- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy (NYSE:DTE) Declares US$1.09 Dividend for Shareholders in July 2025

Reviewed by Simply Wall St

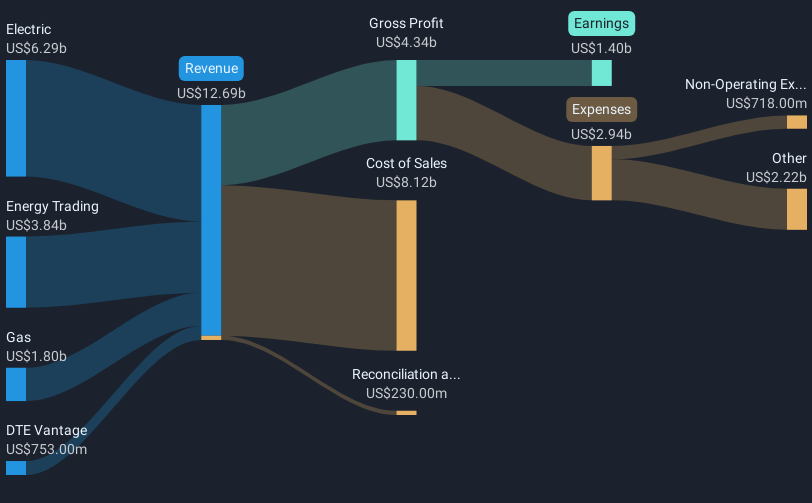

DTE Energy (NYSE:DTE) recently declared a $1.09 per share dividend, affirming its steady dividend strategy. The company's stock rose 10% over the last quarter, against a backdrop of market uncertainty, including fluctuating indices with the Dow Jones slightly declining 0.5% and the S&P 500 down 0.4%. DTE’s strong earnings report, with sales and net income increases from the previous year, likely added confidence for investors. Additionally, the company's focus on renewable energy projects, like the completion of Pine River Solar Park, supports its financial robustness, potentially bolstering investor sentiment during market fluctuations.

The recent dividend declaration by DTE Energy (NYSE:DTE) and its quarterly stock price increase of 10% align with its positive earnings report and growing focus on renewable energy. This strategic focus, particularly the completion of Pine River Solar Park, may positively impact its revenue and earnings outlook. Analysts predict an increase in revenue growth driven by grid modernization in Michigan and heightened demand from data centers. These initiatives could bolster earnings, as reflected in assumptions of future net margin improvements.

Over the past five years, DTE Energy has delivered a total shareholder return, including dividends, of 92.27%, which demonstrates a robust long-term performance. This trajectory compares favorably to its recent one-year performance, where DTE exceeded the Integrated Utilities industry's 15.4% return. This indicates a solid performance relative to its peers.

In terms of revenue and earnings forecasts, ongoing investments in infrastructure and renewable energy are vital. However, potential risks such as regulatory approvals, investment expenses, and fluctuations in demand could impact these projections. The current share price of US$137.66 is marginally below the consensus analyst price target of US$140.78, suggesting a cautious but positive outlook among analysts regarding the stock's potential upside.

Explore DTE Energy's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives