- United States

- /

- Other Utilities

- /

- NYSE:NI

If You Had Bought NiSource (NYSE:NI) Shares Five Years Ago You'd Have A Total Return Of 62%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But even in a market-beating portfolio, some stocks will lag the market. The NiSource Inc. (NYSE:NI) stock price is down 45% over five years, but the total shareholder return is 62% once you include the dividend. That's better than the market which returned 36% over the same time. The falls have accelerated recently, with the share price down 13% in the last three months. But this could be related to the weak market, which is down 19% in the same period.

View our latest analysis for NiSource

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

NiSource became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

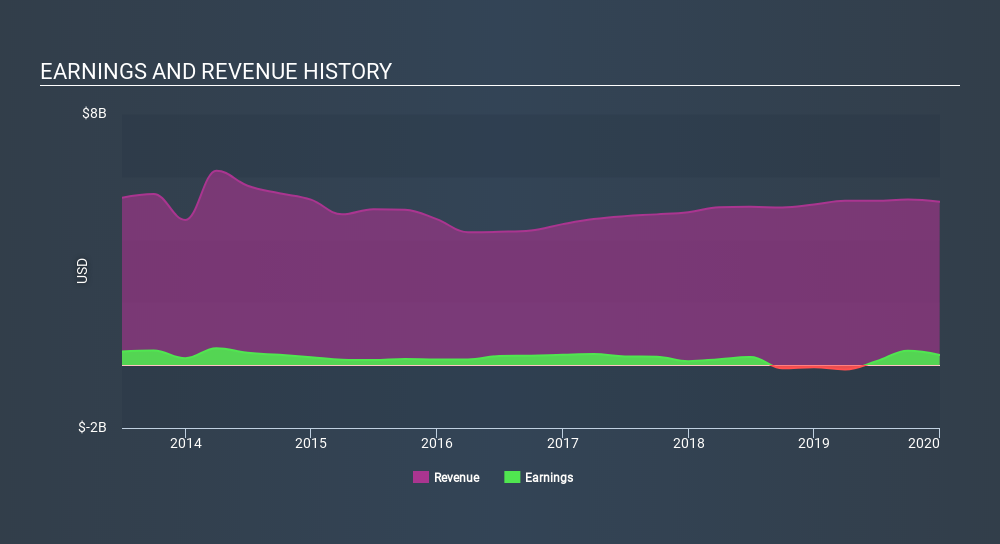

In contrast to the share price, revenue has actually increased by 2.2% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that NiSource has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for NiSource in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, NiSource's TSR for the last 5 years was 62%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that NiSource shareholders are down 11% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 8.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand NiSource better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with NiSource (including 1 which is is concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:NI

NiSource

An energy holding company, operates as a regulated natural gas and electric utility company in the United States.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives