- United States

- /

- Electric Utilities

- /

- NYSE:OGE

OGE Energy (OGE): Evaluating Fair Value Following Steady Growth and Market-Aligned Performance

Reviewed by Kshitija Bhandaru

OGE Energy (OGE) has been steadily gaining attention from investors who are taking a closer look at its year-to-date performance and recent growth figures. The company's healthy 20% return over the past year stands out.

See our latest analysis for OGE Energy.

Steady momentum is building for OGE Energy, with its 1-year total shareholder return reaching 20.7% and a five-year total return of nearly 80%. Despite relatively quiet share price movement in recent weeks, investors are clearly rewarding its growth and outlook for the longer term.

If you’re looking for more companies with a mix of strong growth and insider conviction, take a look at fast growing stocks with high insider ownership.

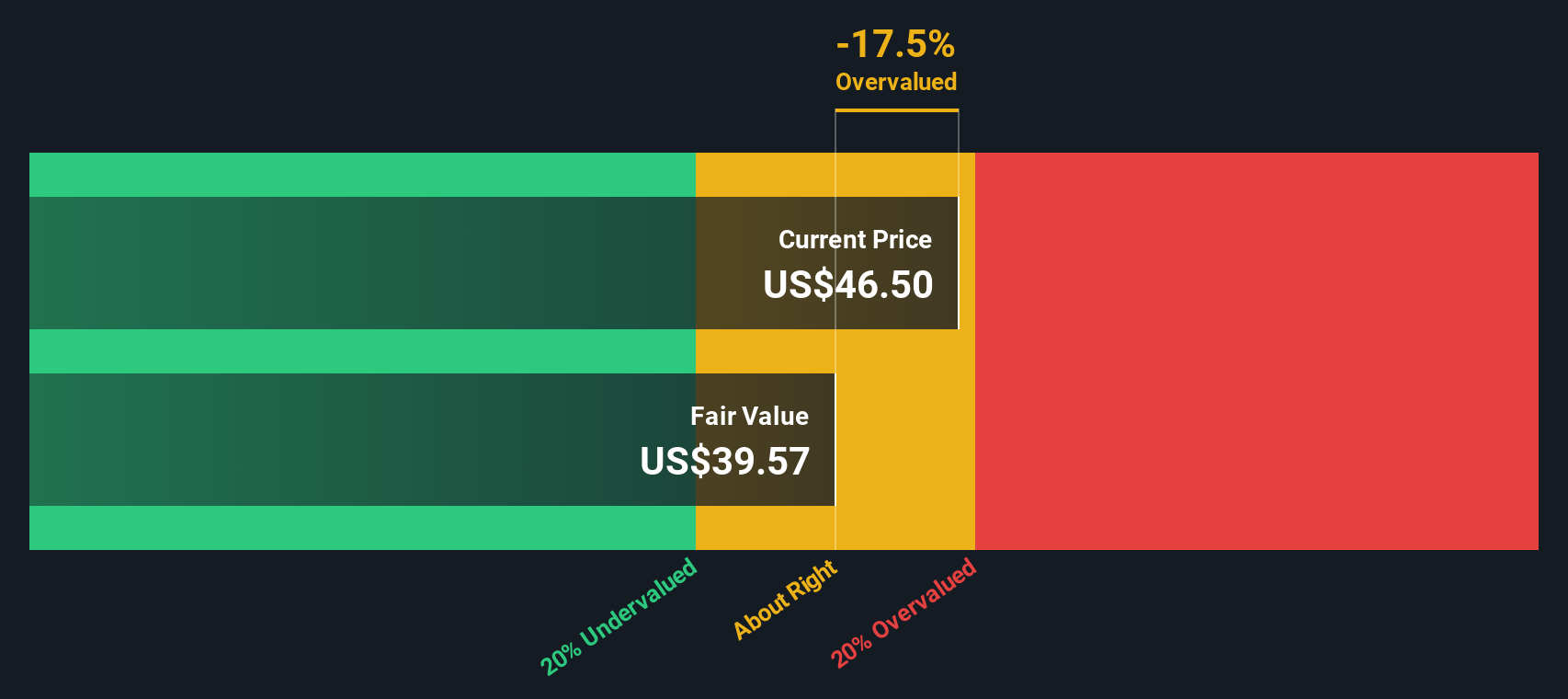

Yet with OGE Energy’s recent rally and shares trading close to analyst price targets, the key question now is whether the stock remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: Fairly Valued

With OGE Energy closing at $46.15 and the most widely followed narrative estimating a fair value of $45.94, the stock appears to be trading right in line with consensus expectations. This positions OGE Energy as neither significantly overvalued nor undervalued based on analyst-driven models that use a 6.78% discount rate.

*Sustained customer growth, electrification trends, and major projects are driving higher revenue and expanding opportunities, especially with data centers and large industrial clients. Strategic investments in infrastructure, favorable policies, and a strong financial position support stable earnings, improved margins, and long-term profitability.*

Curious what’s fueling OGE’s market-aligned valuation? Discover which ambitious growth bets and bold profit margin assumptions the narrative relies on. Wondering how these forward-looking projections shape the fair price? Click to unlock the financial blueprint powering this consensus outlook.

Result: Fair Value of $45.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in industrial demand and limited progress on renewables could challenge OGE’s growth outlook if these risks persist or intensify.

Find out about the key risks to this OGE Energy narrative.

Another View: Sizing Up the SWS DCF Model

While multiples suggest OGE Energy is trading about fair, our DCF model tells a different story. Using future cash flow projections, the SWS DCF model estimates the fair value is just $38.74, which is well below today’s price. Does this mean the market’s confidence is running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OGE Energy Narrative

If you see things differently or want to shape your own perspective, you can dive into the numbers and craft your personal narrative in just a few minutes. Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one story. The Simply Wall Street Screener opens the door to exceptional stock opportunities you won’t want to miss.

- Boost your returns with these 19 dividend stocks with yields > 3%, which offers market-beating yields above 3% and strong dividend histories.

- Tap into the explosive potential of artificial intelligence by checking out these 25 AI penny stocks, making waves in the AI sector.

- Position yourself ahead of the curve with these 26 quantum computing stocks, featuring pioneers unleashing breakthroughs in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives