- United States

- /

- Renewable Energy

- /

- NYSE:VST

Is Now the Right Time to Reassess Vistra After 16% Rally and Renewable Expansion?

Reviewed by Bailey Pemberton

- Thinking about whether Vistra is priced right? You are not alone. With so many moving parts, it is natural to wonder if now is the perfect time to buy, hold, or walk away.

- The stock has put up some dramatic numbers, soaring 16.0% year-to-date despite losing 7.8% in the last 30 days. It is also up an eye-catching 925.1% over five years.

- Vistra has recently made headlines with its expansion into renewable energy and acquisitions in battery storage, fueling conversations among investors and analysts. These strategic moves are seen as significant drivers behind both the recent surge and volatility in the stock price.

- When it comes to valuation, Vistra currently scores a 2 out of 6 on our valuation checklist, hinting at room for improvement. Let us look at how that score was calculated through different valuation methods and why the real story might go even deeper by the end of this article.

Vistra scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vistra Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach is often used to evaluate how much a business is truly worth based on its ability to generate cash in the years ahead.

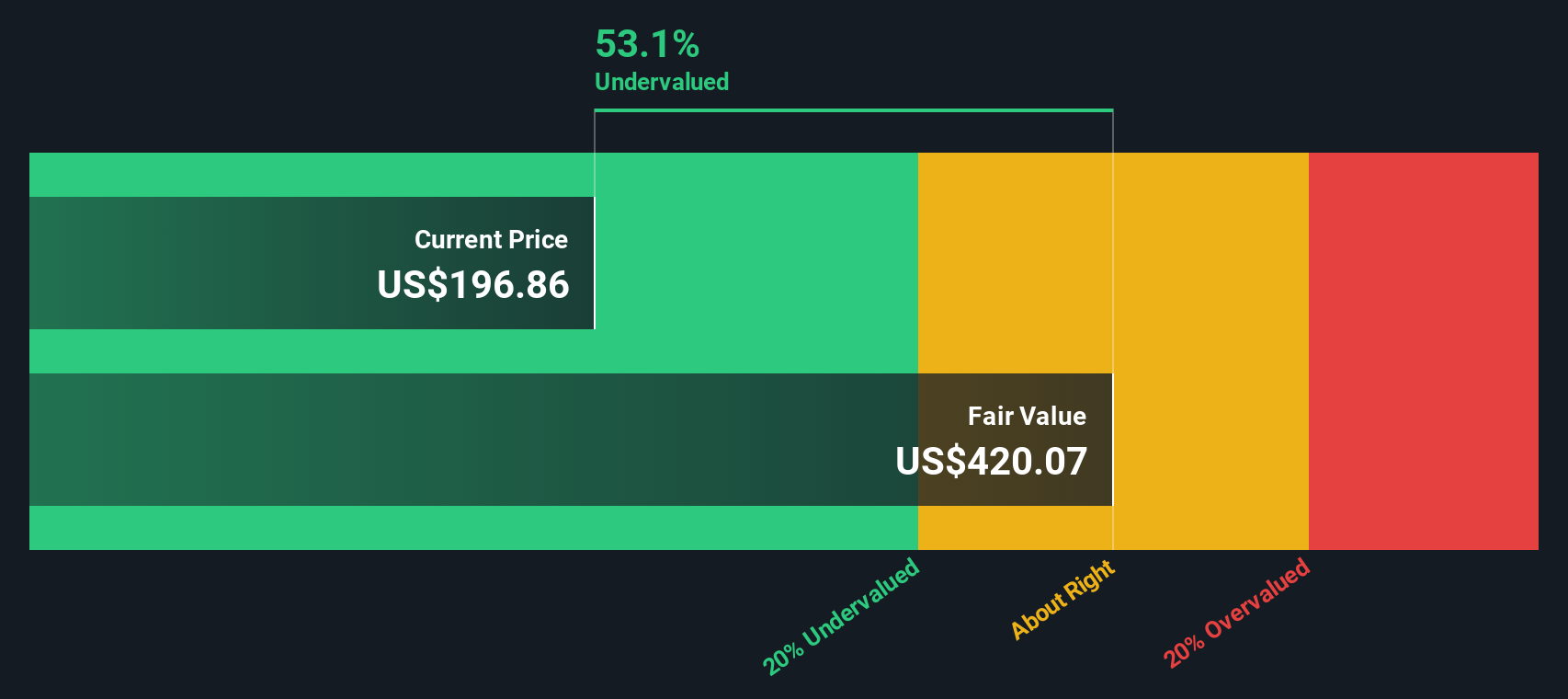

For Vistra, the current Free Cash Flow stands at approximately $1.31 billion. According to analyst projections, this figure is set to rise significantly, with Free Cash Flow expected to reach about $6.03 billion by 2029. Beyond 2029, Simply Wall St extrapolates these estimates, projecting steady growth into 2035. All of these forecasts are considered in US dollars. The DCF model used, specifically the 2 Stage Free Cash Flow to Equity method, blends analyst estimates and automated projections to capture both near-term expectations and long-term trends.

Based on these projections, the model calculates Vistra’s intrinsic value at $386.79 per share. This results in a 55.1% discount to the current share price, signaling that Vistra is substantially undervalued according to this methodology. Investors may see this as a strong buying opportunity backed by robust cash flow growth assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vistra is undervalued by 55.1%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Vistra Price vs Earnings

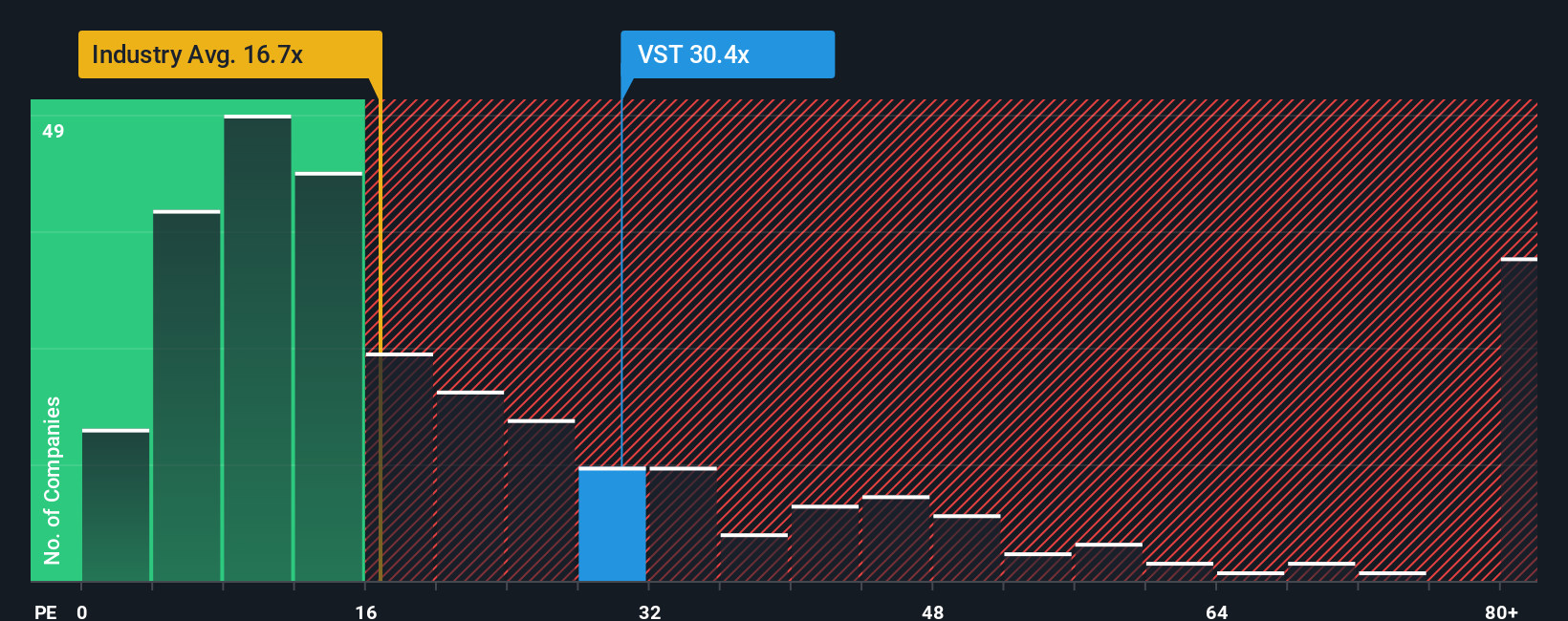

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it connects a company’s share price with its earnings power. For investors, this ratio reflects how much you are paying per dollar of profit, making it useful for comparing similar businesses.

The "normal" or fair PE ratio for a company varies based on its earnings growth prospects and risk profile. Fast-growing companies or those with lower risk often command higher PE ratios, while slower growers or riskier firms typically trade at lower multiples.

Vistra’s current PE ratio stands at 61.3x. This is well above the average for its renewable energy industry peers, which is 17.2x, and also exceeds the average among its closest competitors, which is 30.6x. At first glance, this suggests Vistra is priced at a significant premium to its sector and peers.

Simply Wall St’s proprietary "Fair Ratio" takes a broader look, factoring in Vistra’s anticipated earnings growth, industry positioning, profit margins, risks, and overall market capitalization. For Vistra, the Fair Ratio is 47.2x, which is notably below its current multiple. Unlike industry and peer averages that offer simple comparisons, the Fair Ratio is tailored specifically to the company’s unique strengths, risks, and prospects, providing a more accurate and nuanced benchmark for valuation.

Comparing the Fair Ratio of 47.2x with Vistra’s actual PE of 61.3x, the share price appears to be overvalued on earnings multiples alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vistra Narrative

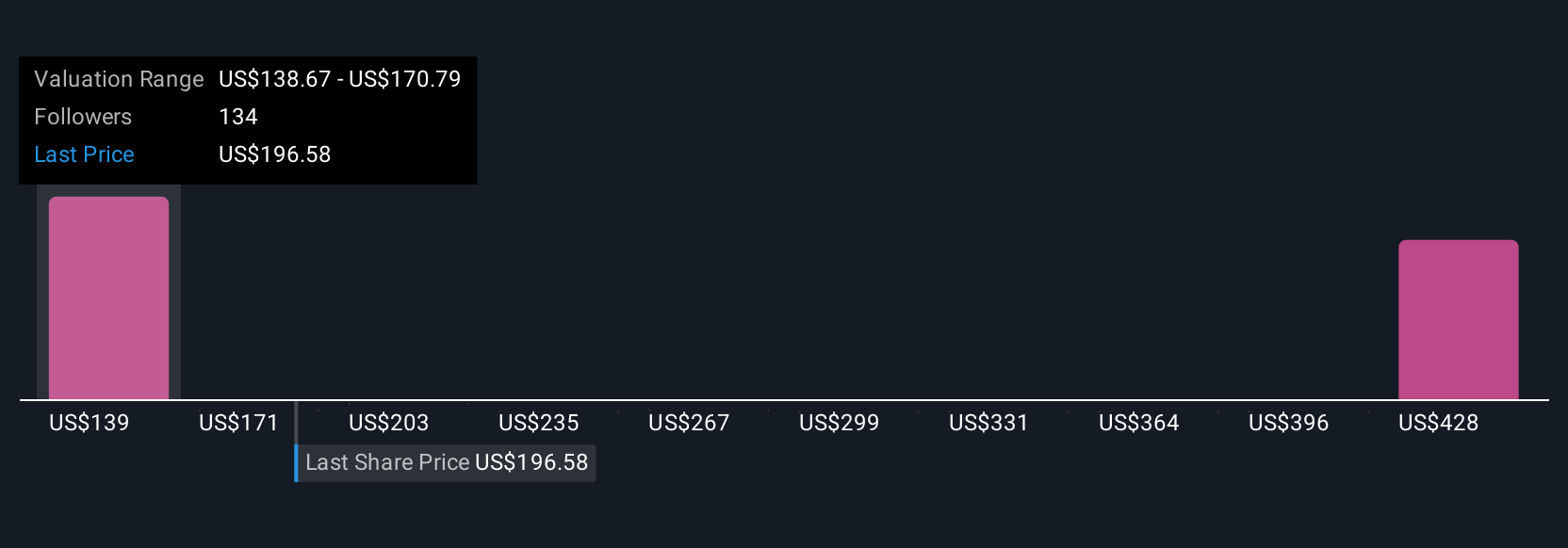

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful way to connect the story you believe about a company, like Vistra, to a financial forecast and, ultimately, to your estimated fair value. With Narratives, you start by describing your outlook. For example, you might believe Vistra’s investment in renewable energy will drive double-digit revenue growth, or that risks from regulatory pressure will keep profit margins under pressure. The platform then helps you turn this perspective into specific forecasts for revenue, earnings, margins, and a fair value estimate, which you can easily compare with the current share price to guide decision making.

Found right on the Community page at Simply Wall St, Narratives are used by millions of investors as an easy, accessible tool for making smarter investment decisions. Importantly, they stay up to date as key news or earnings are released, so your scenario always reflects the latest reality. For example, some Vistra Narratives see fair value as high as $261 per share based on optimism about long-term power contracts and buybacks. Others are more cautious, estimating fair value at $164.53 per share due to concerns over regulatory risks and heavy reliance on fossil assets.

Do you think there's more to the story for Vistra? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026