- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Evaluating IDACORP (IDA): Is the Stock’s Strong Performance Reflected in Its Current Valuation?

Reviewed by Kshitija Bhandaru

See our latest analysis for IDACORP.

IDACORP’s momentum has been building, with strong fundamentals reflected in a 34% one-year total shareholder return while the broader sector stays steady. The consistent gains suggest investors are warming up to the company’s growth and rewarding its steady performance.

If you’re looking for more ways to spot resilient performers, it might be a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares now hovering just shy of analyst price targets after such a strong run, the key question is whether IDACORP remains undervalued or if the market is already factoring in the company’s future growth potential.

Most Popular Narrative: 20% Undervalued

The narrative assigns a fair value well above the last close, implying analysts believe the stock has significant upside potential. This view is grounded in future growth expectations and sector shifts that go beyond price momentum alone.

Massive planned capital investments in transmission lines, energy storage, and generation assets, supported by a constructive regulatory environment and recent rate case filings, are set to expand IDACORP's rate base. This is expected to enhance regulated returns and support long-term earnings growth.

Ongoing national and regional focus on clean energy transition and grid modernization, including federally supported incentives, positions IDACORP to successfully grow its asset base. The company stands to take advantage of tax credits while enhancing earnings stability and net margins through cost recovery.

Curious about what’s powering this valuation spike? The narrative’s math hinges on ambitious top-line growth and surprisingly optimistic earnings forecasts, but the most pivotal variable might not be what you expect. Discover the critical figure that could tilt the entire equation.

Result: Fair Value of $132.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weather-sensitive hydro generation and regulatory uncertainty around major investments could still disrupt IDACORP's strong growth expectations in the years ahead.

Find out about the key risks to this IDACORP narrative.

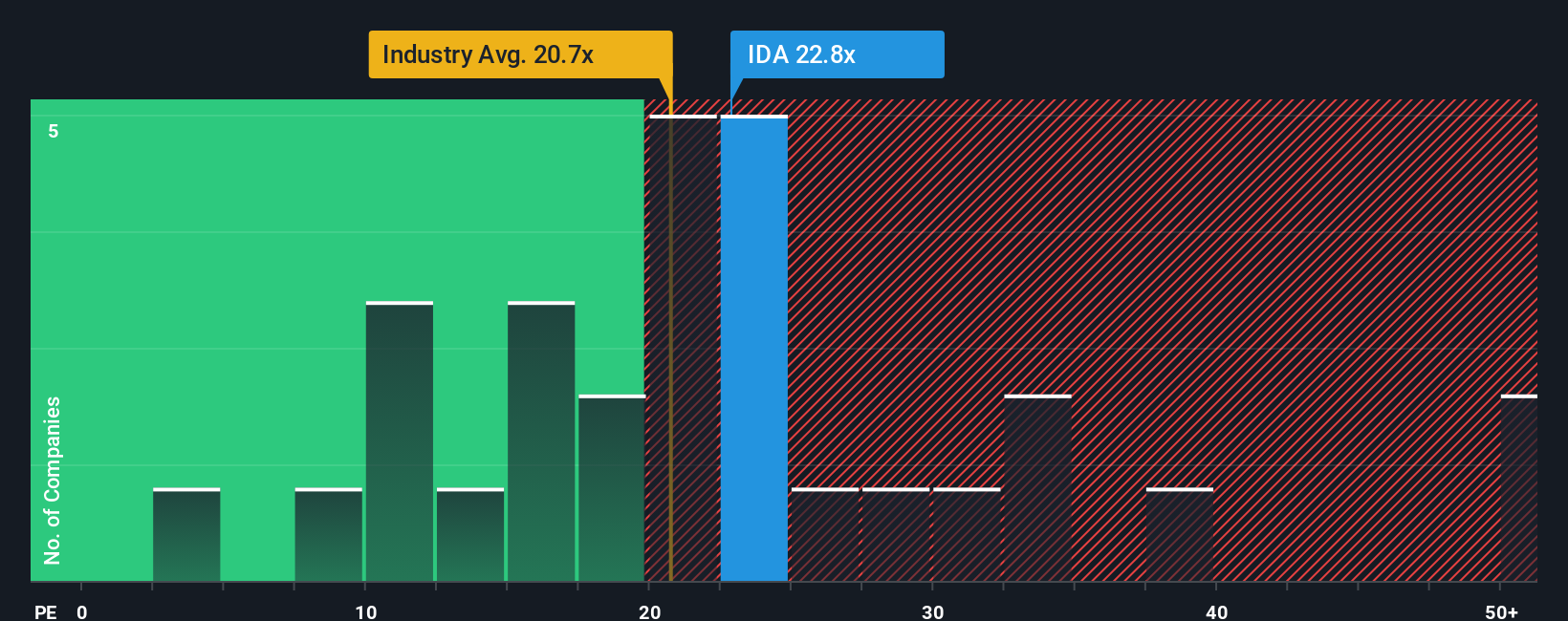

Another View: Testing Value by Industry Benchmarks

Looking at valuation through current market benchmarks, IDACORP’s price-to-earnings ratio stands at 23.3x. That is higher than both the US Electric Utilities industry average of 21x and the fair ratio of 19.9x our models suggest. In practical terms, this premium signals investors are already pricing in some optimism, which could limit upside if expectations fall short. But does the market have it right, or is there hidden risk in this optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDACORP Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your full investing potential by tapping into handpicked opportunities that spotlight emerging trends, resilient performance, and strong yield stories before others catch on.

- Tap into high-yield opportunities and build a more resilient portfolio with these 19 dividend stocks with yields > 3% offering attractive yields above 3% and reliable cash flow histories.

- Get ahead of the curve by searching these 24 AI penny stocks that are forging breakthroughs in artificial intelligence, automation, and smart data solutions.

- Seize the chance to spot value plays using these 901 undervalued stocks based on cash flows, finding solid companies trading below what their cash flows suggest they're really worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives