- United States

- /

- Other Utilities

- /

- NYSE:PEG

Public Service Enterprise Group (PEG): Evaluating Valuation as Long Island Grid Contract Extended

Reviewed by Kshitija Bhandaru

Public Service Enterprise Group (PEG) just secured a five-year contract extension to keep running the electric grid in Long Island and the Rockaways through its subsidiary, PSEG Long Island. This move reinforces PEG’s ongoing partnership with the Long Island Power Authority and provides greater revenue clarity for the years ahead.

See our latest analysis for Public Service Enterprise Group.

PEG’s steady progress running the Long Island grid underpins its reputation for operational reliability, while the recent contract news offers a reassuring signal to investors. Despite modest 1-year share price returns, Public Service Enterprise Group’s 5-year total shareholder return of nearly 69% reflects durable value and long-term resilience rather than day-to-day market moves.

If you’re in the mood to survey other market standouts, now is an ideal time to broaden your investing universe and discover fast growing stocks with high insider ownership

With a solid history of operational improvements and long-term returns, the question now is whether PEG’s stock is trading below its true value or if the market has already anticipated the company’s future growth potential.

Most Popular Narrative: 9.5% Undervalued

With analysts’ narrative valuation for Public Service Enterprise Group pointing to $90.61, and shares last closing at $82.00, there is a notable gap that has caught the market’s eye. This difference highlights both optimistic growth assumptions and the potential rewards in play if projected trends become reality.

Sustained and increasing levels of utility capital investment ($3.8B in 2025; $21 to $24B through 2029) focused on grid modernization, infrastructure resilience, and clean energy programs position PSEG to capture value from regulatory-approved rate increases and expand its regulated asset base, driving future earnings and net margin growth.

Want the full playbook behind this valuation? Analyst expectations here hinge on game-changing investments, ambitious growth, and a profit multiple more often seen in elite industries. What crucial assumptions drive this fair value, and do they stand up to scrutiny? Find out what is fueling the optimism by digging into the full narrative.

Result: Fair Value of $90.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, PSEG’s future earnings depend on turning data center demand into actual customers. Regulatory delays could also slow down grid investments and earnings growth.

Find out about the key risks to this Public Service Enterprise Group narrative.

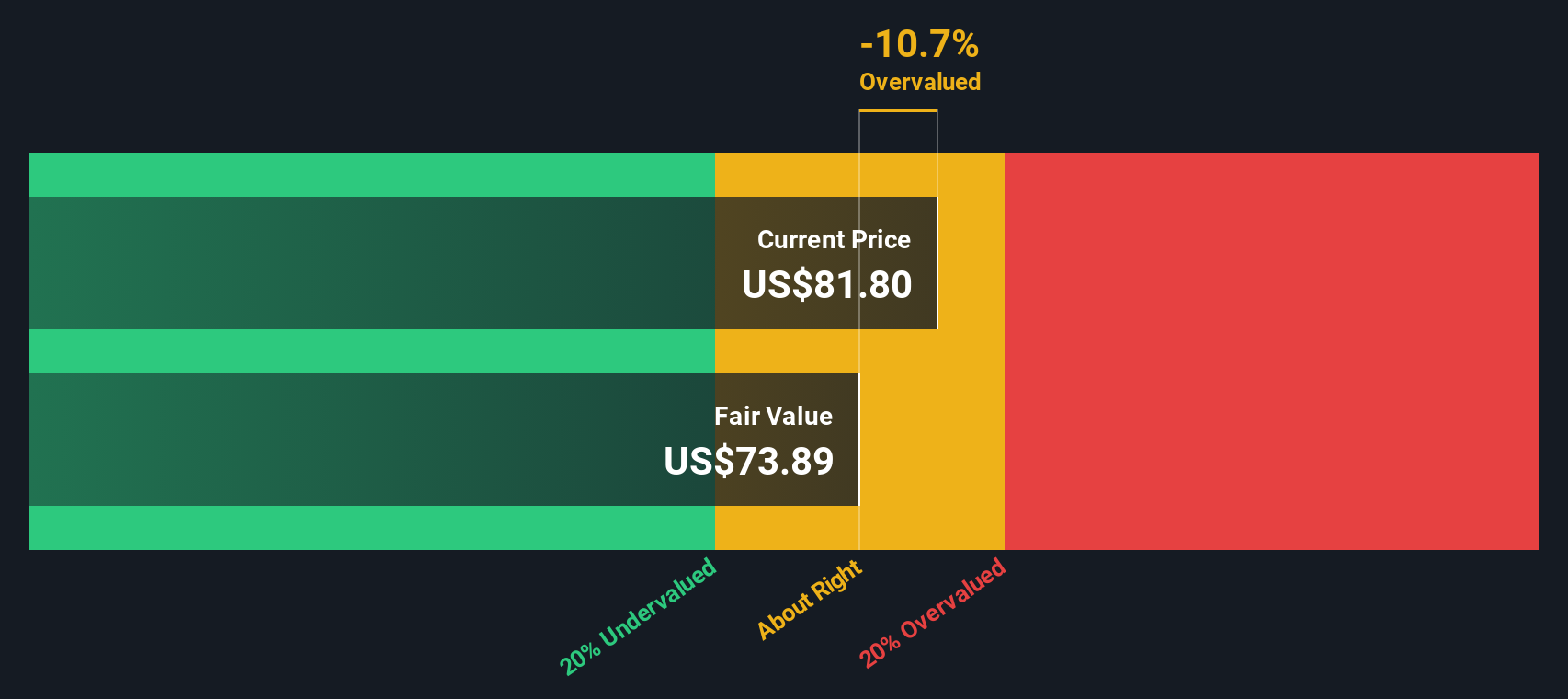

Another View: Our DCF Model Tells a Different Story

While analyst targets suggest Public Service Enterprise Group may be undervalued, our SWS DCF model paints a more cautious picture. By focusing on long-term cash flows, the model estimates fair value at $74.13. This is below the current share price. Does this mean the optimism in analyst forecasts is running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Public Service Enterprise Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Public Service Enterprise Group Narrative

If you see things differently or want to investigate the numbers firsthand, you can craft your own story and conclusions in just a few minutes. Do it your way

A great starting point for your Public Service Enterprise Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip by you. The right stock idea could be closer than you think, and Simply Wall Street’s screeners make it easy to spot standout picks.

- Uncover high-growth opportunities that are harnessing artificial intelligence with these 24 AI penny stocks. Stay ahead of the curve as these trends develop.

- Maximize your income potential by checking out these 19 dividend stocks with yields > 3%, which connects you to impressive yields that can strengthen your portfolio.

- Jump on rare value plays with these 901 undervalued stocks based on cash flows, highlighting stocks the crowd is still overlooking based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEG

Public Service Enterprise Group

Through its subsidiaries, operates in electric and gas utility, and nuclear generation businesses in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives