- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Does NextEra Energy’s Recent Rally Reflect the Price Target Hike After Florida Rate Settlement?

Reviewed by Bailey Pemberton

If you have been watching NextEra Energy lately and wondering what your next move should be, you are far from alone. With shares climbing 10.2% over the last 7 days and a striking 17.4% over the past month, it is clear something is stirring. The stock is up 16.2% year-to-date and has delivered a respectable 25.2% return across the past five years. For investors haunted by memories of more sluggish periods, this uptick feels a bit like a turning point.

What is behind all the action? Headlines have been flying, from buzz about federal clean energy funding possibly being slashed to updates on offshore wind projects shifting the mood across the renewable energy industry. Even as government winds blow hot and cold, analysts are recalibrating, with one boosting a price target to $78. Against this backdrop, the market might be pricing in new risks, or perhaps spotting more upside than meets the eye. Either way, fresh optimism is clearly fueling the recent run.

But is NextEra Energy actually undervalued right now? By the numbers, the company earns a valuation score of just 1 out of 6, meaning only one major valuation check suggests the shares are attractively priced. Some investors see that as a red flag, others as an intriguing opportunity. So, how should you judge for yourself? Let us break down the main valuation approaches, then explore a smarter way to make sense of the numbers that often gets missed.

NextEra Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NextEra Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) evaluates a stock’s fair value by projecting all future dividend payments and discounting them back to the present. For dividend-focused companies like NextEra Energy, this model is especially valuable because it considers both dividend growth and sustainability over time.

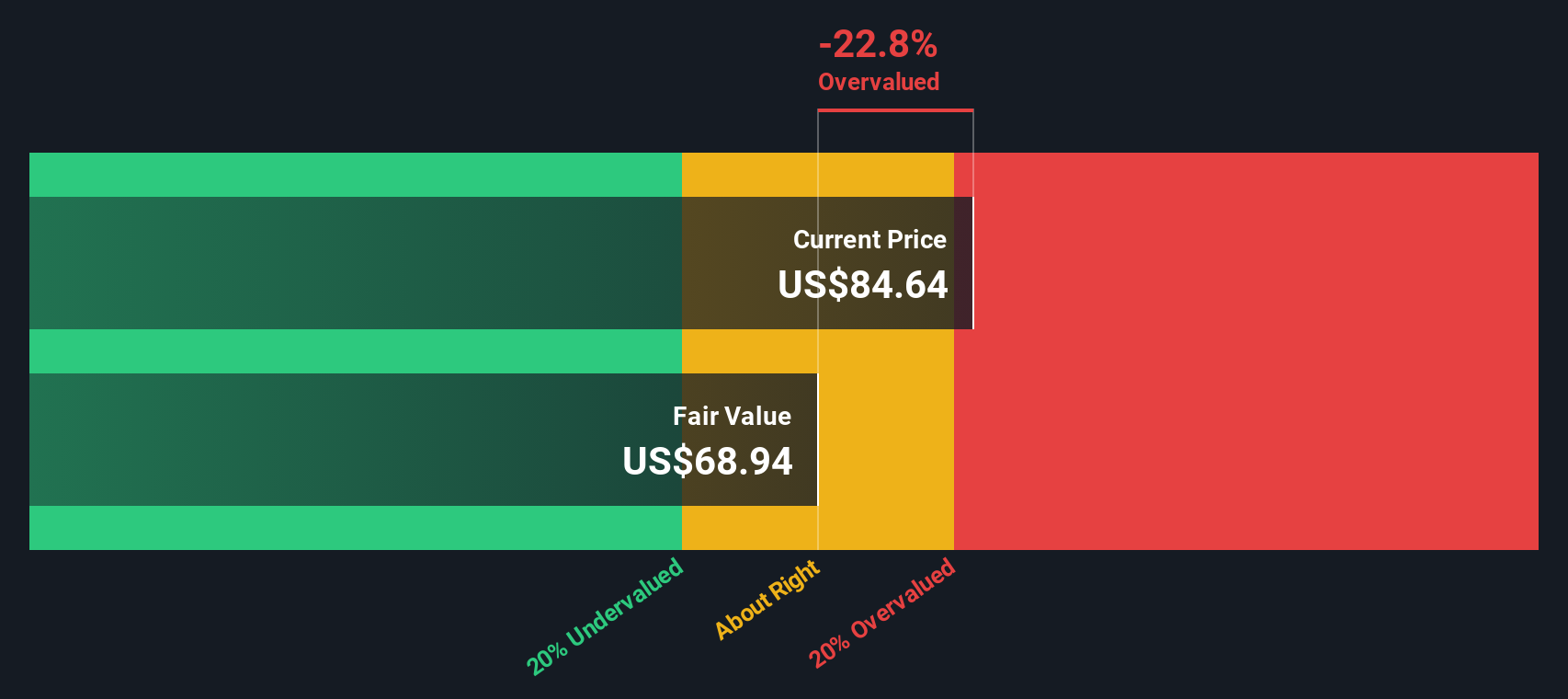

For NextEra Energy, the latest annual dividend per share stands at $2.55, with a payout ratio of nearly 61%. The DDM’s underlying assumption is that dividends will grow at about 3.1% yearly, a figure capped to manage optimistic estimates. With a return on equity just above 9.5%, the company’s ability to sustain and grow its dividend appears robust, particularly in the context of stable industry fundamentals.

Using these projections, the DDM estimates an intrinsic value of $69.07 per share. Compared to the current share price, this approach implies the stock is roughly 20.5% overvalued at present. For investors, this suggests that while NextEra Energy’s dividend potential is solid, new buyers may be paying a premium today for future payout growth.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests NextEra Energy may be overvalued by 20.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NextEra Energy Price vs Earnings

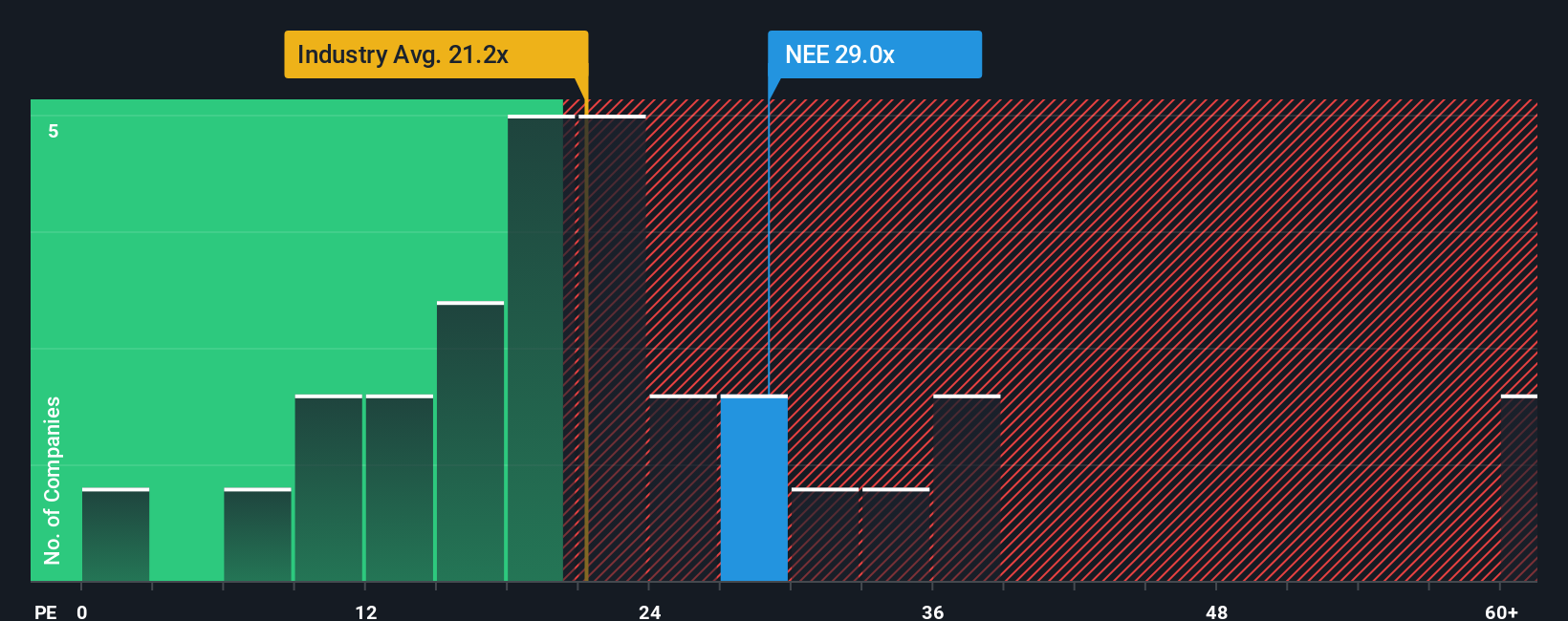

The price-to-earnings (PE) ratio is often the go-to valuation multiple for profitable companies like NextEra Energy, as it directly links a company's market price to its actual earnings. This makes it particularly useful for established businesses with steady profit streams, such as those in the electric utilities sector.

However, what counts as a "reasonable" PE ratio is not set in stone. It is influenced by factors such as expected earnings growth, the riskiness of the company compared to its peers, and broader industry conditions. Higher growth prospects or lower perceived risks typically justify a higher PE ratio, while slower growth or more uncertainty usually brings that number down.

Currently, NextEra Energy is priced at 28.95x earnings, noticeably higher than both the electric utilities industry average of 21.28x and the peer group average of 24.98x. This top-end valuation suggests the market anticipates above-average growth or lower risks compared to competitors. To dig deeper, Simply Wall St’s proprietary “Fair Ratio” estimates the multiple NextEra Energy deserves based on a wider set of measures including earnings growth, profit margins, industry dynamics, risk profile, and market cap. This model assigns a fair PE ratio of 28.99x, nearly identical to the company’s actual multiple.

The Fair Ratio provides a more tailored lens than industry averages, accounting for company-specific strengths and risks that peers may not share. Since NextEra Energy’s current PE is almost exactly in line with its Fair Ratio, the stock appears appropriately valued on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextEra Energy Narrative

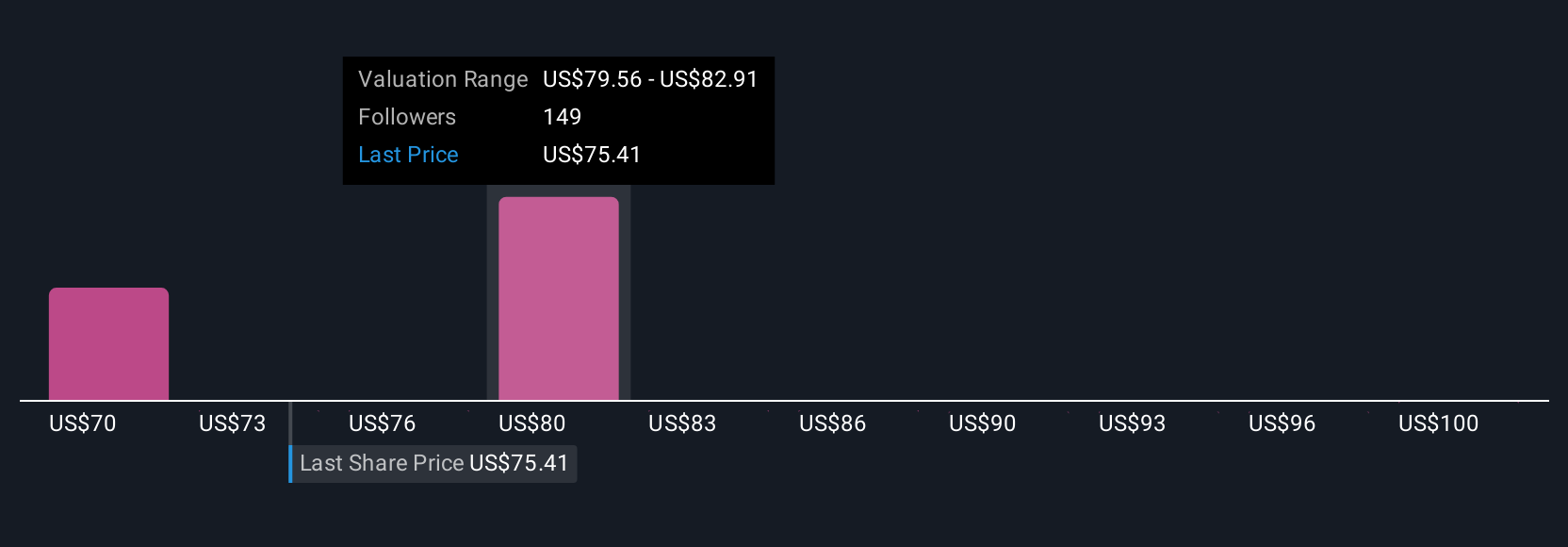

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story—your perspective about a company’s future—translated into numbers such as fair value, and clear expectations for revenue, earnings, and profit margins over time. Narratives connect the “why” behind your view of a company directly to a financial forecast, so you can see exactly how your reasoning shapes your investment decision.

With Narratives, available on Simply Wall St’s Community page used by millions, you can easily personalize your view of NextEra Energy, updating assumptions as new news or earnings releases come out. Narratives let you compare fair value estimates to the current share price, so you know when your story suggests it is time to buy, hold, or sell. These tools update dynamically as new information arrives, ensuring your outlook always reflects the latest developments.

For example, one NextEra Energy Narrative values the stock at $52.00 based on policy headwinds, while another projects $103.00, assuming aggressive renewables growth. This demonstrates how your perspective can drive a completely different investment decision.

Do you think there's more to the story for NextEra Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives