- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern (SO) Enhances Leadership with New CITO and Independent Director Appointments

Reviewed by Simply Wall St

Southern (SO) experienced a 6% price increase over the past month, possibly influenced by the appointment of Hans Brown as Chief Information Technology Officer and John M. Turner, Jr. as an independent director, both signaling a push towards enhanced technological and financial oversight. Alongside these leadership changes, a quarterly dividend declaration of $0.74 per share underscores the company's focus on shareholder returns. While these events unfolded, broader market trends showed flattened movements, with indices like the S&P 500 and Nasdaq experiencing minor retreats from record highs, allowing Southern's specific initiatives to add some positive weight to its gains.

The recent appointment of Hans Brown and John M. Turner, Jr. at Southern underscores a shift toward enhanced technological integration and financial oversight, potentially reinforcing the company's strategic goals outlined in its infrastructure narrative. This focus on governance could stabilize margins and support Southern's capital-intensive growth plans.

Over the past five years, Southern's total shareholder return, inclusive of dividends, was 112.28%, demonstrating strong performance over the long term. For context, over the past year alone, Southern underperformed the broader US Electric Utilities industry, which returned 17.2%. Such long-term gains highlight the company's resilience and growth capacity despite recent short-term fluctuations.

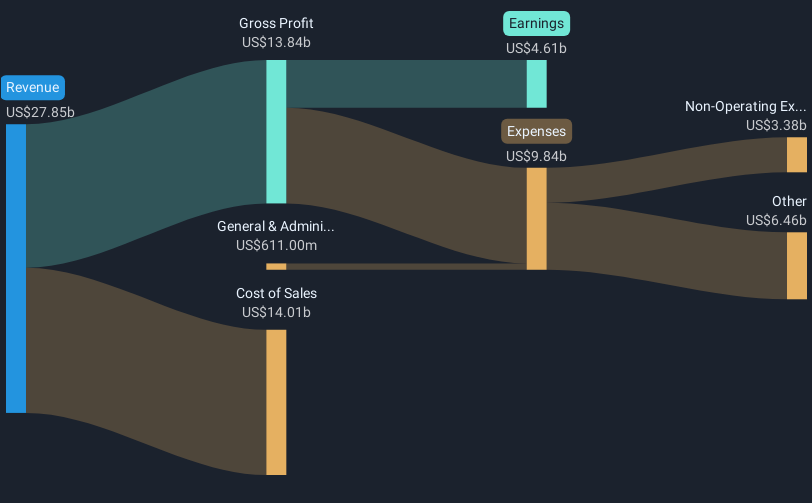

As Southern continues to expand its energy infrastructure and services, the leadership changes could catalyze advancements in execution and operational efficiency, potentially influencing future revenue and earnings forecasts. Analysts project a revenue growth of 4.1% per year and earnings to reach $5.7 billion by 2028, potentially supporting these new strategic directions.

With the current share price at $94.79 and aligned with the analyst price target of around $93.98, the recent price increase brings the shares close to this target. This alignment suggests that the market views current developments as positively impacting the company's valuation, reaffirming overall investor confidence in Southern's future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives