financial Leverage Concerns

Reviewed by Simply Wall St

Navigate through the intricacies of Essential Utilities with our comprehensive report here.

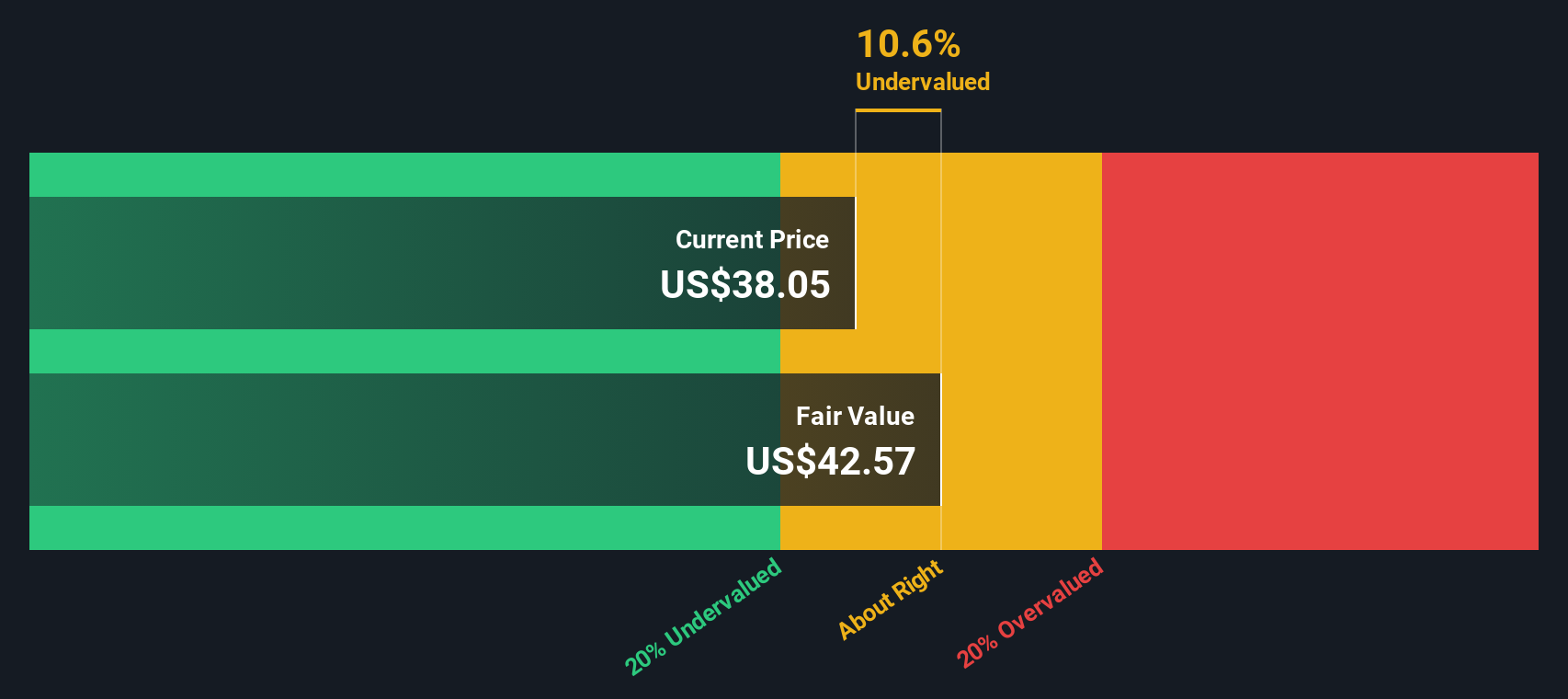

Competitive Advantages That Elevate Essential Utilities

Essential Utilities has demonstrated a commendable growth trajectory, with earnings increasing by 17.4% annually over the past five years. This growth, alongside an improved net profit margin of 27.8%, underscores the company's financial health. CEO Brian Dingerdissen highlighted a 15% rise in revenue, attributing it to strong demand in core markets. The company's commitment to innovation is evident, with a new product line receiving positive feedback and a 20% increase in adoption rates, as noted by COO Christopher Franklin. Additionally, stable dividend payments over the last decade enhance investor confidence, reflecting the company's reliable financial stewardship. Currently trading at $38.6, Essential Utilities is undervalued compared to the SWS fair ratio of $42.61, suggesting potential for appreciation.

Challenges Constraining Essential Utilities's Potential

The company faces certain financial constraints. Earnings growth of 14.3% over the past year aligns with the industry average, indicating room for improvement. The Return on Equity stands at a modest 8.8%, which is considered low, potentially impacting investor perceptions. Furthermore, the high net debt to equity ratio of 119.9% raises concerns about financial leverage and interest coverage, with EBIT covering interest payments only 2.4 times. Such financial metrics may hinder the company's ability to capitalize on emerging opportunities without strategic adjustments.

Growth Avenues Awaiting Essential Utilities

Looking ahead, Essential Utilities is poised for growth through strategic initiatives. The company is investing in AI technology to enhance operational efficiency and customer experience, as Franklin noted. Additionally, exploring geographical expansion into new markets presents opportunities for increased revenue streams. The upcoming product line launch is expected to diversify revenue sources and attract new customers, reinforcing the company's proactive approach to market expansion.

Competitive Pressures and Market Risks Facing Essential Utilities

However, the company must navigate several external challenges. Economic headwinds could impact consumer spending, necessitating vigilant risk management. Regulatory changes pose potential operational hurdles, requiring adaptability to maintain compliance. Supply chain vulnerabilities, highlighted by Franklin, remain a critical focus area, especially with global disruptions. These factors could influence the company's ability to sustain its market position and growth trajectory.

Conclusion

Essential Utilities has shown impressive financial health with a consistent 17.4% annual earnings increase over the past five years and a strong net profit margin of 27.8%. However, its modest Return on Equity of 8.8% and high net debt to equity ratio of 119.9% suggest financial leverage challenges that could impact future growth if not strategically managed. The company's investment in AI and geographical expansion presents promising growth opportunities, yet it must remain vigilant in managing economic and regulatory risks. Trading at $38.6, below the fair value estimate of $42.61, the company's current market price suggests room for appreciation, offering potential value for investors despite its higher-than-average Price-To-Earnings Ratio.

Summing It All Up

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Essential Utilities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WTRG

Essential Utilities

Through its subsidiaries, operates regulated utilities that provide water, wastewater, and natural gas services in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives