- United States

- /

- Renewable Energy

- /

- NYSE:ORA

How Investors May Respond To Ormat Technologies (ORA) Q2 Growth and Raised Full-Year Revenue Guidance

Reviewed by Simply Wall St

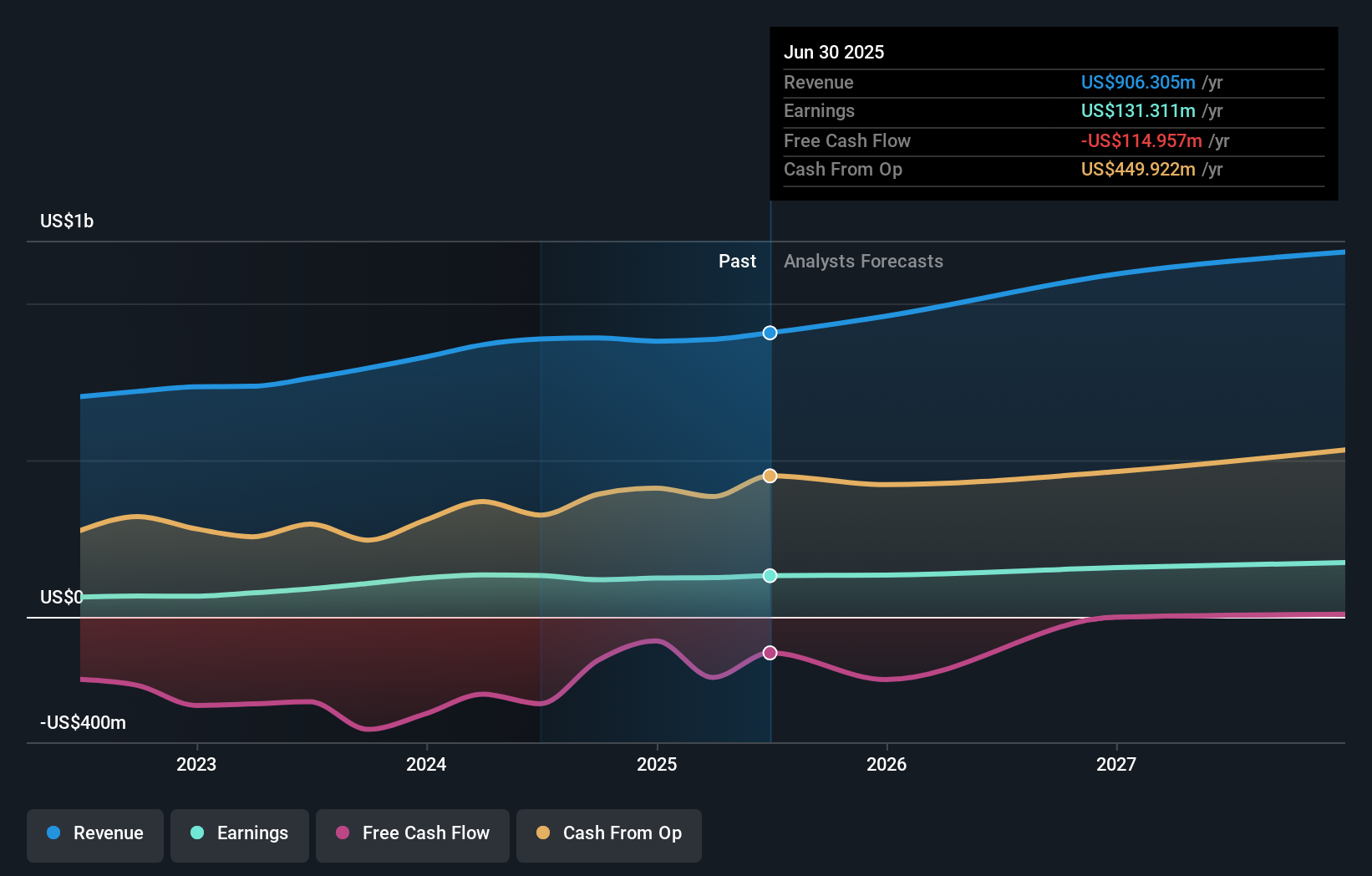

- Ormat Technologies reported second quarter 2025 financial results on August 6, highlighting year-over-year growth in both revenue (US$234.02 million) and net income (US$28.05 million), affirmed its quarterly dividend at US$0.12 per share, and provided updated full-year revenue guidance of US$935 million to US$975 million.

- The company’s performance and updated guidance reflect ongoing execution in clean power markets and continued investor confidence through consistent dividend policies.

- We'll assess how Ormat Technologies' strong second quarter growth and raised revenue outlook influence its ongoing investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ormat Technologies Investment Narrative Recap

Owning Ormat Technologies means believing in the continued expansion of clean energy markets and the company’s ability to maintain operational performance while navigating capital-intensive growth and regulatory uncertainty. The recent Q2 results, featuring solid revenue and net income growth, reinforce the company’s execution and support the primary near-term catalyst: accelerated project delivery in an environment of favorable policy support. Importantly, these results do not meaningfully change the biggest risk, which remains margin pressure from operational or maintenance issues across the electricity segment.

Among the recent announcements, the updated revenue guidance stands out: management increased its 2025 outlook to a US$935 million to US$975 million range. This revision aligns with optimism surrounding geothermal and energy storage demand, and affirms short-term revenue momentum, a key underpinning for project investment and long-term scale advantages.

However, risks around structural declines in electricity segment margins from maintenance or asset performance issues remain critical for investors to be aware of, especially since...

Read the full narrative on Ormat Technologies (it's free!)

Ormat Technologies is projected to reach $1.2 billion in revenue and $171.7 million in earnings by 2028. This outlook implies an annual revenue growth rate of 9.4% and an earnings increase of $40.4 million from current earnings of $131.3 million.

Uncover how Ormat Technologies' forecasts yield a $93.40 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range from US$37.93 to US$236.13, reflecting highly varied expectations for Ormat Technologies. While the community offers broad perspectives, the company’s margin performance and operational reliability are at the forefront of future outcomes, so consider multiple viewpoints as you weigh your own investment decisions.

Explore 3 other fair value estimates on Ormat Technologies - why the stock might be worth less than half the current price!

Build Your Own Ormat Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ormat Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ormat Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ormat Technologies' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORA

Ormat Technologies

Engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, France, Indonesia, the Philippines, and internationally.

Questionable track record with very low risk.

Similar Companies

Market Insights

Community Narratives