- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Southwest Gas Holdings, Inc. (NYSE:SWX) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Southwest Gas Holdings, Inc. (NYSE:SWX) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

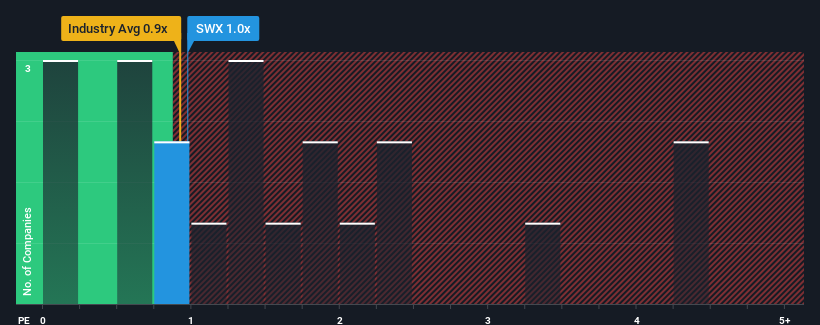

In spite of the firm bounce in price, considering around half the companies operating in the United States' Gas Utilities industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider Southwest Gas Holdings as an solid investment opportunity with its 1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Southwest Gas Holdings

How Southwest Gas Holdings Has Been Performing

Southwest Gas Holdings certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Southwest Gas Holdings will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Southwest Gas Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Southwest Gas Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Southwest Gas Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 9.6% gain to the company's revenues. Pleasingly, revenue has also lifted 65% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 22% during the coming year according to the three analysts following the company. With the industry predicted to deliver 73% growth, that's a disappointing outcome.

With this information, we are not surprised that Southwest Gas Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift Southwest Gas Holdings' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Southwest Gas Holdings' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Southwest Gas Holdings' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Southwest Gas Holdings (at least 2 which are concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, distributes and transports natural gas in Arizona, Nevada, and California.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives