- United States

- /

- Other Utilities

- /

- NYSE:DTE

A Fresh Look at DTE Energy’s Valuation After Leadership Changes and Strategic Communications Shift

Reviewed by Simply Wall St

DTE Energy (DTE) has announced an executive change, appointing Brenda Craig as Chief Communications Officer to succeed Paula Silver, who retires after a decade. This leadership transition reflects an evolving approach to stakeholder engagement and community initiatives.

See our latest analysis for DTE Energy.

DTE Energy’s share price has gained notable momentum lately, with a nearly 18% rise year-to-date and a 4.8% lift over the past month. Looking long term, its total shareholder return has been robust, up more than 61% over five years. This highlights stable performance even as the company navigates leadership changes and adapts to new sector developments.

If you’re watching DTE’s moves and wondering what other opportunities are out there, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With strong recent gains and a robust track record, investors are left to wonder if DTE Energy is still undervalued or if the current share price already reflects the company's future growth prospects.

Most Popular Narrative: 3% Undervalued

At $142.69, DTE Energy’s last close price sits just below the fair value estimate of $147.17. The most-followed narrative calls for a modest upside. This small gap signals that market watchers see a balanced risk and reward scenario, but it is the company’s grid investments that are drawing the spotlight.

"DTE's $30 billion multi-year capital plan is heavily focused (>90%) on grid modernization, digitalization, and reliability upgrades, including deployment of over 220 smart grid devices this year. This is already showing a 70% year-over-year improvement in reliability. These investments are expected to drive regulated asset base growth, supporting long-term earnings stability and margin improvement from lower O&M expenses."

DTE’s future fair value calculation doesn’t just hinge on typical industry growth. There is a strategic bet on an upgraded grid, better margins, and profit expansion, built on bold forecasts for system upgrades, regulatory tailwinds, and a rising profit multiple. How are analysts connecting these high-impact moves to higher earnings by 2028? The details might surprise you.

Result: Fair Value of $147.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hurdles around grid upgrades and potential regulatory pushback could threaten DTE’s earnings outlook and put pressure on its profit margins in coming years.

Find out about the key risks to this DTE Energy narrative.

Another View: How Do Trading Multiples Stack Up?

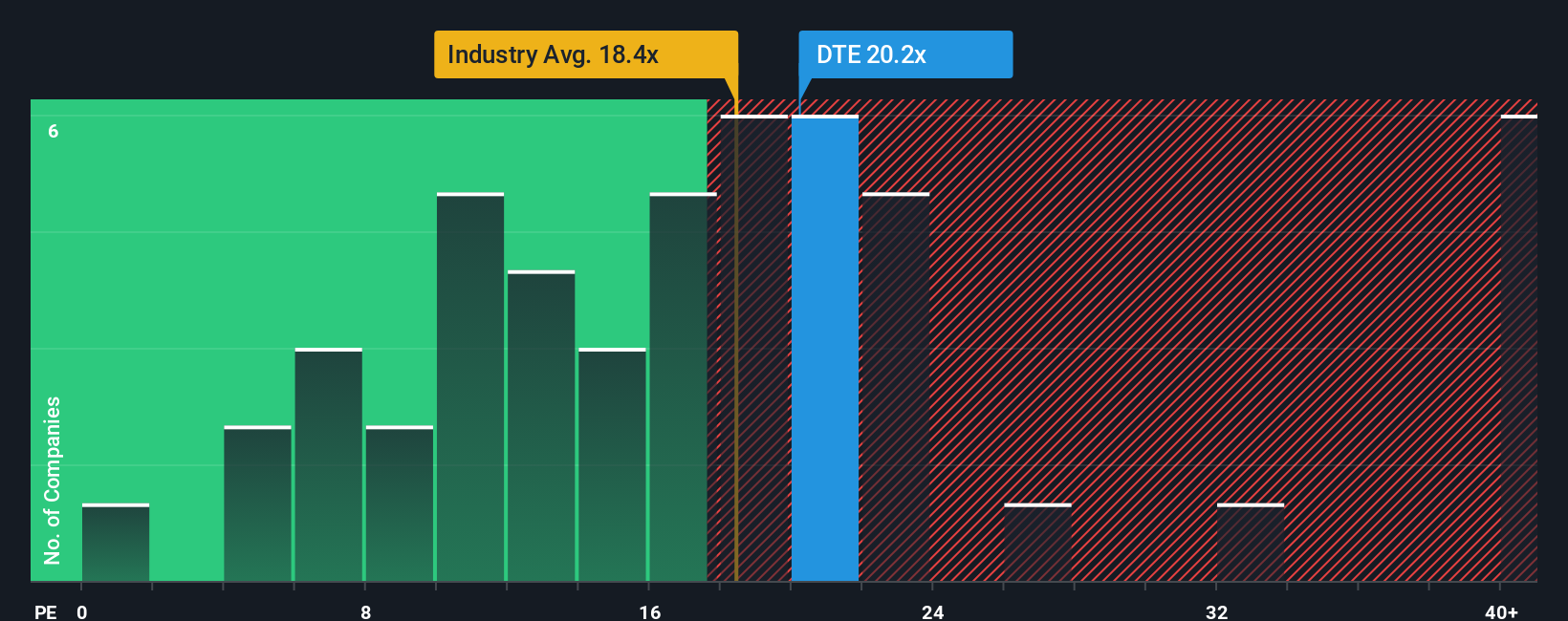

Looking at DTE’s valuation through the lens of its price-to-earnings ratio reveals a different story. At 20.6x, DTE trades above the global industry average of 18.6x, but below its peer group at 24x, and just above its fair ratio of 20.4x. This gap suggests shares are neither a screaming bargain nor overpriced. However, valuation risks could shift quickly if broader industry sentiment changes. Which metric will ultimately set the tone for DTE’s next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DTE Energy Narrative

If you have a different view or prefer a hands-on approach, you can quickly shape your own DTE Energy narrative in just a few minutes with Do it your way.

A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond the obvious. Expand your opportunities with fresh trends, high potential sectors, and stable income ideas right now using these screeners.

- Accelerate your portfolio growth by checking out these 874 undervalued stocks based on cash flows, where strong fundamentals might signal tomorrow's winners before the crowd notices.

- Capture steady income streams by reviewing these 17 dividend stocks with yields > 3%, which is packed with companies offering yields above 3% for financial confidence and reliable returns.

- Tap into disruptive innovation and see which companies are at the forefront with these 26 AI penny stocks focused on artificial intelligence breakthroughs that could change entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Second-rate dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives