- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (OKLO) Is Up 23.0% After NRC Readiness Approval for Aurora Project Has The Bull Case Changed?

Reviewed by Simply Wall St

- Oklo Inc. recently completed the U.S. Nuclear Regulatory Commission's pre-application readiness assessment for Phase 1 of its combined license application for the Aurora powerhouses at Idaho National Laboratory, confirming its readiness to proceed with no significant gaps identified.

- This regulatory achievement, along with Oklo's selection for advanced nuclear projects at federal sites, highlights growing institutional support and confidence in its technology.

- We'll assess how Oklo's progress with the NRC helps shape its investment narrative, particularly as it advances repeatable advanced reactor licensing.

What Is Oklo's Investment Narrative?

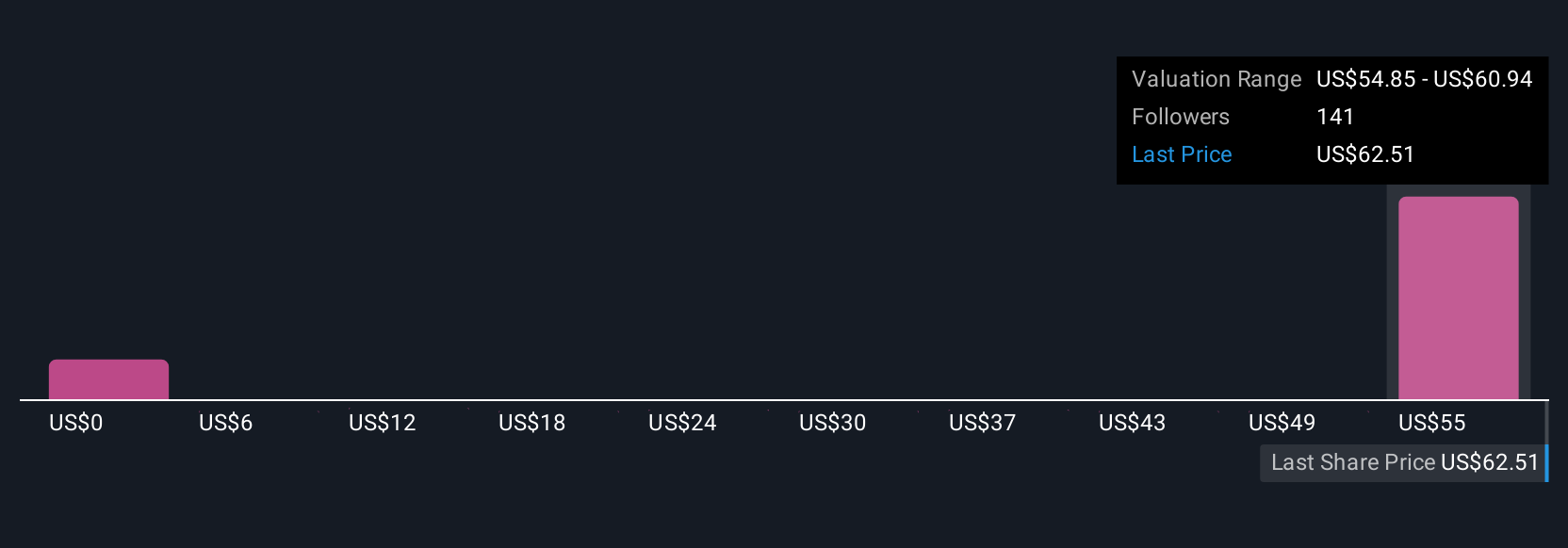

For anyone considering Oklo, the big picture centers on betting that advanced nuclear can become a scalable solution for clean, resilient energy, both commercially and for government contracts. The latest NRC pre-application greenlight signals important momentum, likely boosting confidence behind Oklo’s repeatable licensing story and, in the near term, making regulatory approval less of a bottleneck as the company files its combined license later this year. With this progress and recent federal site wins, near-term catalysts sharpen: regulatory milestones and government project execution come more into focus. On the other hand, financial risk remains, Oklo is still unprofitable with zero revenue, heavy dependence on new equity financing, and a board and management that are relatively new and untested. Share dilution and execution challenges are front of mind, especially following the recent large share offering.

Yet beneath the excitement, new equity raises can have a material impact on existing shareholders.

Exploring Other Perspectives

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives