- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern (NYSE:SO) Reports Q1 Earnings Growth With Revenues Up To US$7,775 Million

Reviewed by Simply Wall St

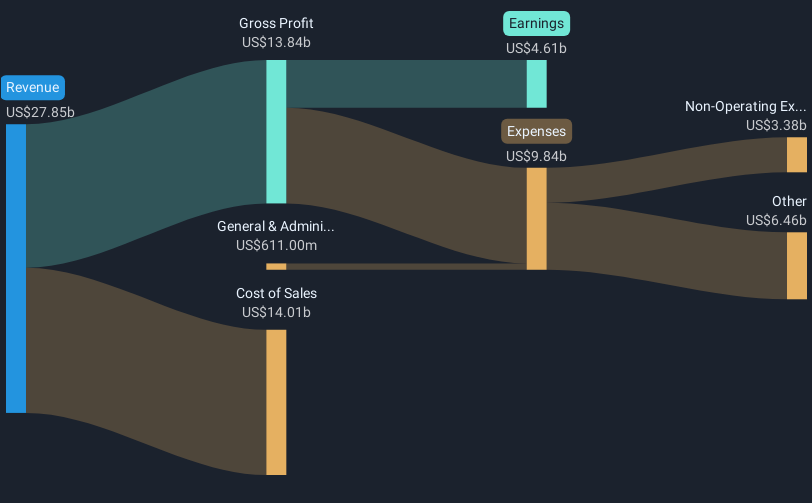

Southern (NYSE:SO) achieved significant growth in its first-quarter earnings for 2025, highlighted by an increase in sales, revenue, net income, and earnings per share, which may have influenced its 8% share price movement over the last quarter. This performance comes during a turbulent period for the broader market, with the Dow and S&P 500 experiencing consistent gains. Despite these broader trends, Southern's robust earnings announcement provided additional momentum, complemented by the company's increased dividend declaration. While market optimism generally lifted stock prices, Southern's specific financial strength likely compounded its positive performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Southern's recent financial achievements underscore its capability to leverage economic development and rising electricity demand in its utility regions. With significant capital investments planned, these developments are anticipated to reinforce long-term revenue and earnings growth. The company's 8% share price movement in the past quarter reflects investor response to its strong earnings report and dividend increase. This strategic alignment with market trends could further bolster Southern's revenue and earnings forecasts, particularly as data center demand continues to escalate.

Over the longer term, Southern's total shareholder return was an impressive 108.87% over the past five years. This performance contrasts with its 1-year return, which exceeded the US Market's 9.6% return and the Electric Utilities industry's 15% return. This suggests consistent market participation and confidence in Southern's capacity to deliver sustained shareholder value.

Regarding valuation, Southern’s current share price of US$91.45 remains close to the analyst consensus price target of US$91.53, indicating that the shares are almost fairly valued. Such a small discrepancy implies that analysts have closely aligned Southern's expected future performance with its current market price. Investors should continue to assess Southern's execution on its capital projects and its ability to navigate regulatory and market pressures for more refined investment decision-making.

Upon reviewing our latest valuation report, Southern's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Southern, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives