- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Northwest Natural (NWN): Assessing Valuation After a Steady 21% Year-to-Date Share Price Climb

Reviewed by Simply Wall St

Northwest Natural Holding (NWN) has quietly built a solid track record, with shares up about 17% over the past year and roughly 15% in the past 3 months, supported by steady earnings growth.

See our latest analysis for Northwest Natural Holding.

With the share price now at $47.86, that 21.1% year to date share price return and 16.8% one year total shareholder return point to steadily building momentum as investors warm to its regulated growth profile and income appeal.

If Northwest Natural’s slow and steady climb appeals to you, this could be a good moment to explore other income leaning pharma stocks with solid dividends for more ideas.

With earnings growing faster than revenue and the share price still sitting below consensus targets, investors face a key question: is Northwest Natural quietly undervalued today, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 9.3% Undervalued

With Northwest Natural Holding closing at $47.86 versus a narrative fair value of $52.75, the story points to modest upside grounded in steady fundamentals.

Ongoing investments in infrastructure modernization and system upgrades, combined with supportive regulatory outcomes (recent rate increase and higher allowed ROE), are likely to improve net margins, operating efficiency, and future earnings reliability.

Want to see the math behind this quiet upside case? The narrative leans on disciplined revenue growth, widening margins, and a richer future earnings multiple. Curious which assumptions really move that fair value?

Result: Fair Value of $52.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could falter if decarbonization policies accelerate or Texas growth underperforms, limiting customer additions, gas volumes, and long term earnings power.

Find out about the key risks to this Northwest Natural Holding narrative.

Another Way to Look at Valuation

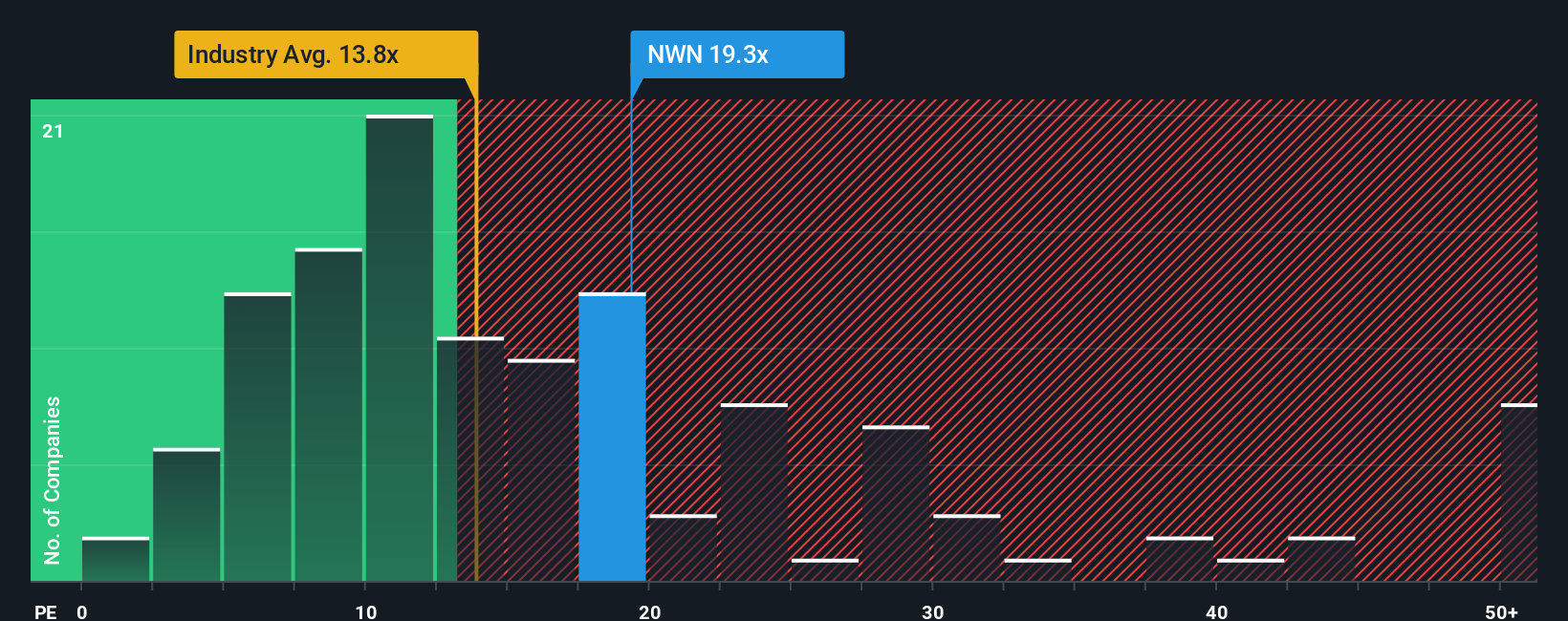

While the narrative fair value suggests modest upside, the current price of $47.86 sits slightly above our fair ratio-based view. Northwest Natural is trading on a 19.8x P/E versus a 19.7x fair ratio and 18.4x peer average, signaling limited margin for error if growth softens.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Natural Holding Narrative

If you want to dig into the numbers yourself and shape a different view, you can build a full narrative in just a few minutes, Do it your way.

A great starting point for your Northwest Natural Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall St Screener to uncover fresh stock ideas that match your income, growth, and innovation goals.

- Capture potential hidden bargains by reviewing these 919 undervalued stocks based on cash flows where strong cash flows suggest the market may be mispricing them right now.

- Ride powerful secular trends by targeting these 25 AI penny stocks at the forefront of automation, data intelligence, and next generation software.

- Strengthen your passive income plan by scanning these 14 dividend stocks with yields > 3% that can keep yield and stability working in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026