- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (NYSE:DUK) Declares Quarterly Dividends Of US$1 And US$0.36

Reviewed by Simply Wall St

Duke Energy (NYSE:DUK) recently announced dividends on both its preferred and common stock, marking its ongoing commitment to shareholder value. Over the last quarter, the company's stock price rose by 8%, a movement that aligns generally with broader market trends. While the company's strategic partnership with GE Vernova and regulatory compliance efforts, such as license renewals for nuclear plants, may have added positive momentum, the overall market rally driven by better-than-expected earnings reports and optimism on trade talks likely offered a supportive backdrop for Duke's upward price movement.

Duke Energy’s recent dividend announcement underscores its commitment to enhancing shareholder value, aligning with broader market trends that may have supported the recent 8% rise in its share price. Over a longer five-year horizon, the company's total shareholder return, including dividends, reached 85.03%, illustrating substantial growth. This reflects a strong performance contextually, considering Duke Energy’s one-year return exceeded the US Electric Utilities industry, which saw a 15.1% increase over the same period.

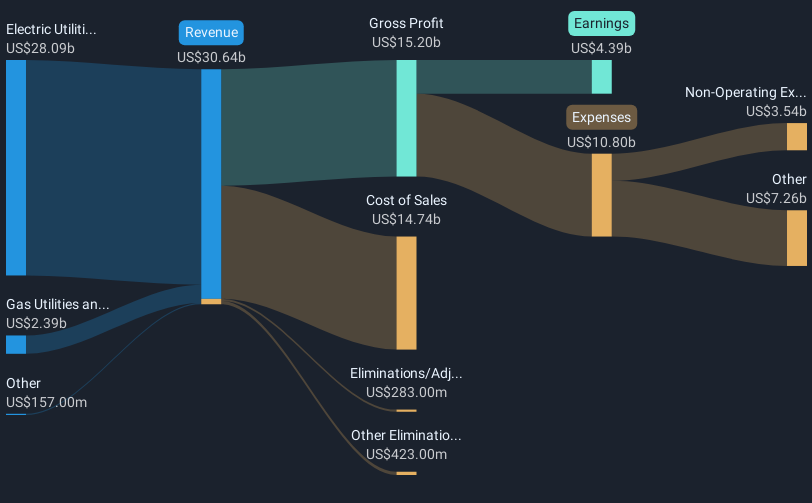

The news of strategic partnerships and regulatory stride could bolster the $83 billion infrastructure investment plan aimed at improving service reliability and expanding capacity through 2029. This plan is integral to the projected revenue growth of 4% annually and earnings climbing to US$5.7 billion by 2028. Analysts foresee enhancements in profit margins, forecasting an increase from 14.7% to 16.8%. If these projections hold true, the alignment with the consensus price target is facilitated, although the current share price of US$121.7 remains close to the target of US$124.21. This indicates that the market might already be pricing in some of the growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives