- United States

- /

- Electric Utilities

- /

- NYSE:ES

How Investors Are Reacting To Eversource Energy (ES) Amid Potential US$12 Billion Clean Energy Cuts

Reviewed by Sasha Jovanovic

- In recent days, reports have surfaced that the U.S. administration is considering a US$12 billion reduction in clean energy funding, a move that could have significant implications for companies like Eversource Energy.

- This development closely follows Eversource's decision to exit a major offshore wind partnership, potentially compounding operational and financial uncertainty for the utility amid an already challenging environment for clean energy investments.

- We’ll now examine how the risk of substantial federal clean energy cuts could affect Eversource's previously discussed investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Eversource Energy Investment Narrative Recap

To be a shareholder in Eversource Energy, you need to believe in regulated utility growth fueled by electrification, grid modernization, and supportive policy, while accepting exposure to regulatory swings and capital cost pressures. The administration’s potential US$12 billion clean energy funding cut raises new questions about near-term federal policy support, but the most immediate catalyst remains rising electricity demand and regulatory approval of cost recovery, whereas the largest risk continues to be regulatory uncertainty in Connecticut; these fundamentals are largely unchanged by the news, though sector sentiment could be affected in the short term.

Among recent announcements, Eversource’s decision to exit its 50% stake in a major offshore wind partnership directly highlights the operational uncertainty facing clean energy initiatives. Given this backdrop, the company’s reaffirmed earnings guidance for 2025, targeting EPS between US$4.67 and US$4.82, provides investors with some baseline expectations during a period marked by shifting federal priorities and energy transition risks.

But with continued volatility in federal policy support, investors should be aware that downside risks remain around regulatory outcomes in Connecticut and...

Read the full narrative on Eversource Energy (it's free!)

Eversource Energy is projected to reach $14.8 billion in revenue and $2.1 billion in earnings by 2028. This outlook is based on analysts forecasting a 4.4% annual revenue growth rate and an earnings increase of about $1.24 billion from current earnings of $858 million.

Uncover how Eversource Energy's forecasts yield a $70.77 fair value, a 4% downside to its current price.

Exploring Other Perspectives

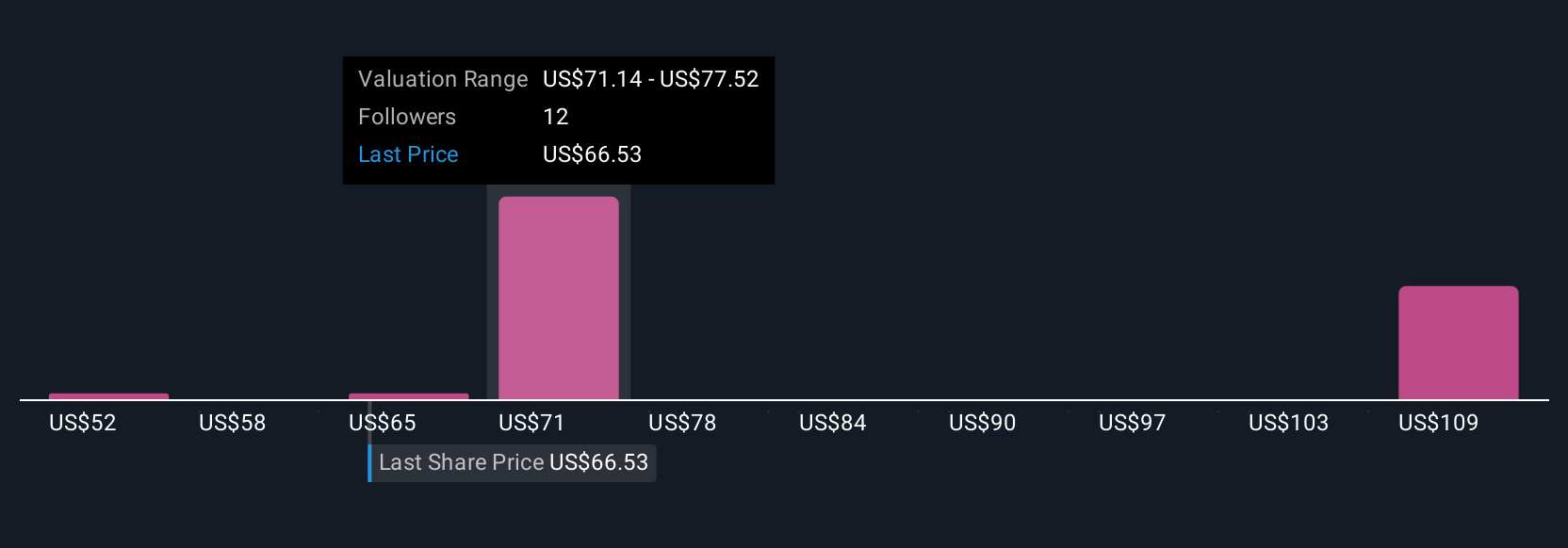

Private fair value estimates from the Simply Wall St Community range from US$52 to US$119.56 based on four analyses. While opinions differ widely, uncertain regulatory outcomes in Connecticut may weigh heavily on Eversource’s future performance, so check out several contrasting perspectives before drawing your own conclusion.

Explore 4 other fair value estimates on Eversource Energy - why the stock might be worth 29% less than the current price!

Build Your Own Eversource Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eversource Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Eversource Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eversource Energy's overall financial health at a glance.

No Opportunity In Eversource Energy?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives