- United States

- /

- Electric Utilities

- /

- NYSE:FE

FirstEnergy (FE): Assessing the Utility’s Valuation After a 14% Three-Month Stock Gain

Reviewed by Kshitija Bhandaru

FirstEnergy (FE) shares have delivered a 14% gain over the past 3 months, catching the interest of investors watching utility sector trends. The company’s recent momentum could signal renewed attention to its fundamentals and growth prospects.

See our latest analysis for FirstEnergy.

Zooming out, FirstEnergy’s stock has built meaningful momentum this year, with its share price climbing nearly 14% over the past three months and the latest close at $45.46. Looking longer-term, the company’s one-year total shareholder return sits around 9.1%, and those who have held for three to five years have seen robust cumulative gains. This reflects steady compounding rather than recent event-driven volatility. The uptick in share price suggests investors are increasingly willing to look past sector headwinds and bet on FirstEnergy’s improving fundamentals and growth outlook.

If you’re curious what else is gathering steam in today’s market, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With FirstEnergy’s recent run-up and price hovering just shy of analyst targets, investors must consider whether the stock remains undervalued or if the market has already accounted for its future growth potential.

Most Popular Narrative: 1.7% Undervalued

FirstEnergy's recent closing price sits just below the consensus fair value. This suggests investors are considering whether the growth prospects justify a higher multiple. The most popular market narrative focuses on the infrastructure boom and grid investments that are driving expectations for future earnings.

Large-scale infrastructure modernization and grid hardening initiatives, including the $28 billion investment plan through 2029 and a 15% CAGR in transmission rate base, enable higher returns on equity, improved reliability, and ultimately enhance net margins and earnings growth.

Wondering what bold assumptions underlie this price target? The key to this narrative is the projected leap in profit margins and earnings per share as grid investments ramp up. Curious how these financial forecasts fit together? Dig in to uncover what analysts are really betting on for FirstEnergy's future.

Result: Fair Value of $46.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal issues and persistent regulatory pressures could still challenge FirstEnergy’s future earnings outlook. These factors may create potential headwinds for the bullish narrative.

Find out about the key risks to this FirstEnergy narrative.

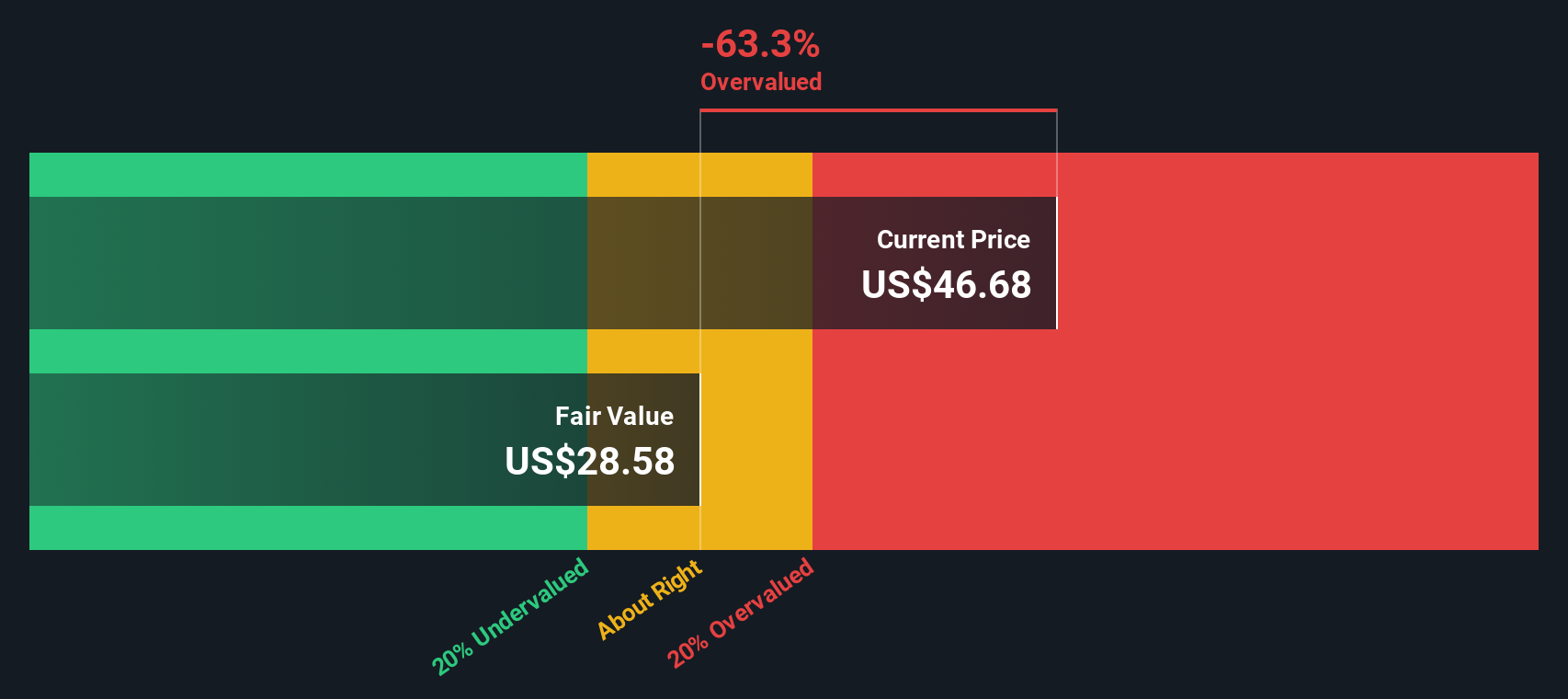

Another View: Our DCF Model Offers a Cautious Perspective

While analyst targets say FirstEnergy is just shy of fairly valued, our SWS DCF model takes a more conservative stance. By estimating future cash flows, it calculates a fair value of $28.64. This suggests the stock currently trades well above this level and could be overvalued. Does this signal the market is too optimistic about growth and stability?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FirstEnergy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FirstEnergy Narrative

If you have your own perspective or enjoy digging into the numbers, you can quickly form your own story in just minutes. Do it your way

A great starting point for your FirstEnergy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Use these powerful tools to spot untapped potential, fresh growth, and income streams in today’s market:

- Seize the chance to uncover high-potential gems with these 909 undervalued stocks based on cash flows. Access companies many investors miss while they’re still attractively priced.

- Target steady income and reliable yields by tapping into these 19 dividend stocks with yields > 3%. Robust dividend payers can show both strength and consistency.

- Harness the momentum of technological breakthroughs by using these 24 AI penny stocks. Support innovators transforming multiple industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives