- United States

- /

- Gas Utilities

- /

- NYSE:SGU

Star Group (SGU) Earnings Rebound and 4.1% Margin Challenge Long-Term Bearish Narrative

Reviewed by Simply Wall St

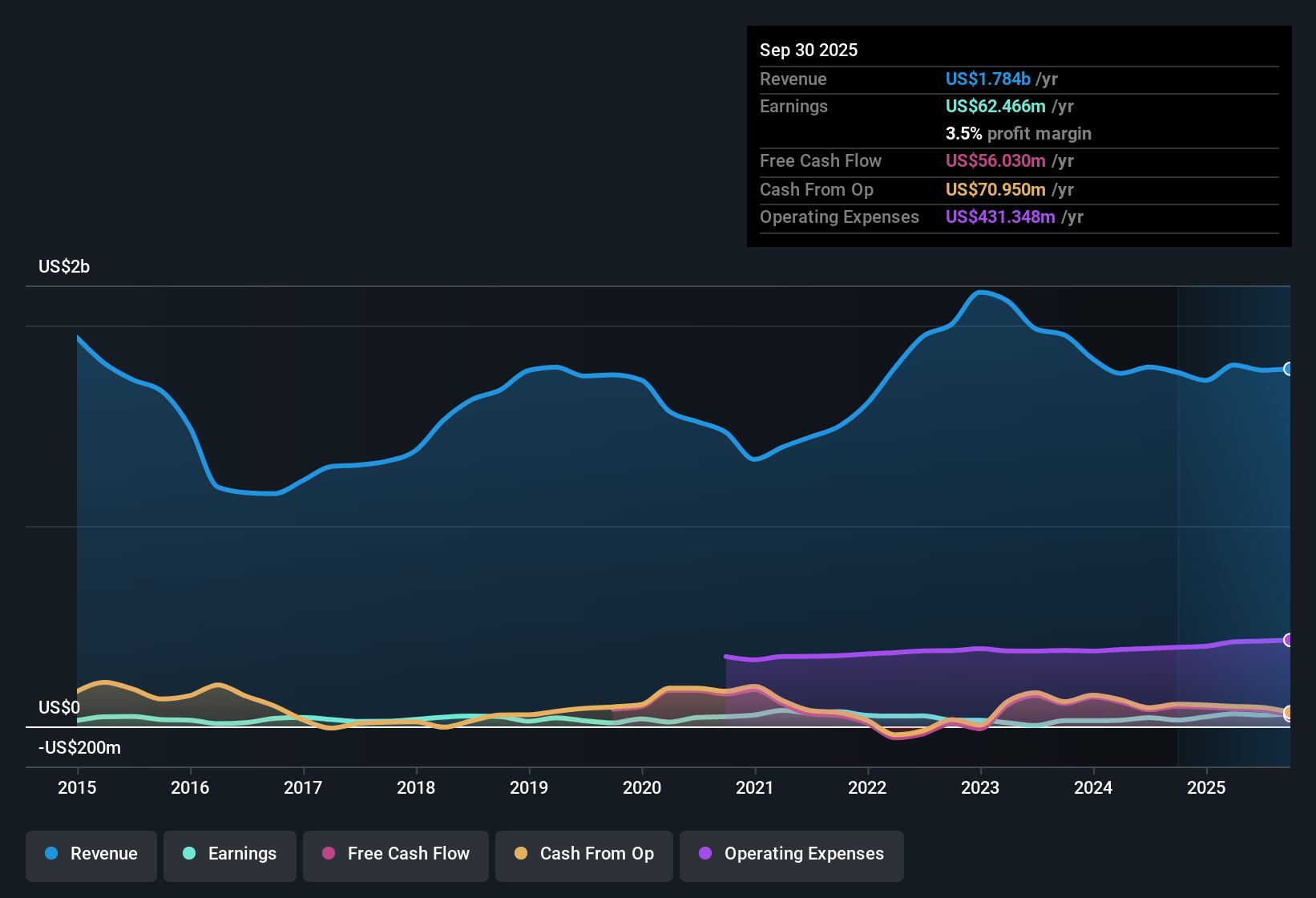

Star Group (SGU) closed FY 2025 with fourth quarter revenue of $247.7 million and basic EPS of -$0.84, capping off a volatile year that nevertheless left trailing 12 month EPS at $2.12 on $1.8 billion in revenue and net income of $72.8 million. The company has seen quarterly revenue swing from $488.1 million and EPS of $0.79 in Q1 2025 to a peak of $743.0 million and EPS of $2.13 in Q2, before moderating in the second half as Q3 delivered $305.6 million of revenue and EPS of -$0.48. Against that backdrop, investors are likely to focus on how the latest quarter fits into a year where margins have ultimately moved in the right direction, even if the path there has been choppy.

See our full analysis for Star Group.With the headline numbers laid out, the next step is to see how this mix of quarterly ups and downs and improving full year margins lines up against the most common narratives investors follow around Star Group.

Curious how numbers become stories that shape markets? Explore Community Narratives

129% earnings rebound vs 5 year slide

- Over the last 12 months, net income of $72.8 million and EPS of $2.12 compare with a five year pattern of earnings falling 5.9% per year and a 129.1% jump versus the prior year.

- What stands out for a bullish take is that the recent 129.1% earnings growth and net margin at 4.1% are rising against that longer term decline, which

- supports the idea that recent operational performance has been much stronger than the multi year average, even though the long run trend is still negative,

- but also reminds investors that a single strong year sits on top of several weaker ones where earnings shrank 5.9% annually.

Net margin climbs to 4.1%

- Trailing 12 month net profit margin improved to 4.1% from 1.8% in the prior year, while revenue over the same period held around $1.8 billion.

- Critics highlight that a higher 4.1% margin coming after several years of shrinking earnings does not erase the structural concern, which

- fits with the data showing multi year earnings contraction of 5.9% per year even though the latest year looks much healthier,

- and means bears can still point to that longer history when they question how durable the current level of profitability really is.

Low 5.4x P/E and 6.3% yield

- At a share price of $11.67, the stock trades on a trailing P/E of 5.4 times versus industry at 13.9 times and peers at 17.6 times, with a 6.34% dividend yield and a DCF fair value of $70.35.

- Consensus narrative style valuation logic would say those numbers heavily support a value case, since

- the gap between the $11.67 market price and the $70.35 DCF fair value is wide even after factoring in a five year earnings decline,

- yet the high level of debt and that same multiyear earnings pressure give bears concrete reasons to argue the discount is at least partly risk driven rather than purely a mispricing.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Star Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a sharp earnings rebound and richer margins this year, Star Group still faces a five year earnings decline and balance sheet concerns that cloud durability.

If that mix of shrinking long term profits and higher leverage makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1938 results) to quickly zero in on financially stronger businesses built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGU

Star Group

Provides home heating oil and propane products and services to residential and commercial customers in the United States.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026