- United States

- /

- Gas Utilities

- /

- NYSE:NFG

National Fuel Gas (NFG): A Fresh Look at Value After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for National Fuel Gas.

Shares of National Fuel Gas have pulled back recently, with a 7-day share price return of -3.68% and a 30-day return of -8.25%. Its year-to-date share price return stands at an impressive 33.8%. This momentum highlights a solid stretch, as the company has delivered a robust 34.58% total shareholder return over the past year and more than doubled investors’ money over five years. This performance underscores its appeal to those seeking steady, long-term growth.

If you value consistency but are also on the lookout for fresh opportunities, now could be the time to discover fast growing stocks with high insider ownership

With National Fuel Gas trading around $82 and still sitting nearly 23% below the consensus analyst price target, investors may wonder if the current valuation offers an overlooked entry point or if the market is already taking future gains into account.

Most Popular Narrative: 17.6% Undervalued

National Fuel Gas last closed at $82.10, while the widely followed narrative assigns a significantly higher fair value. This sets the scene for a valuation thesis worth investigating further.

Accelerating natural gas demand for baseload power generation, including new data centers, electrification of heating and transportation, and structural shifts in state energy policies, is expected to drive higher and more stable demand for National Fuel Gas's pipeline and utility segments. This underpins predictable revenue and margin growth over the long term.

Curious how such a bullish fair value is justified? The narrative hinges on a bold combination of rising demand, future efficiency gains, and heavyweight financial projections included in the model. Find out the critical profit, revenue, and valuation assumptions that push this target price far above where the stock trades now. Are you ready to see what’s driving analyst confidence?

Result: Fair Value of $99.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing decarbonization policies and rising infrastructure spending requirements could challenge National Fuel Gas’s outlook and limit future earnings momentum.

Find out about the key risks to this National Fuel Gas narrative.

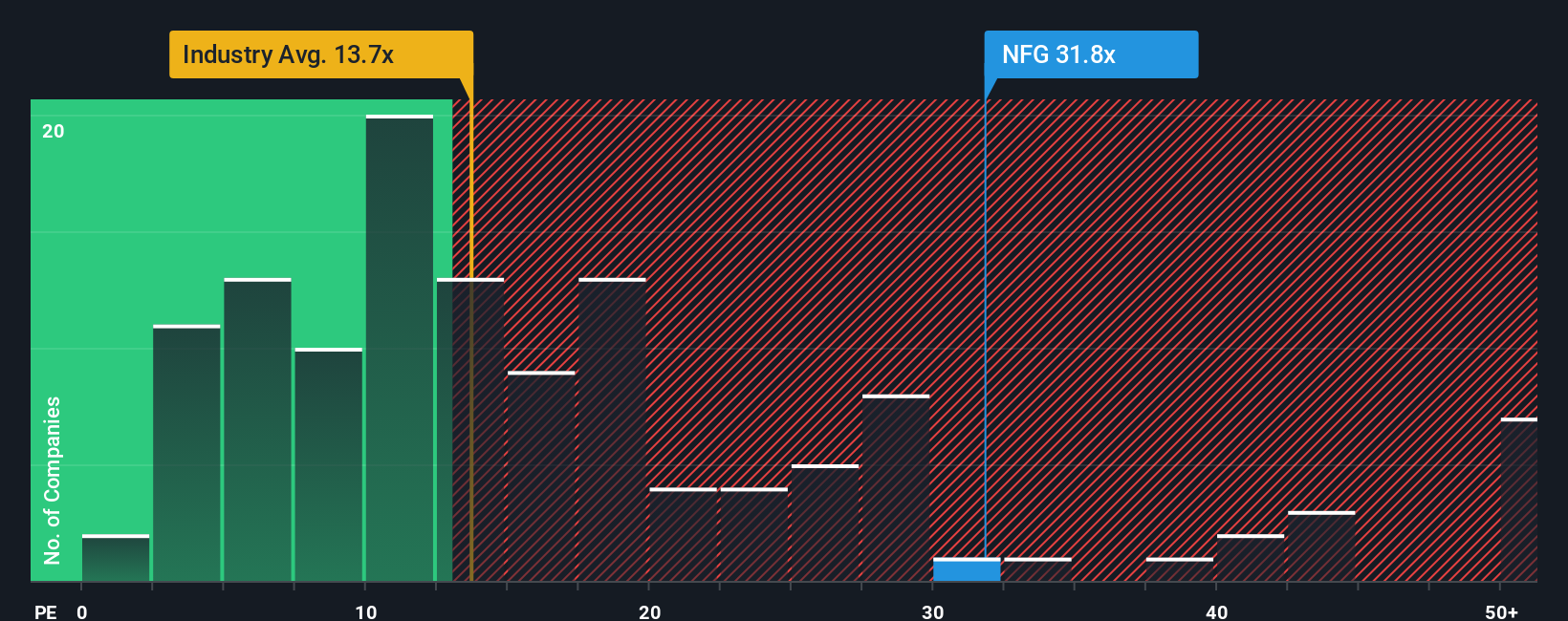

Another View: Market Ratios Tell a Different Story

Looking at National Fuel Gas through the lens of its price-to-earnings ratio paints a more cautionary picture. The stock trades at 30.5 times earnings, which is notably higher than both the global industry average of 14.1 and the peer average of 21.6. Even though the fair ratio sits at 45.2, this gap means investors are paying a premium relative to the sector but not necessarily compared to where the ratio could move over time. Is the market overestimating future growth, or could there still be hidden value if sentiment catches up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Fuel Gas Narrative

If you have a different perspective or prefer taking a hands-on approach, explore the numbers and craft your own story in just a few minutes with Do it your way.

A great starting point for your National Fuel Gas research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not limit your portfolio to just one strong performer. Stay ahead by checking out other exciting stocks and opportunities on Simply Wall Street’s powerful Screener platform.

- Uncover tomorrow’s industry giants by exploring these 3570 penny stocks with strong financials, which are poised for explosive potential and impressive financials.

- Ride the wave of technological change and discover innovative companies among these 27 AI penny stocks, as they transform AI innovation from the ground up.

- Enhance your search for market bargains with these 868 undervalued stocks based on cash flows, which highlights stocks with attractive prices and overlooked upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Good value with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives