- United States

- /

- Other Utilities

- /

- NYSE:PEG

Public Service Enterprise Group's (NYSE:PEG) investors will be pleased with their notable 42% return over the last three years

Buying a low-cost index fund will get you the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. For example, the Public Service Enterprise Group Incorporated (NYSE:PEG) share price return of 28% over three years lags the market return in the same period. Disappointingly, the share price is down 9.8% in the last year.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

See our latest analysis for Public Service Enterprise Group

SWOT Analysis for Public Service Enterprise Group

- Debt is well covered by earnings.

- Dividend is low compared to the top 25% of dividend payers in the Integrated Utilities market.

- Annual earnings are forecast to grow for the next 3 years.

- Good value based on P/E ratio compared to estimated Fair P/E ratio.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

- Annual earnings are forecast to grow slower than the American market.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Public Service Enterprise Group became profitable within the last three years. So we would expect a higher share price over the period.

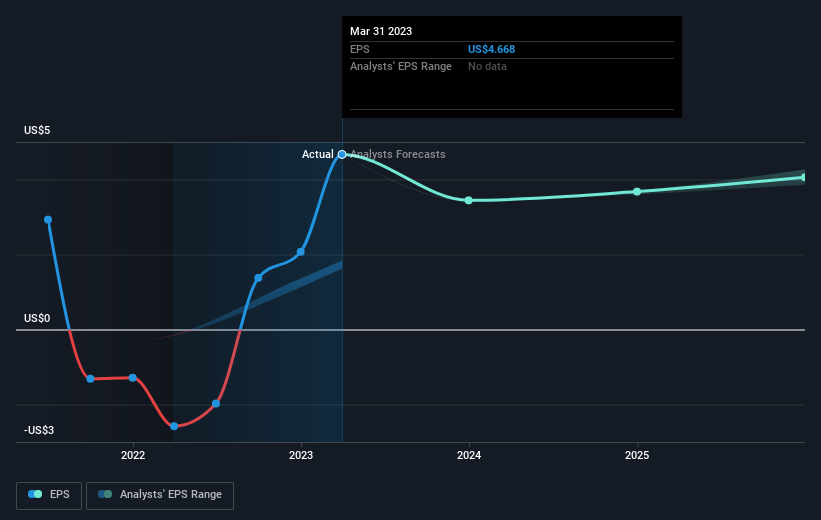

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Public Service Enterprise Group has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Public Service Enterprise Group the TSR over the last 3 years was 42%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Public Service Enterprise Group had a tough year, with a total loss of 6.6% (including dividends), against a market gain of about 6.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Public Service Enterprise Group (1 can't be ignored) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Public Service Enterprise Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PEG

Public Service Enterprise Group

Through its subsidiaries, operates in electric and gas utility, and nuclear generation businesses in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives