- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Is Now the Right Moment for IDACORP Shares After 35% Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with IDACORP stock right now? You are not alone. As investors scan the market for reliable opportunities, IDACORP’s recent price action stands out. Over the last year, shares have delivered an impressive 35.1% gain, and if you have held on for five years, you are up nearly 75%. Even looking at just the past month, the stock climbed 5.6%, showing clear momentum that has drawn fresh attention from both new and seasoned investors.

What is driving this performance? For the most part, it is a combination of stable utility sector fundamentals and broader optimism about regulated utilities’ resilience in a changing market environment. Of course, recent market developments like shifting investor sentiment and the search for defensive stocks may be at play. However, there is no single piece of news fully explaining the uptrend.

All of this calls for a closer look at valuation. With a quantitative valuation score of 0 out of 6, meaning IDACORP is not currently undervalued based on the standard checks we use, it is natural to wonder if the market’s enthusiasm might be running ahead of the company’s true worth. That is exactly what the next part of this article will tackle: the major approaches used to assess value, and later, an even smarter way to understand what the numbers really mean for your investment decisions.

IDACORP scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDACORP Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company’s intrinsic value based on its future expected dividend payments, adjusted for growth and discounted back to present value. This model is particularly relevant for established utilities like IDACORP, which have predictable dividend policies and stable earnings.

According to the latest DDM metrics, IDACORP pays an annual dividend per share of $3.67, with a dividend payout ratio of 60.9%. The company’s return on equity stands at 9.27%. The model uses a dividend growth rate of 3.08%, slightly reduced from previous expectations to account for sector stability. These factors suggest that IDACORP’s dividends are sustainable but growing at a modest pace.

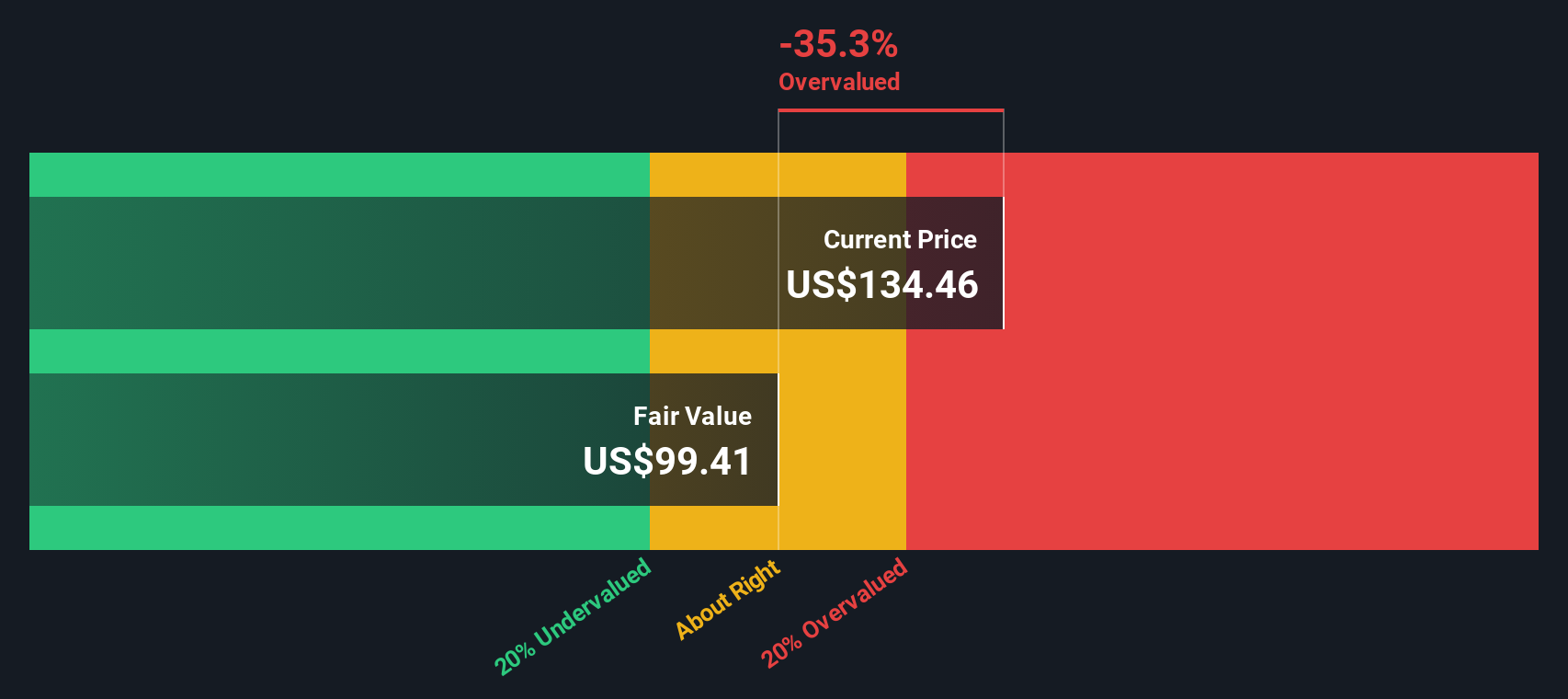

Based on these projections, the DDM estimates IDACORP’s fair value at $99.41 per share. When compared to the current share price, the intrinsic discount implies that the stock is about 33.2% overvalued using this method. For investors focusing on dividend yield and growth, this is a sign that IDACORP may currently be priced above its long-term fundamentals.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests IDACORP may be overvalued by 33.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: IDACORP Price vs Earnings

For companies like IDACORP that generate steady, reliable profits, the Price-to-Earnings (PE) ratio is a time-tested valuation tool. The PE ratio allows investors to see how much the market is willing to pay for each dollar of earnings. This makes it especially useful when a business is consistently profitable.

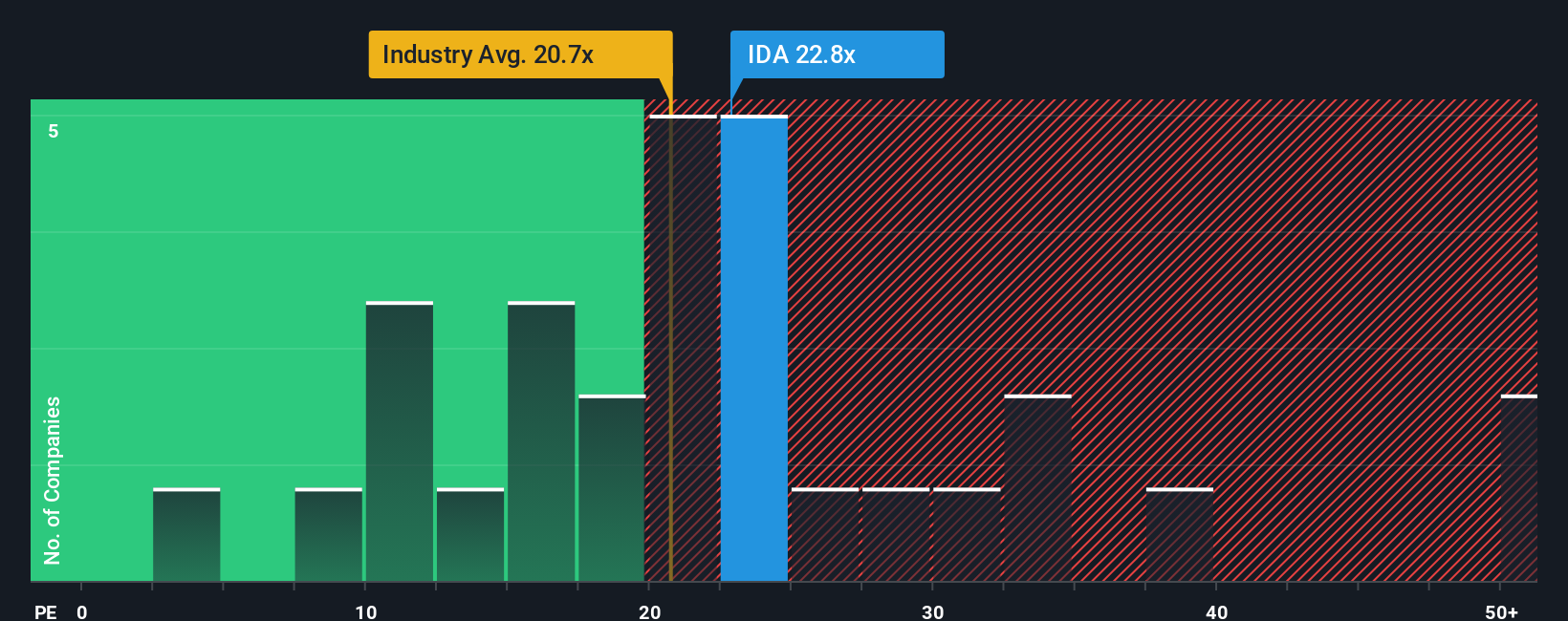

The right PE ratio for a stock depends on expectations for future growth and the level of risk investors are willing to take. Faster-growing, lower-risk companies can justify a higher PE, while slower-growing or riskier firms tend to trade at lower multiples. As of now, IDACORP is trading at a PE of 23.3x, which is above both the industry average of 21.1x and its peer group’s average of 21.9x.

However, just comparing to the industry or peers has limits. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. This benchmark considers not only IDACORP’s sector but also integrates expected earnings growth, profit margins, company size, and risk profile. According to this measure, IDACORP’s Fair PE Ratio is 19.9x. Because the current PE is noticeably higher than this Fair Ratio, it suggests the stock is somewhat overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDACORP Narrative

Earlier we mentioned there is an even better way to make sense of valuation: introducing Narratives. A Narrative is simply your story about a company, where you link what you believe about its future (like revenue growth, profit margins, and fair value) to a financial forecast and then to a clear estimate of what the business might be worth.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to connect their own insights and research to the numbers, creating a practical guide for buy or sell decisions by directly comparing Fair Value to today’s price. Narratives are updated instantly when major news or earnings come in, so you are always acting on the freshest possible information.

For IDACORP, for example, some investors’ Narratives see big earnings upside from electrification trends and major industrial investments, arriving at a fair value as high as $132.67. Others are more cautious, pointing to uncertain regulation or hydro risks, and land at lower valuations. With Narratives, you can see all these viewpoints at a glance, compare them to your own, and make decisions with confidence based on a dynamic story rather than just static ratios or models.

Do you think there's more to the story for IDACORP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives