- United States

- /

- Gas Utilities

- /

- NYSE:NFG

How Expanded Drilling Inventory and a New Pipeline Deal at National Fuel Gas (NFG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- National Fuel Gas Company recently reported fourth quarter results with sales and revenue of US$456.41 million and net income of US$107.34 million, reversing a net loss a year earlier, and reiterated its 2026 production guidance of 440 to 455 Bcf.

- CEO David Bauer also announced the addition of 220 Upper Utica drilling sites, expanding the company’s well inventory to nearly 20 years, alongside a new pipeline deal to move more gas to high-value markets by late 2028.

- We’ll look at how the expanded drilling inventory and new pipeline agreement may reshape National Fuel Gas’s long-term growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

National Fuel Gas Investment Narrative Recap

If you believe in the case for stable, long-term natural gas demand and the company’s ability to grow through upstream resource additions and infrastructure expansion, National Fuel Gas’s latest results may reinforce that view. The addition of Upper Utica drilling locations and a new pipeline agreement support the most important short-term catalyst, capacity to supply higher-value markets, but do not materially change the biggest risk, which stems from policy and societal pressures toward decarbonization in core markets.

Among the recent announcements, the reiterated 2026 production guidance of 440 to 455 Bcf stands out, providing a benchmark for volume growth and operational confidence as the company pursues continued investment in its shale assets. Ultimately, this figure supports investor attention on execution rather than speculation, even as regulatory and capital cost risks remain close to the surface.

However, investors should not lose sight of the long-term threat from accelerating decarbonization trends, which could...

Read the full narrative on National Fuel Gas (it's free!)

National Fuel Gas' narrative projects $3.3 billion in revenue and $1.1 billion in earnings by 2028. This requires 14.9% yearly revenue growth and an earnings increase of $856.5 million from current earnings of $243.5 million.

Uncover how National Fuel Gas' forecasts yield a $101.33 fair value, a 25% upside to its current price.

Exploring Other Perspectives

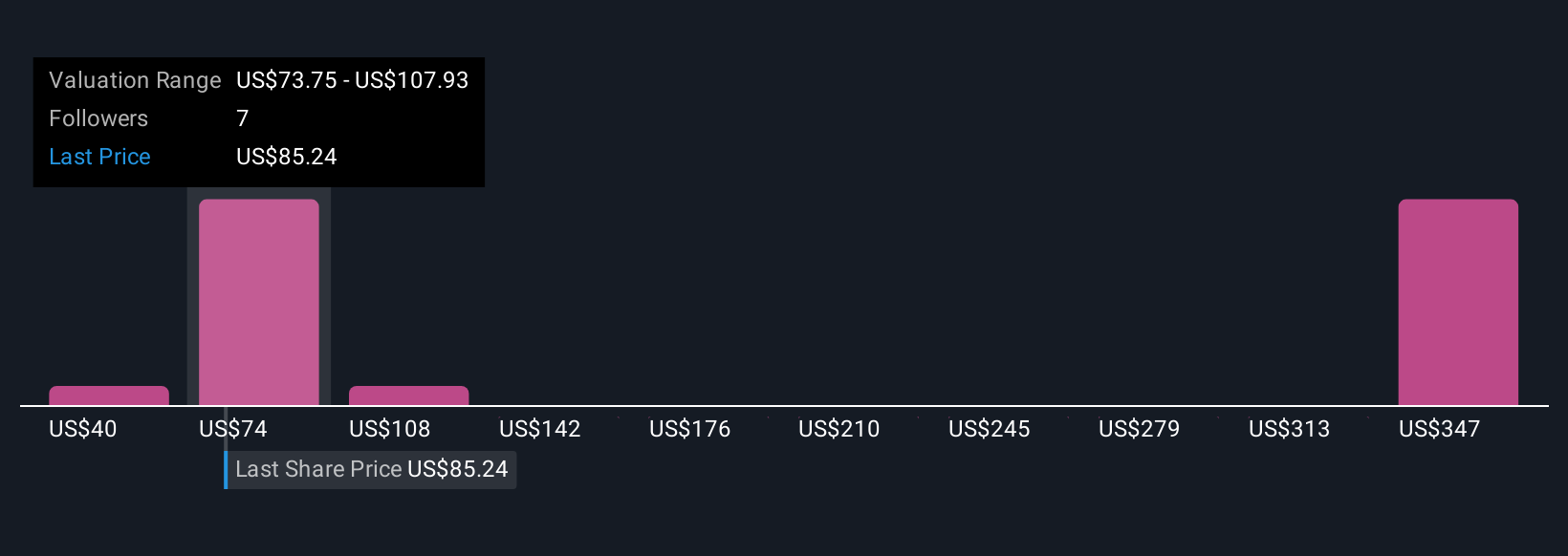

The Simply Wall St Community’s fair value estimates for National Fuel Gas range widely from US$39.58 to US$252.36, based on four independent views. Many see future opportunity in production growth, but shifts in energy policy could have far-reaching effects that shape expectations, make sure to consider all sides before forming your own view.

Explore 4 other fair value estimates on National Fuel Gas - why the stock might be worth over 3x more than the current price!

Build Your Own National Fuel Gas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Fuel Gas research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Fuel Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Fuel Gas' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives