- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Southwest Gas Holdings (SWX): Reviewing Valuation After 2024 Sustainability Progress and Top Customer Satisfaction Marks

Reviewed by Kshitija Bhandaru

Southwest Gas Holdings (SWX) has just published its 2024 Sustainability Report, highlighting its strengthened safety protocols, emissions reductions, investments in renewable energy, and improvements in infrastructure. The company’s top customer satisfaction ranking also reinforces steady operational momentum for investors.

See our latest analysis for Southwest Gas Holdings.

Southwest Gas Holdings’ steady operational execution and recent sustainability milestones have helped it maintain industry confidence. This has been reflected in the stock’s year-to-date share price return of almost 12% and a 10% total shareholder return over the past year. The stock’s longer-term gains, with over 29% total return across three years, suggest momentum is building as the company invests in cleaner infrastructure and continues to lead in customer satisfaction.

If you’re interested in where else growth and strong leadership are making a mark, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

But with a strong run-up in its share price and continued operational progress, should investors view Southwest Gas Holdings as undervalued at current levels, or is the market already factoring in its future growth?

Most Popular Narrative: 4.6% Undervalued

With Southwest Gas Holdings’ fair value set at $82.5 by the most popular narrative, the closing price of $78.72 leaves a small but notable gap. This signals analysts see additional upside if the company delivers on its projected growth and profitability milestones.

Robust customer growth facilitated by ongoing population and economic expansion in the Southwest, with 40,000 new meter connections in the last 12 months. This suggests extended demand for natural gas in core service territories and directly underpins long-term revenue and earnings growth.

Curious about the bold assumptions that power this valuation? Hidden beneath the surface are aggressive margin forecasts and game-changing growth drivers. See how the numbers stack up and what needs to go right for this price target to be reached.

Result: Fair Value of $82.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating decarbonization trends and tighter regulatory limits could challenge demand and future earnings growth if market conditions shift faster than expected.

Find out about the key risks to this Southwest Gas Holdings narrative.

Another View: Market Multiple Signals Potential Overvaluation

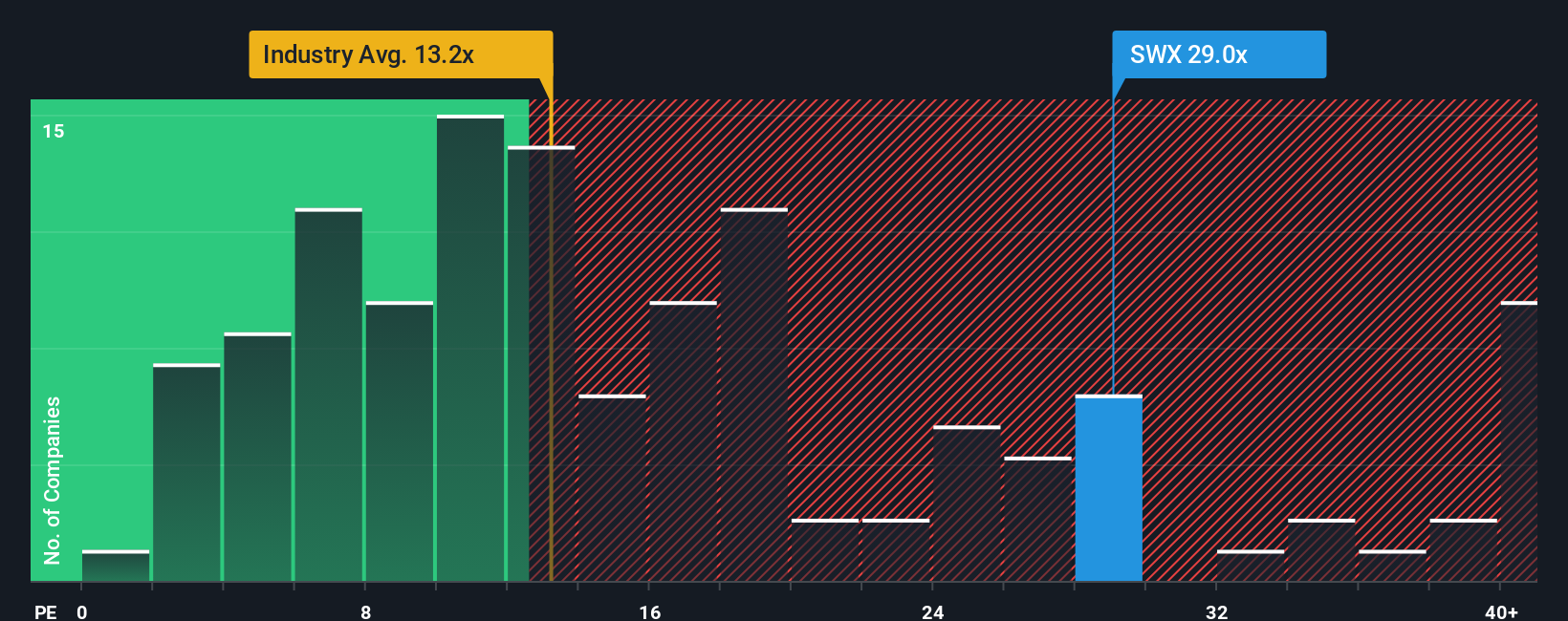

Looking at Southwest Gas Holdings through the lens of the price-to-earnings ratio tells a different story. The company trades at 29.2x earnings, which is noticeably higher than the industry average of 13.2x and also above its fair ratio of 23.6x. This premium suggests investors may be factoring in strong future performance or that there is a risk of the valuation coming down toward these benchmarks. Could the current price be outpacing fundamentals? Does that signal caution for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Gas Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, exploring your own narrative is quick and straightforward, taking just a few minutes. Start now: Do it your way

A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't leave potential gains on the table. Boost your investing toolkit by targeting fresh opportunities where others aren’t looking. Simply Wall Street’s screeners make it easy.

- Unlock income potential by adding high-yield payers to your watchlist, starting with these 19 dividend stocks with yields > 3% offering yields over 3%.

- Position yourself at the forefront of medical innovation and track these 32 healthcare AI stocks reshaping healthcare with artificial intelligence and smarter diagnostics.

- Jump ahead of the crowd by filtering for value with these 898 undervalued stocks based on cash flows, making it easier to spot attractive stocks with compelling cash flow discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives