- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy’s Valuation in Focus as Data Center Approval Draws Scrutiny from State and Environmental Groups

Reviewed by Simply Wall St

DTE Energy (DTE) is drawing increased scrutiny after its request for fast-tracked approval of contracts to power a new data center in Saline Township. Michigan’s Attorney General and environmental groups are voicing concerns about transparency and customer impact.

See our latest analysis for DTE Energy.

Despite headline-grabbing scrutiny around its data center contracts, DTE Energy’s stock has quietly pushed higher, delivering a nearly 13% share price return year-to-date and a 12.4% total return over the last year. Longer-term holders have seen solid gains, with a 31.8% three-year and 50.5% five-year total shareholder return. This momentum suggests investors are increasingly confident in DTE’s ability to manage both operational growth and regulatory challenges.

If regulatory risks and large projects have you rethinking your strategy, it could be the right moment to broaden your view and discover fast growing stocks with high insider ownership

Yet with shares trading just under 10% below average analyst price targets and continued scrutiny of its major projects, the real question is whether DTE Energy is undervalued or if the market is already factoring in its future growth prospects.

Most Popular Narrative: 9% Undervalued

With DTE Energy’s fair value from the consensus narrative set at $150.31 versus a last close of $136.78, sentiment is leaning toward meaningful upside. The dynamic is driven by expectations of sustained earnings strength and disciplined expansion.

A major upcoming catalyst for DTE is the rapid expansion in electricity demand being driven by hyperscale data centers, with 3 gigawatts of advanced negotiations and an additional 4 gigawatts in the pipeline. These loads, operating at nearly 90% capacity factors, will materially increase revenues and provide significant headroom for rate growth while improving overall system load factor and grid utilization.

Curious about what’s powering that higher fair value? The narrative is built on a punchy blend of growth optimism, smart capital bets, and a profit outlook that challenges typical utility valuations. Want to see which specific financial projections are fueling so much optimism, especially with some bold moves not seen in peer companies? Dive into the numbers and uncover what’s driving analyst conviction.

Result: Fair Value of $150.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory pushback or costly delays on DTE’s ambitious expansion plans could quickly shift investor sentiment and test the current optimistic outlook.

Find out about the key risks to this DTE Energy narrative.

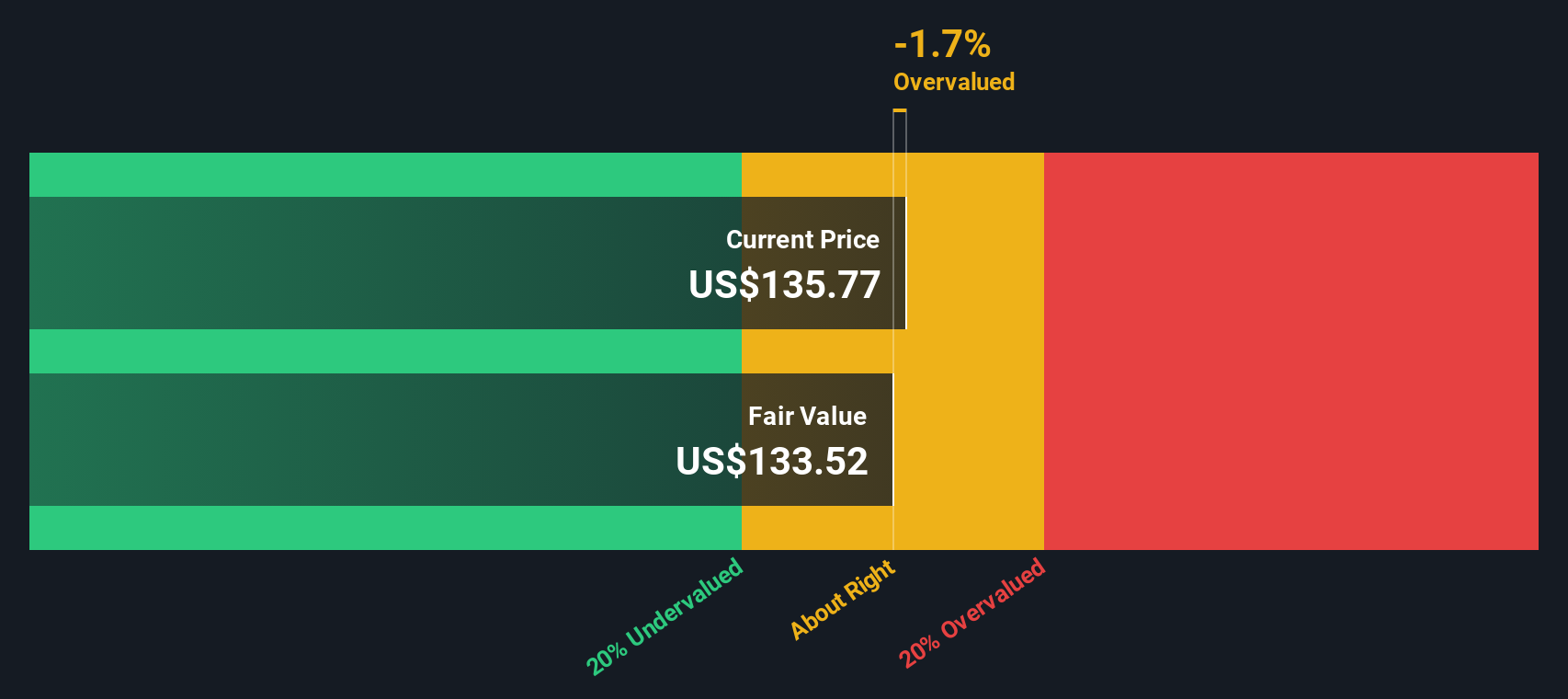

Another View: The SWS DCF Model

Taking a different approach, our DCF model currently estimates DTE Energy’s fair value at $133.30, slightly below the current share price of $136.78. While this does not indicate significant overvaluation, it challenges the consensus narrative’s optimism and raises the question: which perspective is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DTE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DTE Energy Narrative

You don't have to take these perspectives at face value. If you want to dig into the data on your own terms, building your own narrative is simple and quick. Do it your way

A great starting point for your DTE Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to just one opportunity when there are so many ways to strengthen your portfolio? Leverage Simply Wall Street’s handpicked screeners to seize what others might miss.

- Tap into tomorrow’s digital breakthroughs by checking out these 25 AI penny stocks for companies at the forefront of artificial intelligence innovation.

- Boost your income potential and stability with these 15 dividend stocks with yields > 3% which offers powerful dividend yields and resilient businesses.

- Capitalize on untapped upside and market mispricings among these 922 undervalued stocks based on cash flows with exciting financial prospects others may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.