- United States

- /

- Other Utilities

- /

- NYSE:DTE

How Investors May Respond To DTE Energy (DTE) Analyst Downgrade Amid Earnings and Market Concerns

Reviewed by Sasha Jovanovic

- Following a recent analyst downgrade by Scotiabank, DTE Energy was cited for limited earnings upside and reduced investor interest amid a risk-on market backdrop.

- This shift in sentiment arises despite DTE’s projected earnings growth and ongoing investments in clean energy, as analysts expressed concern about guidance and slower growth from new customer segments.

- We’ll examine how the recent analyst downgrade over limited earnings potential may impact DTE Energy’s long-term investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

DTE Energy Investment Narrative Recap

To be a DTE Energy shareholder, you need to believe that large-scale investments in renewables, grid modernization, and rising electricity demand from data centers can drive steady long-term growth while the company manages execution and regulatory risks. The recent downgrade by Scotiabank points to near-term headwinds, primarily muted earnings upside and lower investor interest in regulated utilities, but does not materially change the main short-term catalyst, which is the growing demand from data centers. Execution delays or regulatory setbacks remain the main risks to watch, and these have not been directly altered by the downgrade.

The most relevant recent announcement is DTE’s completion of a US$600 million debenture sale, intended to repay short-term borrowings and support general corporate purposes. This move strengthens the company’s balance sheet, which may help it pursue its capital-intensive growth projects at a time when execution and financial discipline are critical to capturing the earnings uplift from burgeoning data center demand. But while the company pursues growth, investors should also pay close attention to...

Read the full narrative on DTE Energy (it's free!)

DTE Energy's narrative projects $15.3 billion in revenue and $1.8 billion in earnings by 2028. This requires 2.6% yearly revenue growth and a $0.4 billion increase in earnings from the current level of $1.4 billion.

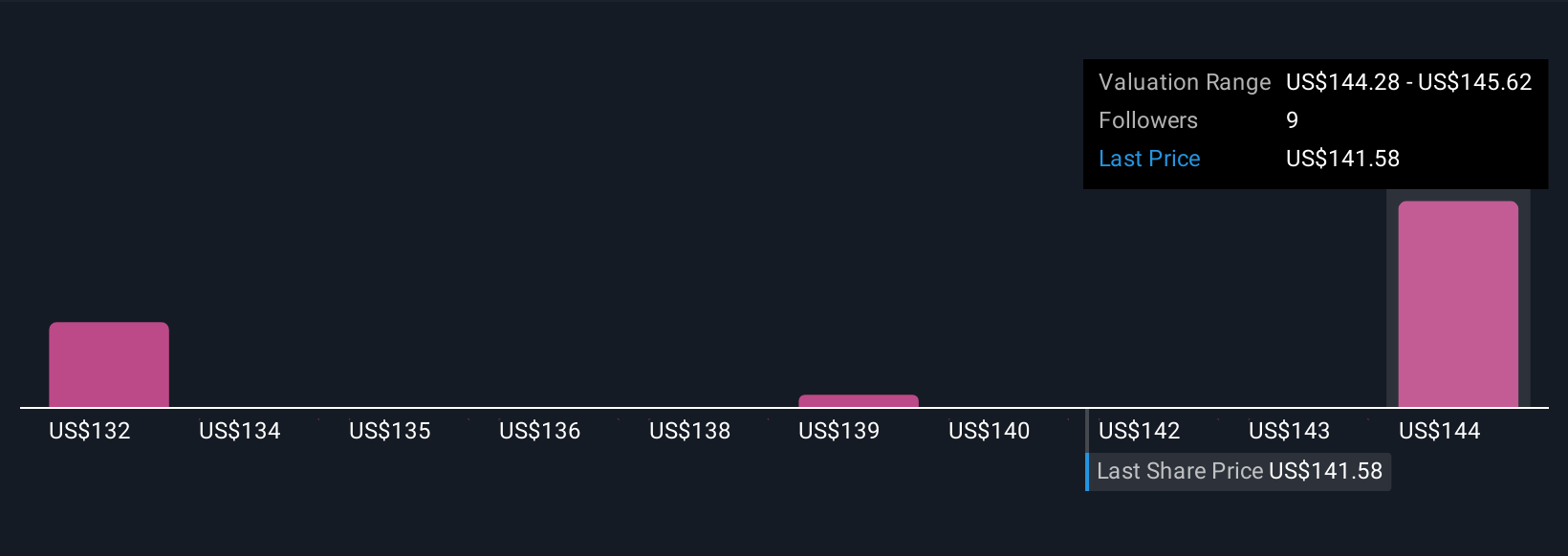

Uncover how DTE Energy's forecasts yield a $145.62 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range from US$131.49 to US$145.62 per share. While you will find a diversity of views here, the speed and scale of DTE’s data center-driven load growth could prove pivotal in determining outcomes beyond what any single forecast suggests.

Explore 3 other fair value estimates on DTE Energy - why the stock might be worth as much as $145.62!

Build Your Own DTE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DTE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DTE Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives