- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (NYSE:PCG) Announces US$0.03 Per Share Dividend For Q1 2025

Reviewed by Simply Wall St

PG&E (NYSE:PCG) recently declared a cash dividend of $0.03 per share, marking an affirmation of its commitment to returning value to shareholders. Despite this announcement, the company's stock experienced a 1% decline over the past week. This drop coincides with a broader trend in the market, where major indexes, including the Dow and the S&P 500, recorded losses due to various factors, such as the pressure on UnitedHealth weighing on the Dow. The overall bearish sentiment within the market, illustrated by major indexes on track for weekly declines, likely contributed to PG&E's share price movement. These market dynamics underscore the environment in which PG&E’s price change occurred, as market forces rather than company-specific news may have played a more significant role in the stock's modest decline.

See the full analysis report here for a deeper understanding of PG&E.

Over the past three years, PG&E's total shareholder return, including dividends, was 42.10%. This performance, set against some market headwinds, reflects a period of strategic adjustments and financial resilience. During this time, PG&E consistently declared dividends, with notable increases, such as the fourth-quarter 2024 increase to $0.025 per share, showing a commitment to shareholder returns amidst their ongoing turnaround.

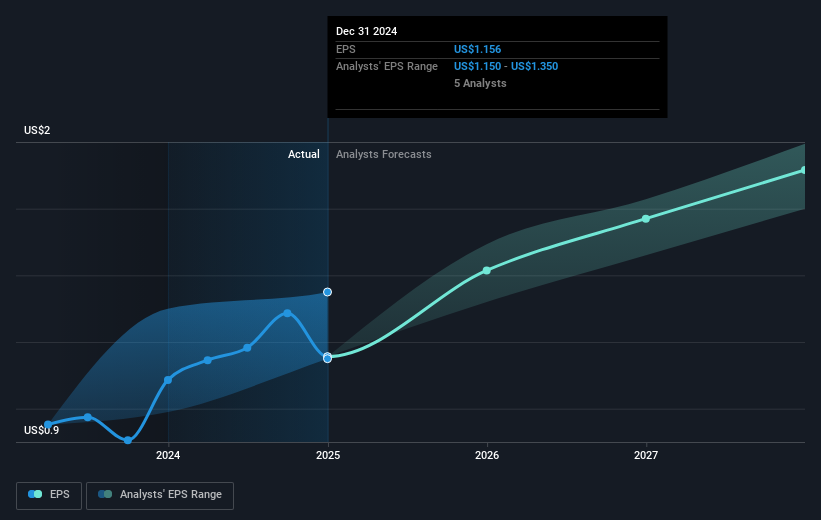

In terms of growth, PG&E's earnings outpaced the Electric Utilities industry over the past year, with a 10.4% earnings rise compared to the industry’s 8.2%, evidencing operational improvements. Despite a slight downturn in full-year 2024 sales, net income increased, marking profitability efforts. The filing for $2.10 billion debt financing supports ongoing initiatives and potential strategic investments, aligning with broader operational goals and the three-year positive return trajectory.

- Discover whether PG&E is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the downside scenarios for PG&E with our risk evaluation.

- Got skin in the game with PG&E? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives