- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): Is the Recent Rebound Justified by Its Valuation?

Reviewed by Simply Wall St

NextEra Energy (NEE) has been quietly grinding higher, with the stock up about 4% over the past month and nearly 20% in the past 3 months, drawing fresh attention from income and growth investors.

See our latest analysis for NextEra Energy.

That move fits into a stronger rebound story, with NextEra’s share price delivering a solid double digit year to date return, while its five year total shareholder return underscores steady, income backed compounding for long term holders.

If this kind of steady climb appeals to you, it could be worth exploring healthcare stocks as another way to uncover resilient, long term compounders in a very different part of the market.

With shares now hovering just below analyst targets and trading at a premium to some traditional utilities, the key question is whether NextEra is still mispriced or if the market is already banking on years of growth.

Most Popular Narrative Narrative: 6.6% Undervalued

With NextEra Energy last closing at $84.95 versus a most popular narrative fair value of $91, the story hinges on sustained growth and resilient margins.

Declining costs and rapid deployment timelines of renewables (solar, wind, and especially battery storage), along with NextEra's unrivaled supply chain and perpetual construction capabilities, allow the company to extract significant pricing and operational advantages over competitors, helping to expand margins and accelerate earnings as cost pressures mount elsewhere in the sector.

Want to see how steady double digit growth, rising margins, and a premium future multiple all fit together in one model? The hidden levers might surprise you.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and tighter permitting for large renewable projects could squeeze returns and slow the growth that underpins this bullish narrative.

Find out about the key risks to this NextEra Energy narrative.

Another Way to Look at Valuation

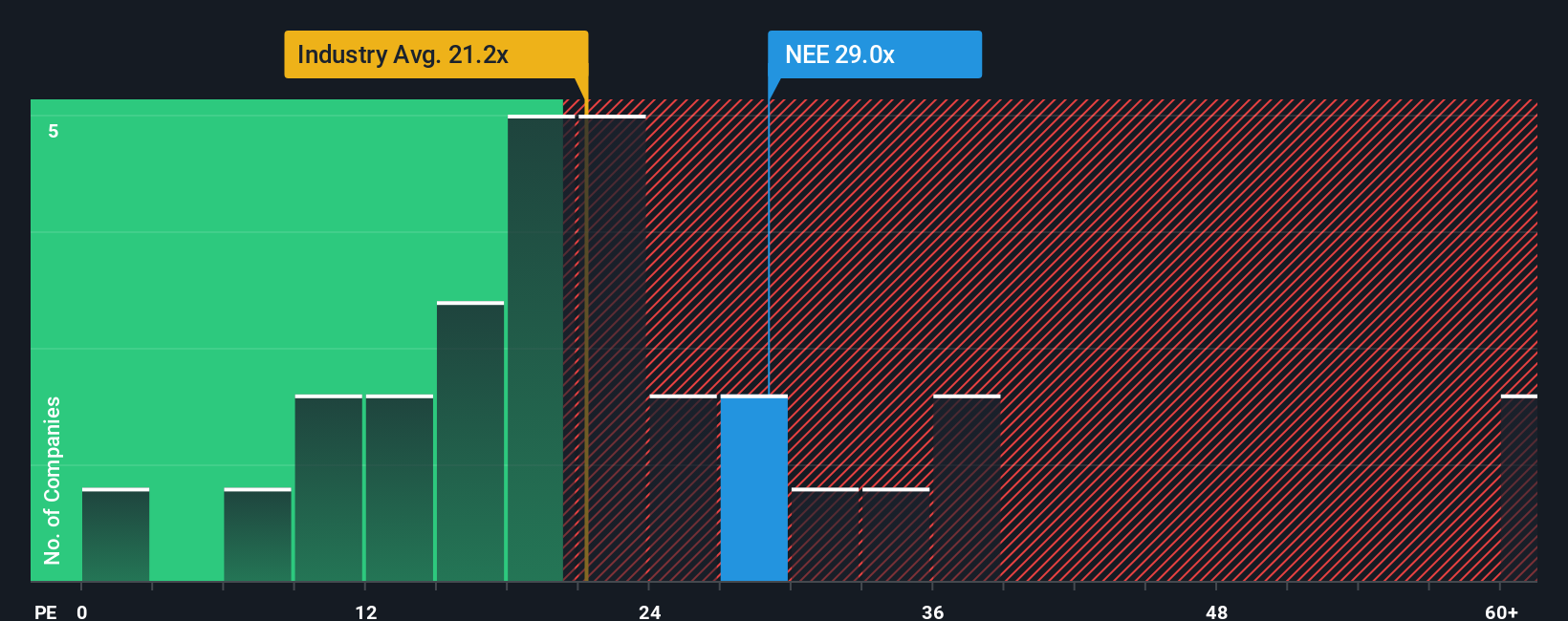

Not everyone agrees that NextEra is modestly undervalued. On a price to earnings basis it trades at 27.2 times earnings, richer than both peers at 24.7 times and the US utilities average at 20.2 times, though still below a fair ratio of 29.5 times.

That leaves investors weighing a smaller upside against a real risk of de rating if growth underwhelms, especially with rates and regulation in flux. Which side of that trade would you rather be on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If you are not fully convinced by this take or simply prefer digging into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next watchlist upgrade with fresh stock ideas from the Simply Wall St Screener, tailored to different strategies and risk levels.

- Capture high potential mispricings by scanning these 920 undervalued stocks based on cash flows that may be trading well below their long term cash flow power.

- Ride powerful innovation trends by targeting these 25 AI penny stocks positioned at the forefront of artificial intelligence transformation.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that can help anchor total returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026