- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (NYSE:OKLO) Announces Leadership Change as Sam Altman Steps Down as Chairman

Reviewed by Simply Wall St

Oklo (NYSE:OKLO) recently announced that Sam Altman will step down as Chairman, a significant leadership change that sees Co-Founder and CEO Jacob DeWitte assuming the role. This transition could suggest continuity for the company and may have supported Oklo's shares, which rose by 24% last month. The broader market also enjoyed a positive period, with the Dow Jones and S&P 500 recording strong gains driven by fresh trade deals and optimism around economic policies. The leadership shift at Oklo may have lent additional support to its stock alongside these wider market trends.

Over the past three years, Oklo's shares have achieved an impressive total return of 179.30%. This gain surpasses the recent one-year performance where Oklo outpaced both the US Market, which returned 7.7%, and the US Electric Utilities industry, which returned 13.7%. This longer-term context indicates Oklo's substantial appreciation relative to broader benchmarks.

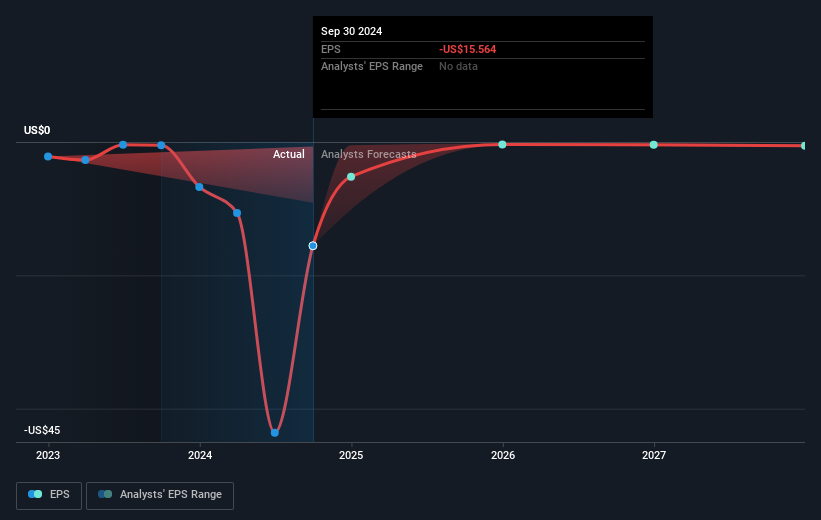

The recent leadership changes, particularly Sam Altman's departure and Jacob DeWitte's appointment as Chairman, could influence internal strategies and investor sentiment. Despite the positive stock movement, Oklo continues to face challenges with revenue generation, as its forecast indicates no revenue next year and its current earnings show a net loss of US$73.62 million. Such figures underline potential hurdles in achieving profitability in the near term. Meanwhile, Oklo's current share price trades at a discount when compared to the consensus analyst price target of US$46.83, suggesting differing views on its growth prospects and perceived value within the market.

Upon reviewing our latest valuation report, Oklo's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives