- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy’s 2024 Net-Zero Plan Might Change the Case for Investing in DTE (DTE)

Reviewed by Sasha Jovanovic

- DTE Energy recently released its 2024 Sustainability Report, reaffirming its plan to eliminate coal use by 2032 and achieve net-zero carbon emissions while documenting ongoing clean energy progress. The report aligns with recognized ESG frameworks and highlights advances in reliability, community initiatives, and operational milestones relevant to investors and stakeholders.

- By emphasizing a clear timeline and transparent progress for decarbonization, DTE is signaling its commitment amid accelerating statewide renewable energy targets and increasing regulatory and investor focus on sustainability impacts.

- We'll examine how DTE Energy's strengthened long-term environmental commitments reflected in the new report reshape the company's investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DTE Energy Investment Narrative Recap

To be a shareholder in DTE Energy, you need to believe in the long-term opportunity from Michigan’s surging electricity demand, especially from data centers, and the company's ability to manage its multibillion-dollar clean energy transition. The release of the 2024 Sustainability Report provides credibility to DTE's environmental objectives, but it does not materially alter the immediate catalyst: successfully executing generation and grid projects to meet rising loads, with cost control being the largest risk right now.

Among recent announcements, completion of the Polaris Solar Park stands out, expanding renewable capacity as DTE works toward Michigan’s 2030 renewable energy goals. This development is particularly relevant as it highlights tangible progress on infrastructure that supports both regulatory commitments and the company’s broader plan to capture data center-driven revenue, a key short-term catalyst for growth.

By contrast, investors should be aware that as DTE moves quickly to expand renewable generation, the risk of project delays and cost overruns remains...

Read the full narrative on DTE Energy (it's free!)

DTE Energy's outlook anticipates $15.3 billion in revenue and $1.8 billion in earnings by 2028. This is based on an annual revenue growth rate of 2.6% and a $0.4 billion increase in earnings from the current $1.4 billion.

Uncover how DTE Energy's forecasts yield a $147.17 fair value, a 4% upside to its current price.

Exploring Other Perspectives

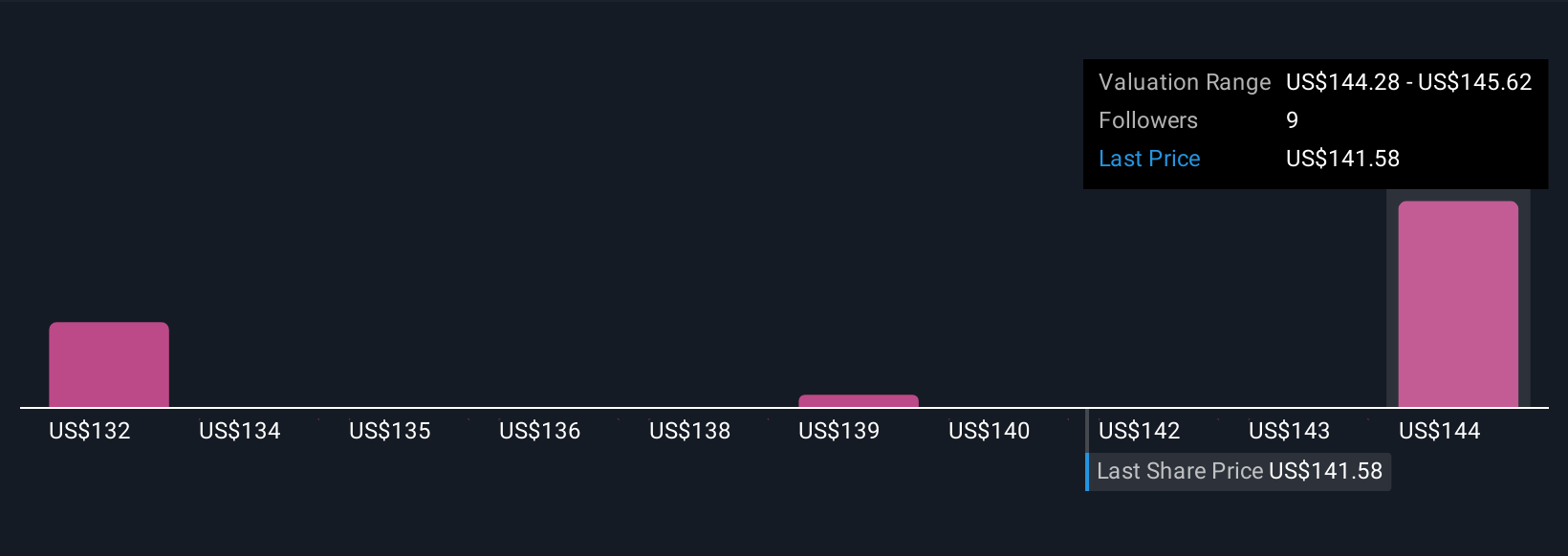

Simply Wall St Community members submitted three fair value estimates for DTE Energy ranging from US$132.31 to US$147.17 per share. While many see growth upside from new data center demand, execution risks on major grid upgrades and renewables could shape the outcome in ways that differ from consensus, so check out these community viewpoints for broader insight.

Explore 3 other fair value estimates on DTE Energy - why the stock might be worth as much as $147.17!

Build Your Own DTE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DTE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DTE Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Second-rate dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives