- United States

- /

- Renewable Energy

- /

- NYSE:VST

Is There Still Opportunity in Vistra After a 766% Three Year Surge?

Reviewed by Bailey Pemberton

- Curious if Vistra is truly undervalued, or if the recent run-up has left the stock priced for perfection? Let’s dig in and see what’s really going on beneath the headlines.

- Despite a 6.6% pullback over the past month, Vistra stock has soared 25.8% year-to-date and delivered an incredible 766.4% return over the past three years.

- Recent news has focused on Vistra’s expanding role in the domestic energy market and their push into renewable power generation. This has contributed to both bullish sentiment and increased volatility. Several analyst upgrades have also highlighted long-term demand growth, adding to speculation around the company’s future.

- With a value score of 4 out of 6, there is plenty to unpack, from traditional multiples to more forward-looking models. Let’s break down how the numbers stack up, and stay tuned for a fresh perspective on valuation you won't want to miss at the end.

Approach 1: Vistra Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model calculates a company’s intrinsic value by estimating its future cash flows and discounting them back to the present. This process gives investors a sense of what the business is fundamentally worth today.

For Vistra, the current Free Cash Flow stands at $1.47 billion, which serves as a healthy baseline for future projections. Over the next decade, analysts anticipate significant growth in Free Cash Flow, with projections reaching $5.89 billion by 2029. Simply Wall St’s extrapolations continue this upward trajectory toward $9.0 billion by 2035. The first five years of projections are based on analyst estimates, while years beyond that rely on model-based assumptions.

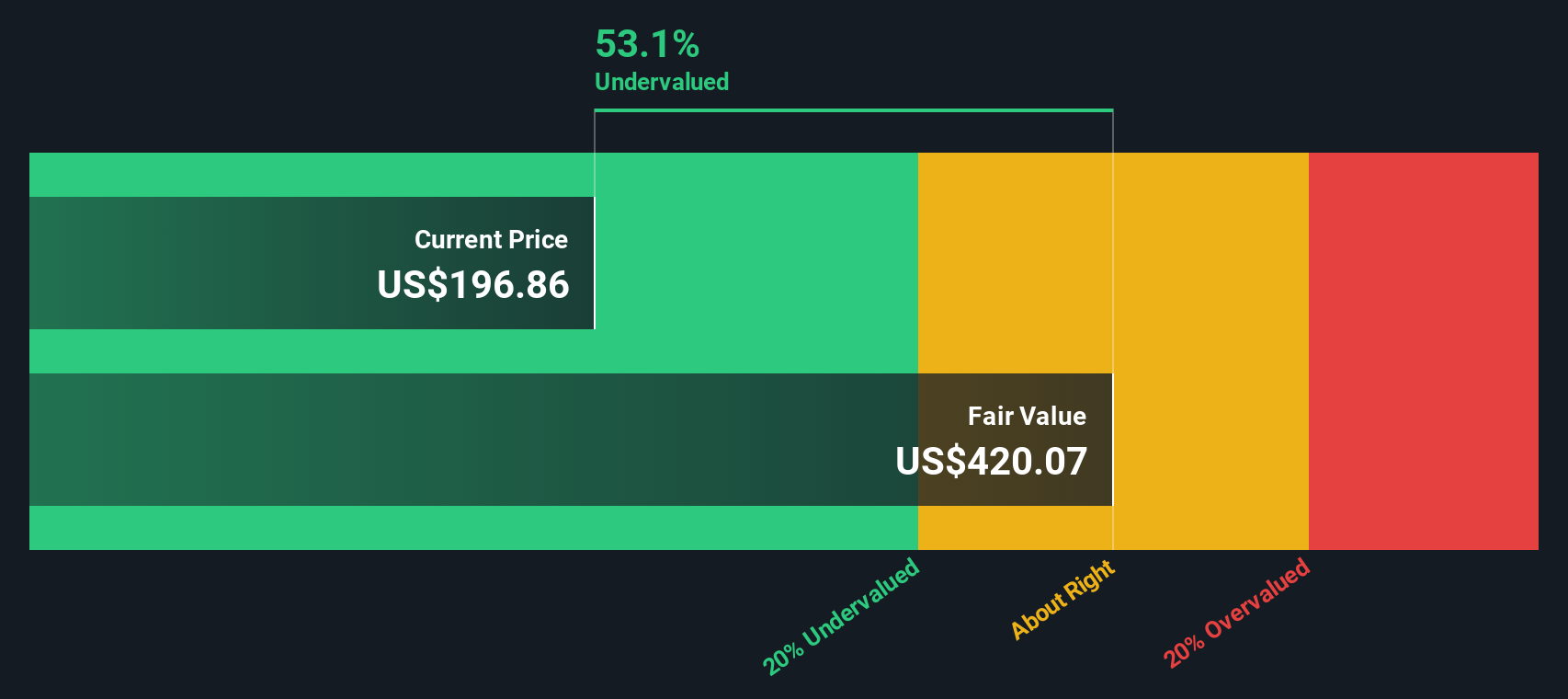

Based on this DCF analysis using the 2 Stage Free Cash Flow to Equity model, Vistra’s estimated intrinsic value is $411.47 per share. With the current share price at just under half that value, the model implies the stock is trading at a steep 54.2% discount.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vistra is undervalued by 54.2%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Vistra Price vs Earnings

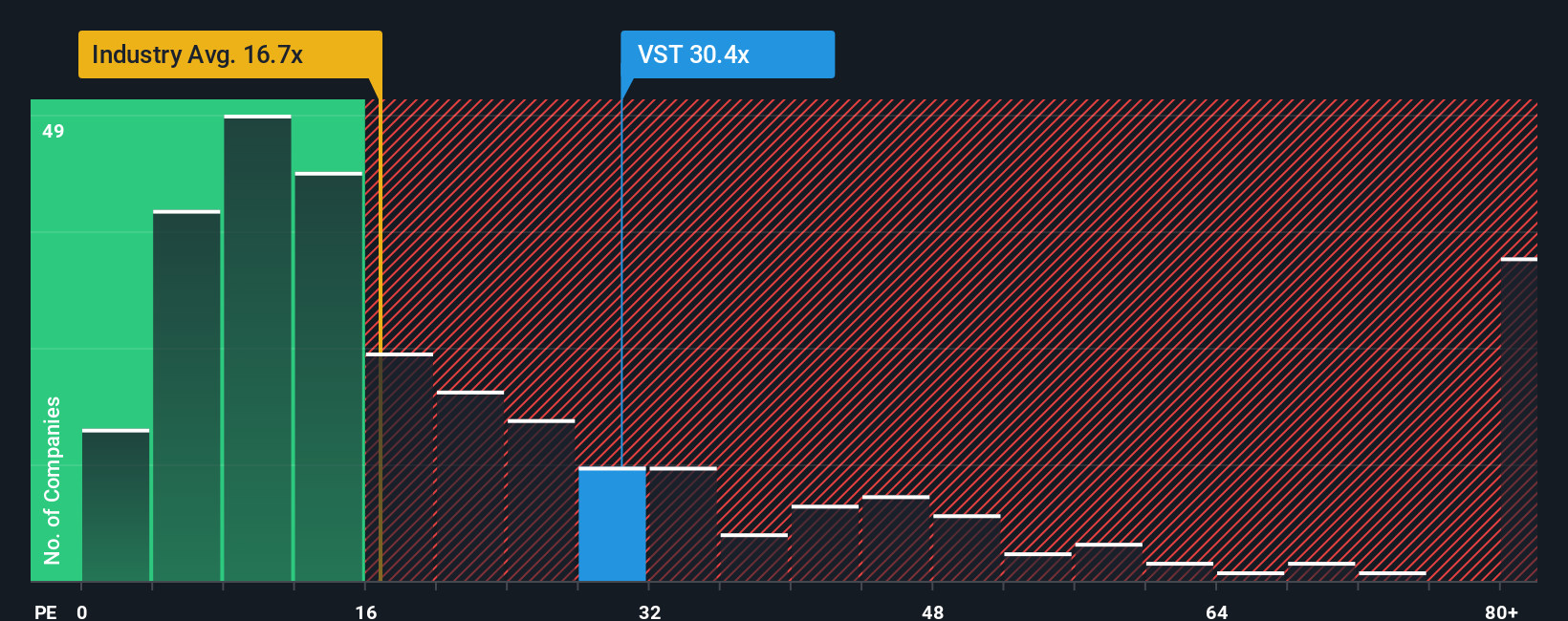

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Vistra because it relates the company’s market value directly to its earnings, providing a straightforward gauge of investor expectations. For businesses generating steady profits, the PE ratio can offer a clear comparison point for both industry and market-wide standards.

However, what qualifies as a “normal” or “fair” PE ratio varies. Investor appetite for growth, perceived risks, and even industry-specific trends can shift what is considered reasonable. Lower growth or higher risk companies usually warrant lower PE ratios, while faster-growing or safer companies can command higher multiples.

Vistra currently trades at a 29.05x PE ratio. Compared to the Renewable Energy industry average of 17.31x, and a peer group average of 35.89x, Vistra sits somewhere in the middle. This suggests stronger growth prospects than the average renewable energy stock, but at a more moderate price than its direct peers.

To dig deeper, Simply Wall St’s Fair Ratio metric gives us a more tailored benchmark. The Fair Ratio for Vistra is 41.83x, which factors in the company’s earnings growth outlook, profit margins, industry characteristics, and overall risk profile. Unlike simpler peer or industry comparisons, the Fair Ratio provides a context-driven expectation by considering what matters most to the business and its shareholders.

With Vistra’s PE ratio well below the Fair Ratio, the numbers suggest the stock remains attractively priced for its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vistra Narrative

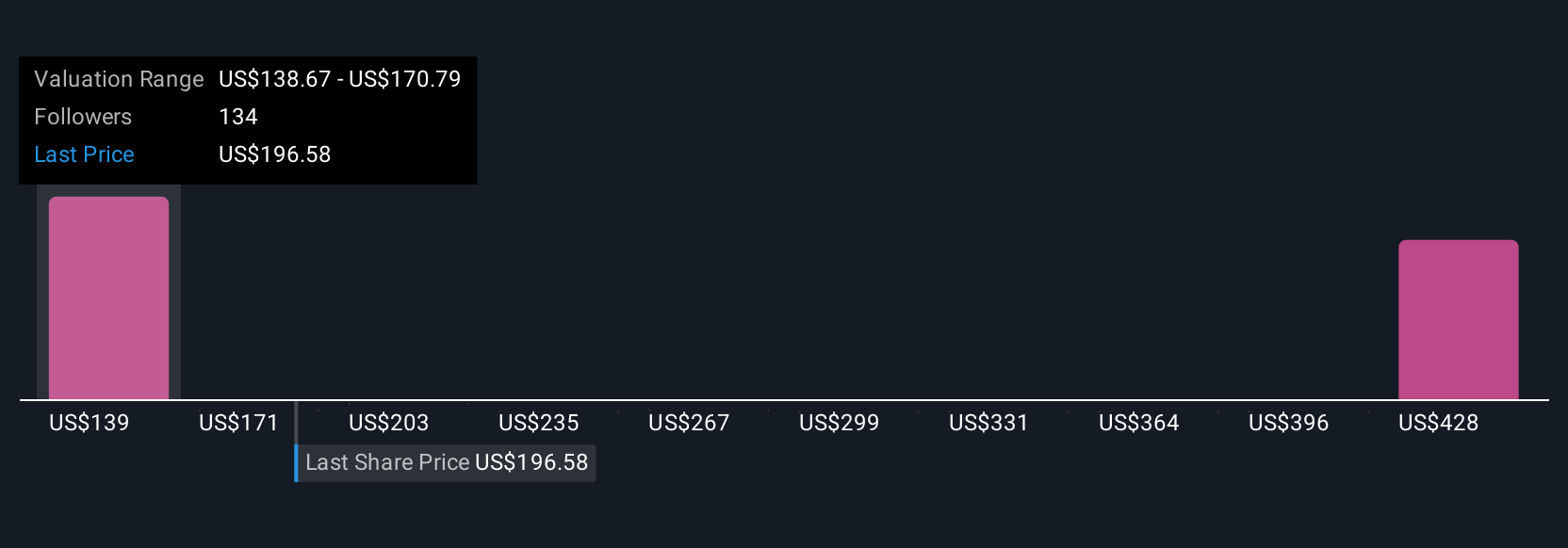

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story—a way to express how you see a company's future, including your own assumptions about future revenue, profit margins, and what you think is a fair value for the shares.

With Narratives, you link your perspective on Vistra’s competitive strengths, growth opportunities, and risks directly to a financial forecast and a resulting fair value. This makes the numbers personal and helps you see if your view lines up with what the market is pricing in today.

On Simply Wall St’s Community page (used by millions), anyone can create or explore Narratives to make investment decisions more transparent and collaborative. When you set your expectations, Narratives will instantly compare your Fair Value to the current share price, helping you spot buying opportunities or identify when it might be time to sell.

Narratives are always up to date. As soon as fresh news or earnings are released, the numbers and conclusions refresh so your decisions are based on the very latest data.

For Vistra, some investors expect as much as $261 per share (assuming aggressive demand and margin expansion), while more cautious users estimate fair value around $164.50. The narrative you choose really does shape your investment path.

Do you think there's more to the story for Vistra? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives