- United States

- /

- Other Utilities

- /

- NYSE:DTE

We think DTE Energy Company's (NYSE:DTE) CEO May Struggle To See Much Of A Pay Rise This Year

Key Insights

- DTE Energy's Annual General Meeting to take place on 2nd of May

- CEO Jerry Norcia's total compensation includes salary of US$1.34m

- The total compensation is similar to the average for the industry

- DTE Energy's EPS grew by 4.7% over the past three years while total shareholder return over the past three years was 3.1%

Performance at DTE Energy Company (NYSE:DTE) has been reasonably good and CEO Jerry Norcia has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 2nd of May. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for DTE Energy

Comparing DTE Energy Company's CEO Compensation With The Industry

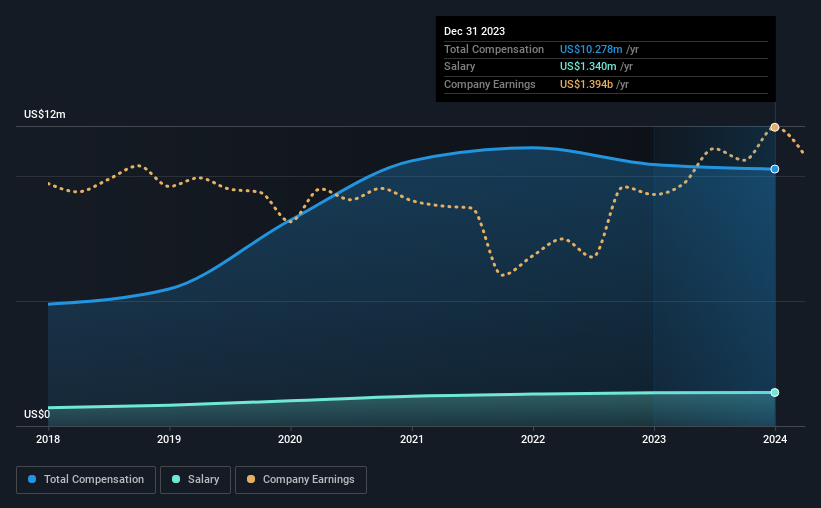

According to our data, DTE Energy Company has a market capitalization of US$23b, and paid its CEO total annual compensation worth US$10m over the year to December 2023. This means that the compensation hasn't changed much from last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.3m.

For comparison, other companies in the American Integrated Utilities industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$9.6m. From this we gather that Jerry Norcia is paid around the median for CEOs in the industry. What's more, Jerry Norcia holds US$36m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.3m | US$1.3m | 13% |

| Other | US$8.9m | US$9.1m | 87% |

| Total Compensation | US$10m | US$10m | 100% |

Talking in terms of the industry, salary represented approximately 13% of total compensation out of all the companies we analyzed, while other remuneration made up 87% of the pie. There isn't a significant difference between DTE Energy and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

DTE Energy Company's Growth

DTE Energy Company's earnings per share (EPS) grew 4.7% per year over the last three years. It saw its revenue drop 34% over the last year.

We generally like to see a little revenue growth, but the modest EPS growth gives us some relief. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has DTE Energy Company Been A Good Investment?

With a total shareholder return of 3.1% over three years, DTE Energy Company has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for DTE Energy (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DTE

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives