- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR) Valuation Check as New Louisiana Gas Plants and Meta-Backed Expansion Advance

Reviewed by Simply Wall St

Entergy (ETR) just broke ground on two new combined cycle natural gas plants in north Louisiana, projects regulators approved to boost grid reliability, accommodate Meta’s incoming data center, and support the region’s broader economic expansion.

See our latest analysis for Entergy.

The stock’s 1 day share price return of 1.37 percent, taking Entergy to 94.24 dollars, builds on a solid year to date share price gain of 24.99 percent and a 5 year total shareholder return of 116.97 percent. This signals momentum that reflects growing confidence in its long term grid investment story.

If this kind of infrastructure driven growth theme interests you, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other compelling ideas beyond the utility space.

Yet with Entergy trading near record highs but still below analyst targets, investors face a dilemma: is the market underestimating the earnings power of these new projects, or already pricing in years of regulated growth?

Most Popular Narrative: 9.4% Undervalued

With the narrative fair value at 104.06 dollars versus Entergy’s last close of 94.24 dollars, the valuation case leans toward upside based on accelerating fundamentals.

Capital investment of 40 billion dollars over four years, with an expanded pipeline for renewables, grid modernization, and resilience upgrades, is expected to grow the company's rate base and support above average EPS and earnings growth for several years.

Want to see what powers that growth math? The narrative quietly stacks revenue, margins, and future earnings into a premium multiple most utilities never reach.

Result: Fair Value of $104.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if extreme Gulf weather or unfavorable rate decisions inflate costs faster than regulators allow for recovery.

Find out about the key risks to this Entergy narrative.

Another Lens on Valuation

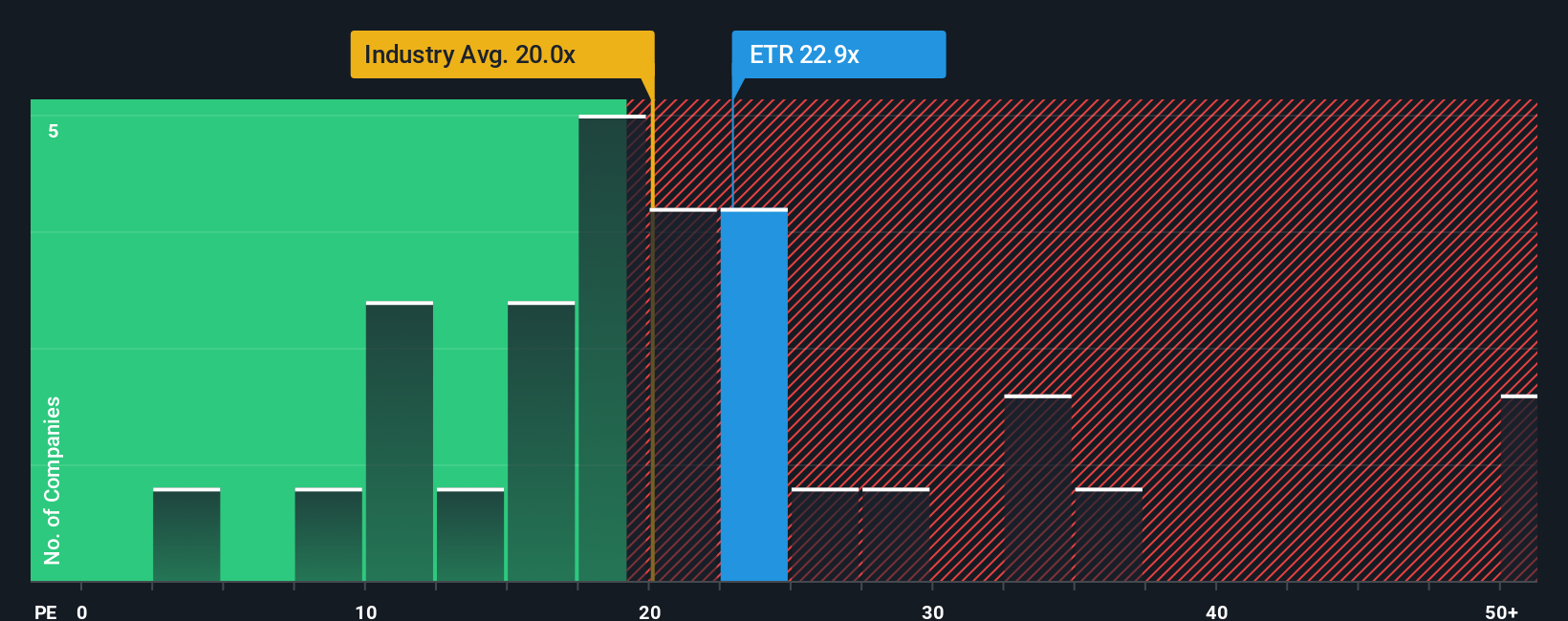

Market based pricing tells a tougher story. Entergy trades at 23.6 times earnings, richer than the US Electric Utilities average of 20.2 times and peers at 19.1 times, but below its 25.2 times fair ratio. Investors must judge whether they are paying up for quality or just overpaying.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If you see the story differently or want to stress test the assumptions using your own inputs, you can build a fresh view in just minutes, Do it your way.

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step and widen your opportunity set with targeted stock ideas on Simply Wall St before the market prices in their full potential.

- Capture potential mispricings by reviewing these 919 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Position yourself for structural growth by assessing these 25 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Strengthen your income strategy by evaluating these 14 dividend stocks with yields > 3% that can add resilience and yield to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026