- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (NYSE:ETR) Announces US$1890 Million Common Stock Offering

Reviewed by Simply Wall St

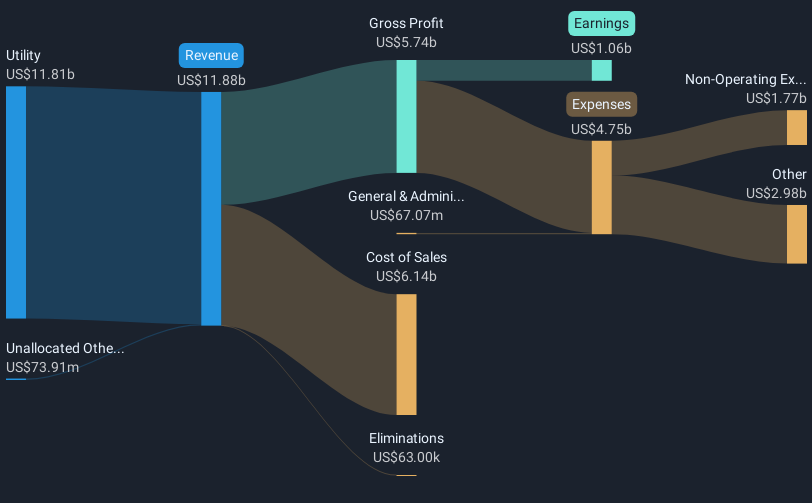

Entergy (NYSE:ETR) has recently announced a $1.89 billion follow-on equity offering, which aligns with the company's efforts to bolster its capital for potential ventures and debt management. This financial maneuver, executed as an at-the-market offering, could reflect positively on its agility to adapt to market conditions and might have contributed to the 14% price increase over the last quarter. Furthermore, despite a significant drop in net income and earnings per share on a year-over-year basis, the slight growth in sales and revenue might provide a nuanced picture of the company's financial health. Additionally, the quarterly dividend affirmation of $0.60 per share may underscore long-term shareholder commitment. In contrast, broader market negativity, peaking with declines in major indexes including the Dow and tech-heavy Nasdaq, highlights the resilience of Entergy’s share price given the prevailing economic headwinds.

Click here and access our complete analysis report to understand the dynamics of Entergy.

Over the last three years, Entergy Corporation (NYSE:ETR) has achieved a total shareholder return of 88.75%. This period has witnessed significant corporate actions, such as the 2:1 stock split announced in November 2024, which may have made shares more accessible to a broader base of investors. Additionally, the company's decision to increase its quarterly dividend in October 2024 might reflect a strong commitment to returning capital to shareholders, potentially enhancing investor sentiment.

The company's share performance has outpaced industry averages over the past year, with a noteworthy contrast between the company's negative earnings growth and the Electric Utilities industry's 8.2% growth. Despite lower profit margins compared to the previous year, the consistent delivery of dividends may have attracted yield-focused investors. Meanwhile, Entergy's adoption of amended bylaws in December 2024 could also demonstrate a focus on governance, influencing investor confidence positively.

- Get the full picture of Entergy's valuation metrics and investment prospects—click to explore.

- Assess the potential risks impacting Entergy's growth trajectory—explore our risk evaluation report.

- Shareholder in Entergy? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives