- United States

- /

- Renewable Energy

- /

- NYSE:VST

A Look at Vistra (VST) Valuation Following KeyBanc’s Bullish Coverage and Sector Growth Signals

Reviewed by Simply Wall St

KeyBanc’s recent coverage of Vistra (VST) has caught investor attention, as the firm highlighted accelerating growth trends in the U.S. power sector. The report specifically noted increased activity from data center expansion and rising electrification.

See our latest analysis for Vistra.

Vistra’s share price has seen some volatility in recent months, with a 1-month share price return of -11.3%. Its 18.1% gain year-to-date signals a strong run overall. The underlying momentum is notable when looking at the company’s longer arc, with a 1-year total shareholder return of 15.1% and a five-year total shareholder return just shy of 950%. The recent pullback coincides with excitement and uncertainty around the power sector’s growth, as new demand drivers like data centers create both opportunity and speculation.

If the dynamics in utilities have you curious about similar opportunities, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares pulling back and analysts still setting targets well above the current price, investors are left asking a key question: Is Vistra’s valuation lagging its future potential, or has the market already priced in all the upside?

Most Popular Narrative: 22.5% Undervalued

With Vistra trading at $176.80 and the most-followed narrative placing fair value at $228.26, the current price trails what analysts see as justified by future fundamentals. Analysts’ consensus hinges on strong earnings prospects, ambitious growth projections, and sector tailwinds. These factors set the scene for the driver behind their optimism.

Progress on large-scale, multi-decade contracts, such as potential colocation and long-term supply agreements with hyperscalers and data centers, provides a forward pipeline for stable, premium cash flows that are likely to support strong, visible earnings growth.

Curious about the quantitative leap that justifies this valuation? What if revenue growth, improved margins, and a future profit multiple usually reserved for industry heavyweights set the pace? The surprising logic behind these aggressive projections is only revealed in the full narrative. Don’t miss the hidden financial drivers that shape this bold call.

Result: Fair Value of $228.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a rapid increase in debt from acquisitions or unexpected regulatory changes could quickly challenge Vistra’s bullish outlook and put pressure on future earnings.

Find out about the key risks to this Vistra narrative.

Another View: Looking at Market Ratios

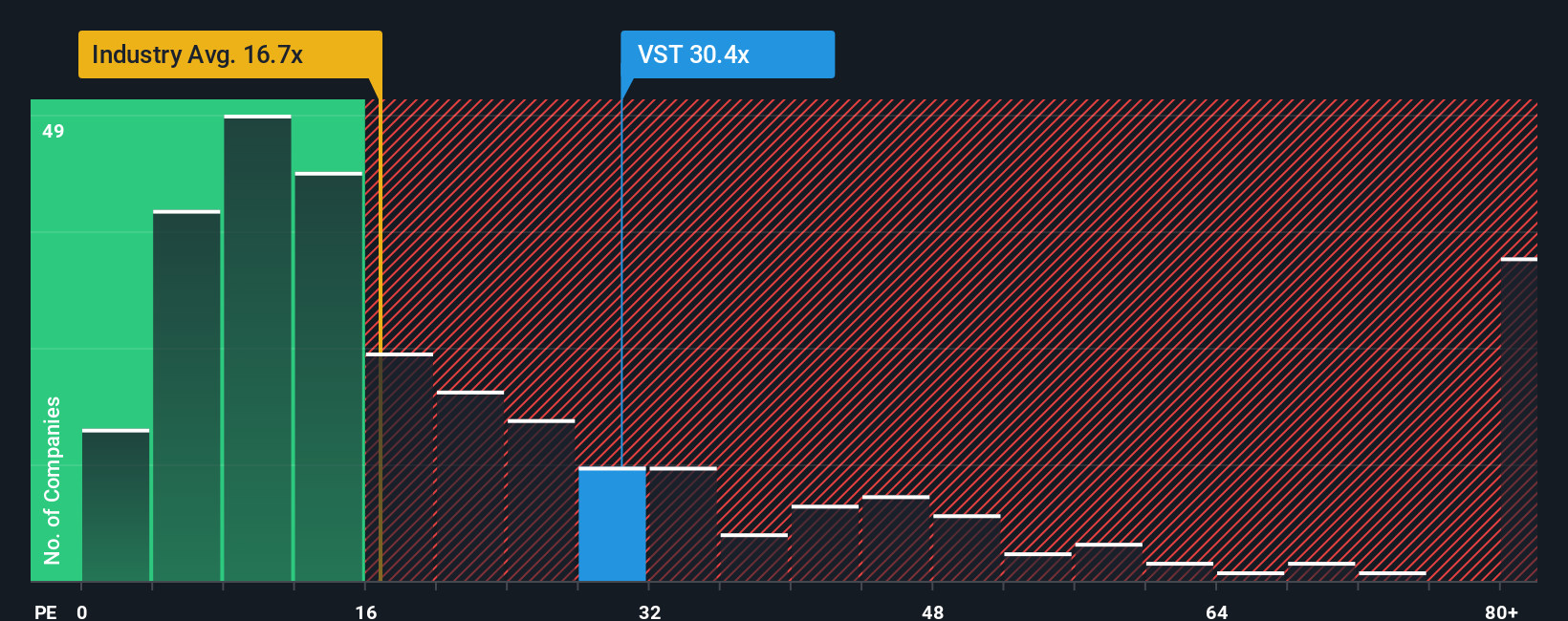

Stepping back from earnings projections, the price-to-earnings ratio tells a noticeably different story. Vistra trades at 62.4x, higher than both the peer average of 30.8x and the global industry average of 16.8x. The market’s willingness to pay this premium hints at big expectations, but it also raises questions around valuation risk. Is future growth enough to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you’d rather draw your own conclusions or want to see how the numbers stack up from your perspective, you can build your own Vistra narrative in under three minutes: Do it your way

A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your portfolio to the next level by tapping into new opportunities that others might overlook. Don’t let smart investments slip past you.

- Boost your income potential by uncovering top yield opportunities with these 15 dividend stocks with yields > 3%, a choice for those seeking steady cash flow.

- Tap into the next wave of healthcare innovation and find trailblazing companies changing patient outcomes with these 30 healthcare AI stocks.

- Capitalize on untapped potential by targeting value with these 926 undervalued stocks based on cash flows and spot companies trading below what their financials suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success