- United States

- /

- Electric Utilities

- /

- NYSE:PCG

Will Easing Wildfire Liability Concerns and Regulatory Support Change PG&E's (PCG) Narrative?

Reviewed by Sasha Jovanovic

- In recent days, analysts and market participants have expressed renewed confidence in PG&E, citing easing concerns over wildfire-related liabilities and highlighting ongoing efforts in wildfire mitigation and regulatory protections under California law.

- This shift in perception reflects recognition of PG&E's substantial investment in wildfire risk management and the potential impact of favorable legislative frameworks on the company’s financial stability.

- We’ll see how this improved sentiment around wildfire liabilities and regulatory support influences PG&E’s long-term earnings outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PG&E Investment Narrative Recap

To own PG&E stock today, you need to believe that legislative and regulatory support for wildfire cost recovery will hold, and that the company’s substantial investment in wildfire mitigation will be enough to manage future liability risk. The recent analyst optimism around easing wildfire liability concerns may buoy sentiment, but the biggest short term catalyst remains progress toward investment-grade credit ratings, while persistent regulatory uncertainty continues as the core risk, this news does not materially alter those priorities.

The announcement of PG&E’s upcoming Q3 2025 results on October 23 is the most relevant, as investors will watch for updates on wildfire cost trends, progress on mitigation spending, and any potential impacts on the company’s recently narrowed full-year earnings guidance. The results could signal how effectively PG&E is balancing risk management with the need to support earnings and strengthen its financial position in the face of legislative scrutiny.

However, investors should be aware that while optimism has improved, the path forward still depends on evolving state policy and the possibility that future legislative changes could ...

Read the full narrative on PG&E (it's free!)

PG&E's narrative projects $27.6 billion revenue and $4.0 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $1.6 billion earnings increase from $2.4 billion today.

Uncover how PG&E's forecasts yield a $20.69 fair value, a 26% upside to its current price.

Exploring Other Perspectives

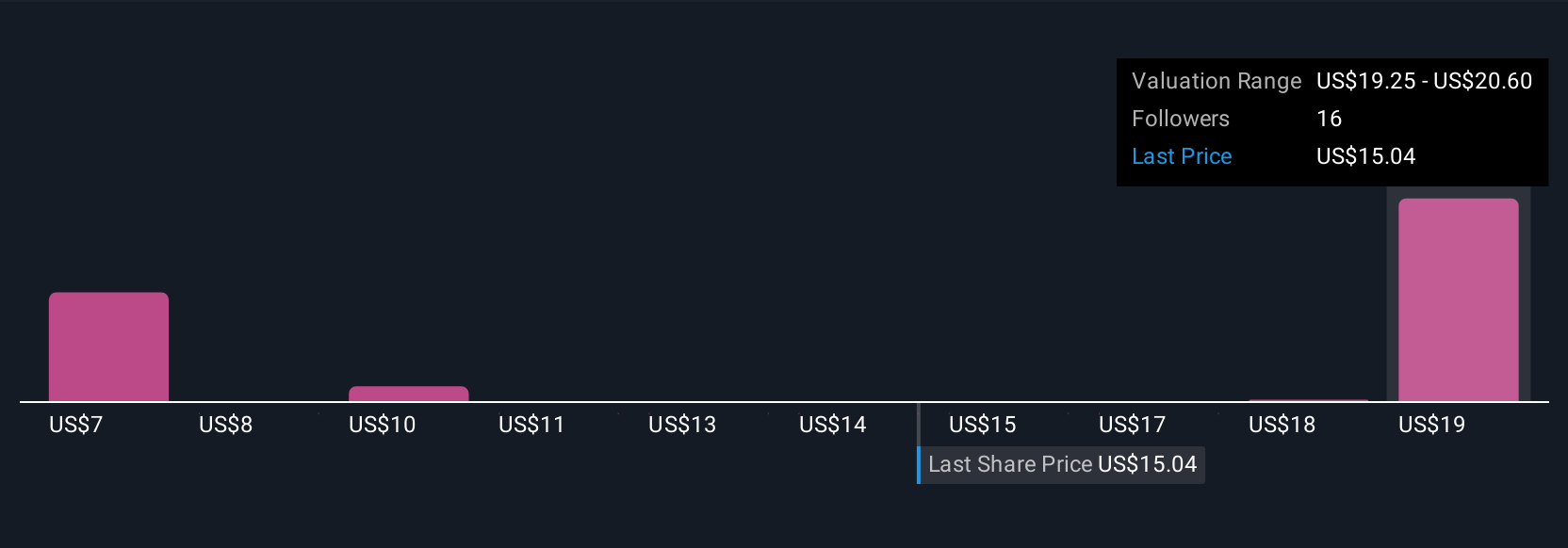

Four fair value projections from the Simply Wall St Community span a wide range from US$10.28 to US$20.69 per share. Yet, regulatory uncertainty around wildfire liability reforms could continue to drive volatility and differing expectations about PG&E’s long-term earnings potential, explore how your own outlook compares.

Explore 4 other fair value estimates on PG&E - why the stock might be worth 37% less than the current price!

Build Your Own PG&E Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PG&E research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PG&E's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives