- United States

- /

- Gas Utilities

- /

- NYSE:NFG

Is National Fuel Gas Still Attractive After 6% Pullback and Recent Pipeline Approval News?

Reviewed by Bailey Pemberton

If you have been debating what to do with your National Fuel Gas shares, or wondering if now is the right time to buy in, let’s look at what has caught investors’ attention lately. The stock closed at $81.34 yesterday, and while the past week has seen a dip of nearly 6%, National Fuel Gas has still delivered a gain of 32.6% year-to-date and an even more impressive 137.2% over the past five years. That is not the kind of track record you ignore lightly, especially given the choppy energy sector landscape.

Much of this long-term growth can be tied to steady expansion in the company’s natural gas operations and optimism about strategic investments in infrastructure. Share price movements can also be traced to recent news highlighting regulatory approvals for pipeline upgrades, which could further enhance long-term cash flows. While short-term volatility is par for the course, the market’s overall perception of risk seems to be shifting as more investors are factoring in National Fuel Gas’s stability in a changing energy environment.

Of course, when it comes to deciding if the stock is actually a good buy right now, valuation matters. By our model, National Fuel Gas earns a solid value score of 4 out of 6, showing it is undervalued on two-thirds of the key checks we consider. But what exactly goes into that score? Let’s break down the different valuation methods to see where the company shines and which areas deserve a closer look. Plus, learn about a smarter way to assess value that might surprise you.

Approach 1: National Fuel Gas Discounted Cash Flow (DCF) Analysis

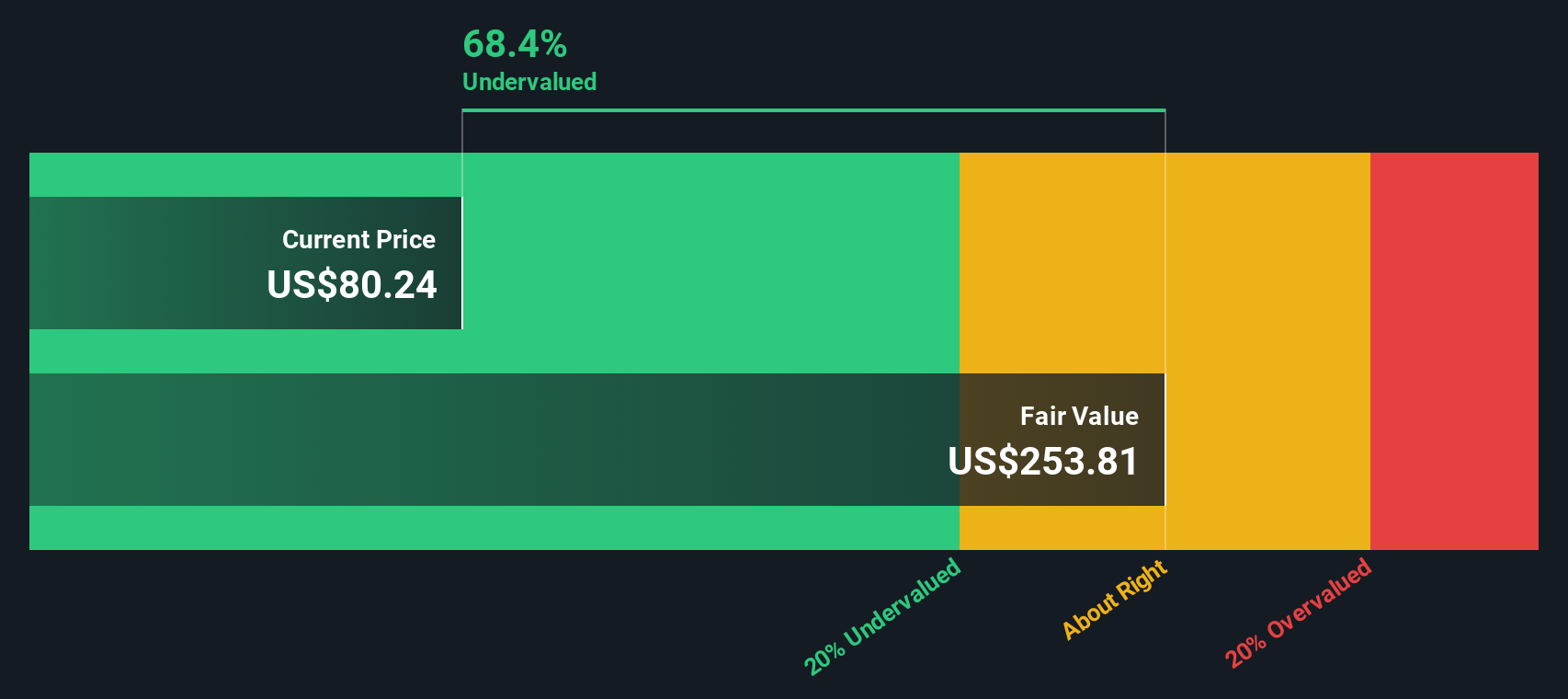

A Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today’s dollars. This approach helps investors understand how much a stock should be worth based on the business’s ability to generate cash in the years ahead.

For National Fuel Gas, the model uses the company’s latest twelve-month Free Cash Flow (FCF) of $61.2 Million as a starting point. Analysts project sustained growth in these cash flows; by 2027, FCF is estimated to reach $472 Million, with extrapolated forecasts indicating a potential of $1.2 Billion in 2035. These projections combine both analyst expectations over the next few years and more cautious, systematically calculated growth rates further into the future.

Bringing all these future cash flows back to today results in an estimated intrinsic value of $253.81 per share. With the current share price at $81.34, this model suggests a sizeable 68.0% discount, indicating the stock is significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests National Fuel Gas is undervalued by 68.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: National Fuel Gas Price vs Earnings (PE Ratio)

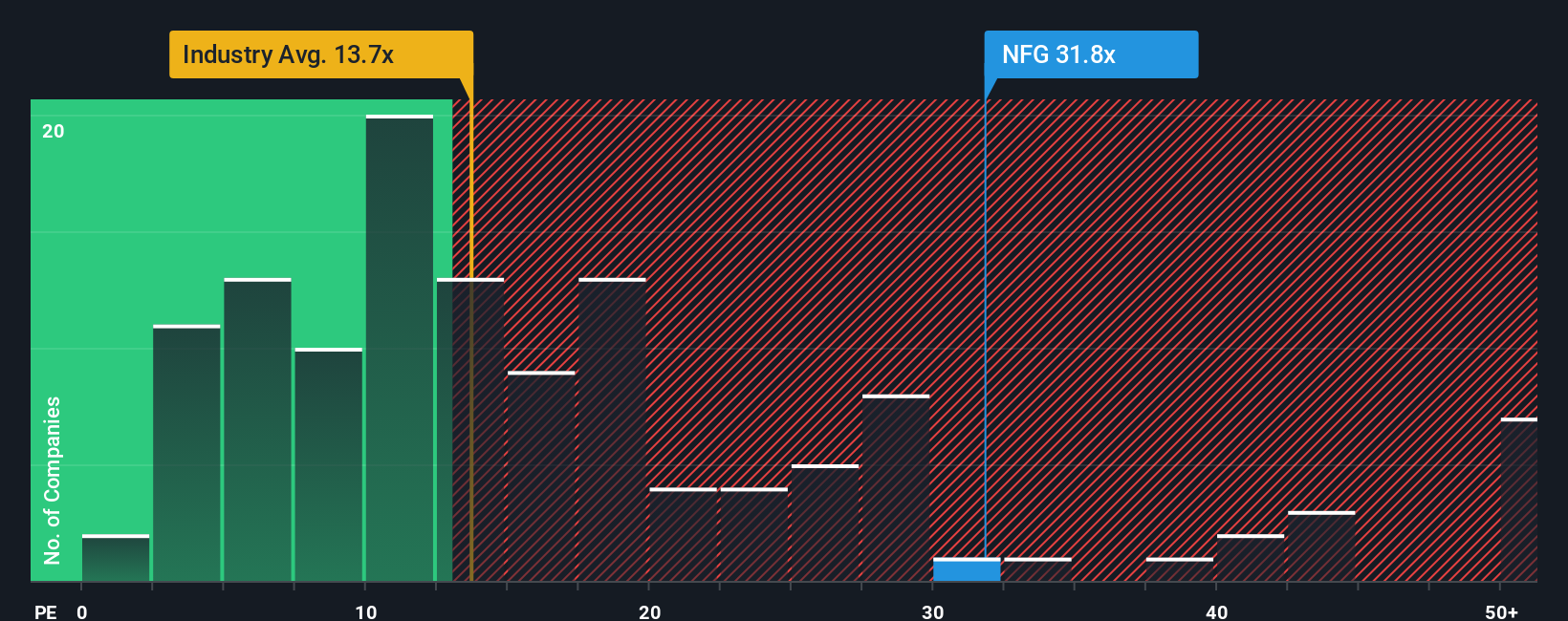

The Price-to-Earnings (PE) ratio is a commonly used valuation metric, especially for profitable companies like National Fuel Gas, because it compares a company’s stock price to its current earnings. For companies with steady profits, the PE ratio helps investors quickly gauge how much the market is willing to pay for a dollar of those earnings.

A “normal” or “fair” PE ratio can vary depending on factors like expected growth, overall risk, and the stability of earnings. Companies with higher expected growth or lower risk typically command higher PE multiples. In contrast, slower growth or greater uncertainty often warrants a lower ratio.

National Fuel Gas currently trades at a PE ratio of 30.2x. For comparison, the average PE for the Gas Utilities industry is much lower at 13.5x, and the company’s peer average is 21.8x. At first glance, this might make the stock appear expensive relative to its sector.

However, Simply Wall St’s “Fair Ratio” takes additional factors into account. The Fair Ratio for National Fuel Gas is estimated at 45.1x, calculated by considering not only its profitability, but also its growth expectations, profit margins, industry dynamics, company size, and specific risks. This makes it a more tailored benchmark than simply using industry or peer averages.

When comparing National Fuel Gas’s actual PE of 30.2x to the Fair Ratio of 45.1x, the stock appears undervalued based on this more comprehensive measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

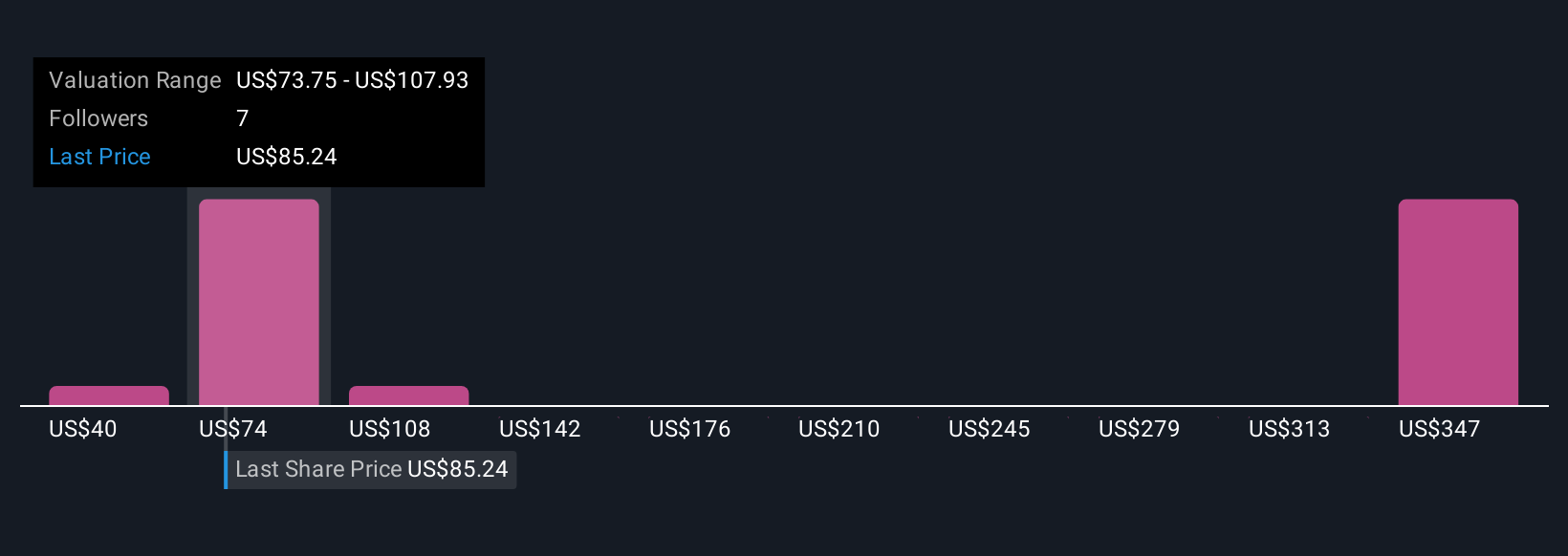

Upgrade Your Decision Making: Choose your National Fuel Gas Narrative

Earlier, we mentioned there is an even better way to understand a company’s value: Narratives. A Narrative is a story you build about a company by connecting the facts you believe in (like future revenue, earnings, and profit margins) with your own assumptions to project a fair value. Narratives help bridge the company’s story with the numbers, so you can see how your expectations, or those of analysts, play out in financial forecasts and potential share prices. On Simply Wall St’s Community page, millions of investors use Narratives to clarify their thinking and decide if it is time to buy or sell, since you can instantly compare the calculated Fair Value against the stock’s current price. Because Narratives are updated dynamically whenever new news or earnings are released, they help you stay ahead as the story evolves. For example, the most optimistic Narrative for National Fuel Gas sees aggressive clean energy demand and operational efficiency lifting earnings to over $1.1 billion by 2028. In contrast, the most cautious Narrative sees stricter regulations and rising costs capping margins, and each perspective results in very different Fair Value estimates.

Do you think there's more to the story for National Fuel Gas? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Good value with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives