- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (VST): Assessing Valuation After Recent Stock Volatility

Reviewed by Simply Wall St

Vistra (VST) has been in the spotlight, catching the interest of investors after its recent stock swings. While there is no specific news event driving the move, the price action itself is raising questions about whether this is a shift in market sentiment or simply normal volatility. This kind of movement can prompt shareholders to take a closer look at what is happening beneath the surface, especially for those debating whether to buy, hold, or move on.

Over the past year, Vistra's stock has jumped an impressive 124%. That surge is grabbing attention, but it has not been all smooth sailing. Over the past month, the price has pulled back by about 5%. Even with this recent dip, the broader picture remains: momentum has been strong this year, and Vistra has posted healthy revenue and profit growth. Other companies in the utilities space have not matched these kinds of returns, which makes Vistra stand out among its peers.

After this remarkable run, it is natural to ask whether the market has already factored in all of Vistra's potential or if there is still room for investors to benefit from future growth.

Most Popular Narrative: 12.4% Undervalued

According to community narrative, analysts see Vistra as undervalued relative to their estimate of its fair value. They highlight strong potential for future growth and profitability under current market dynamics.

Accelerated diversification into grid-scale battery storage and renewable projects, leveraging existing sites and interconnects, positions Vistra to capture growth from rising demand for grid flexibility and reliability services as well as support for decarbonization. This approach broadens future revenue streams and contributes to improved net margins.

Curious how analysts arrive at this bullish fair value? The narrative points to a mix of surging revenues, ambitious margin milestones, and a future profit multiple that rivals other industry leaders. Want to know what is fueling these high expectations for earnings expansion? The full story reveals bold forecasts and surprising assumptions driving this valuation target.

Result: Fair Value of $217.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including Vistra's continued reliance on fossil fuel assets as well as the financial pressures that could come with rapid expansion and elevated debt levels.

Find out about the key risks to this Vistra narrative.Another View: Challenging the Fair Value

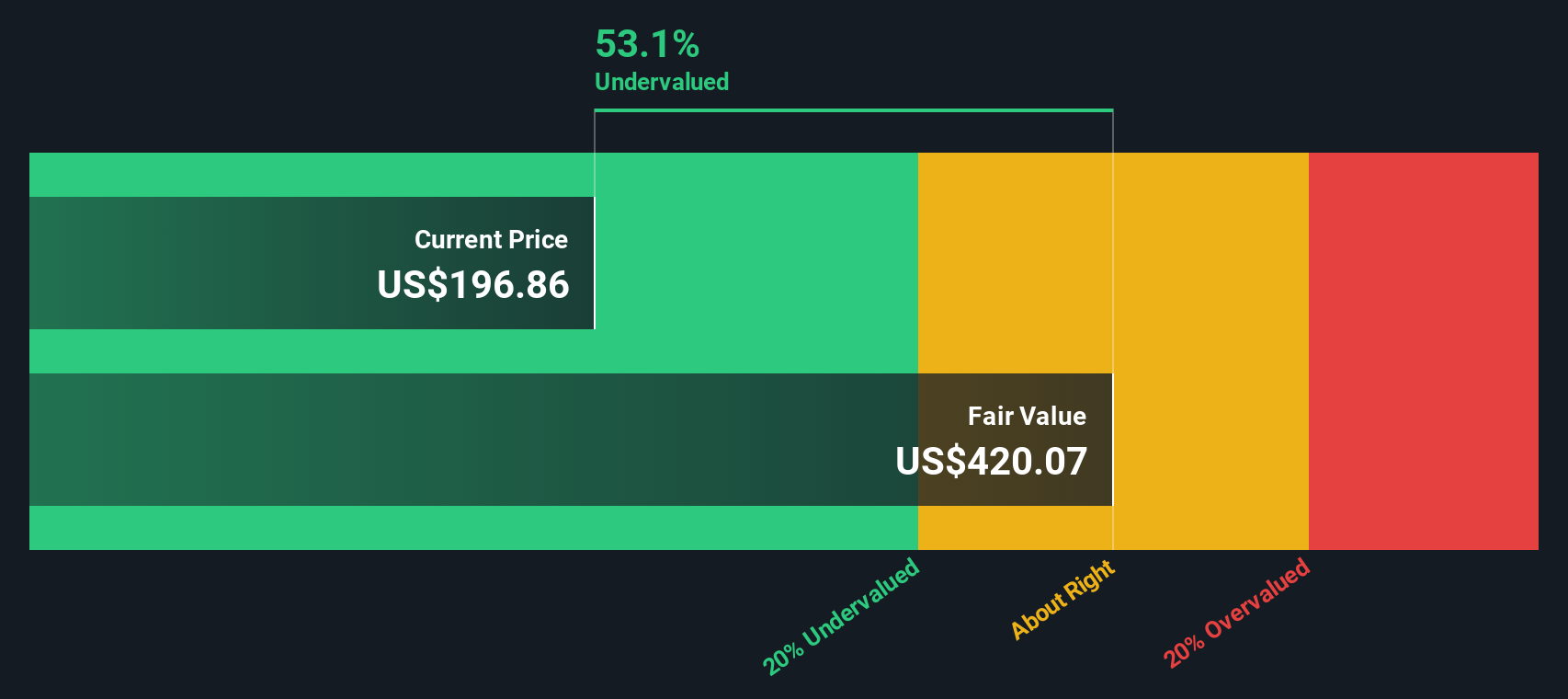

Looking from a different angle, the SWS DCF model also suggests Vistra’s shares are trading well below their estimated worth. However, it is worth considering whether this model might overlook certain risks or unforeseen industry shifts.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vistra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vistra Narrative

If you have a different perspective or want to dig deeper on your own, you can easily create a personal narrative using the data in just a few minutes. So why not do it your way?

A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great investors look beyond just one opportunity. If you want to uncover remarkable stocks that fit your financial goals, the Simply Wall Street Screener puts powerful tools at your fingertips. Don’t miss the chance to spot tomorrow’s winners and sharpen your strategy with expert-built ideas tailored to what matters most to you.

- Target steady portfolio growth by scanning for dividend stocks with yields > 3%. This brings proven income potential and above-average yields right to your shortlist.

- Spot the hottest opportunities in transformative healthcare by surfing through healthcare AI stocks. This gives you access to innovators using AI to revolutionize medicine and patient care.

- Zero in on companies making big strides in affordable pricing by searching for undervalued stocks based on cash flows. This helps you find tomorrow’s value standouts before the crowd catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion