- United States

- /

- Other Utilities

- /

- NYSE:D

Is Dominion Energy’s Clean Energy Progress Justifying the 15% Share Price Rally in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Dominion Energy's current share price really reflects its true worth? You are not alone, and there's plenty to consider before making your next move.

- Shares have climbed 6.0% over the past month and are now up 15.0% since the start of the year, hinting at renewed optimism and possibly shifting sentiment around the company's outlook.

- One major reason behind this momentum is recent news about Dominion's ongoing strategic review and continued progress in its clean energy initiatives, including permitting advances for offshore wind projects. These developments have caught the attention of both investors and analysts, offering a fresh narrative around the company's growth potential and long-term strategy.

- When it comes to valuation, Dominion Energy scores 2 out of 6 on our undervaluation checks, so there is still some work to do before it qualifies as a top value pick. To dig deeper, we will walk through different valuation methods, and at the end introduce a novel approach to valuation that ties it all together.

Dominion Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dominion Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company’s true value by projecting its future dividend payments and discounting them back to their present value. This approach is particularly relevant for mature companies like Dominion Energy, which have consistent dividend track records.

For Dominion Energy, the latest data shows an annual dividend per share of $2.69. The company's return on equity stands at 6.72%, but the payout ratio is unusually high at 105.41%, meaning Dominion is paying out more than it earns in profits. As a result, the model calculates a slightly negative growth rate for future dividends, reflecting concerns about long-term sustainability. The expected long-term dividend growth rate sits at approximately -0.36% per year, indicating minimal room for future increases.

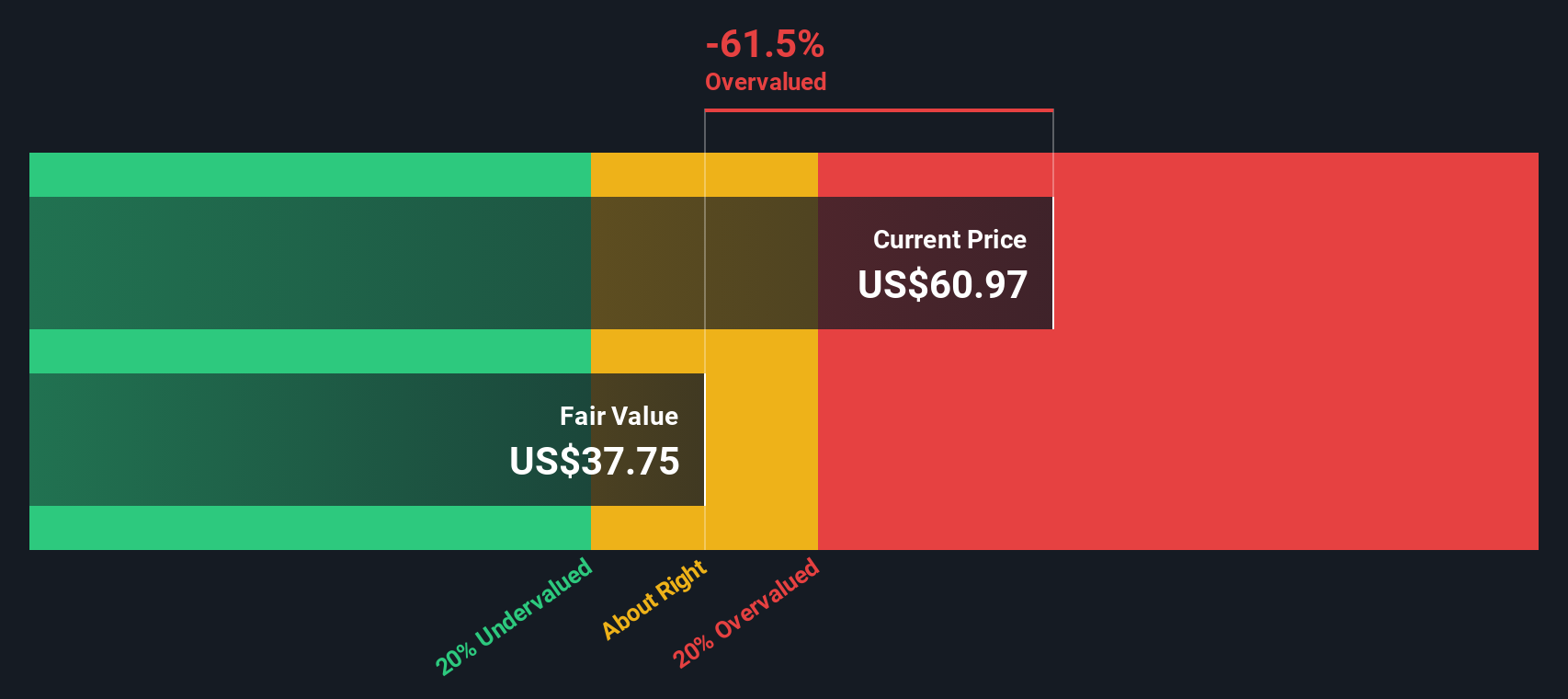

Comparing Dominion Energy’s estimated intrinsic value using the DDM, the model arrives at $36.73 per share. With the stock trading well above this figure, the DDM implies the shares are overvalued by 70.3%. This signals caution for value-focused investors. Despite recent momentum, current prices appear stretched when put under the dividend microscope.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Dominion Energy may be overvalued by 70.3%. Discover 923 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dominion Energy Price vs Earnings (PE) Analysis

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies such as Dominion Energy. It relates a company’s share price to its per-share earnings, helping investors gauge how much they are paying for a dollar of earnings today. This is a key consideration for companies with steady profitability.

Growth expectations and risk levels play a big role in determining what constitutes a “fair” PE ratio. Companies with stronger growth prospects or lower perceived risk often command higher multiples. On the other hand, slower growth or greater uncertainty typically brings the multiple down.

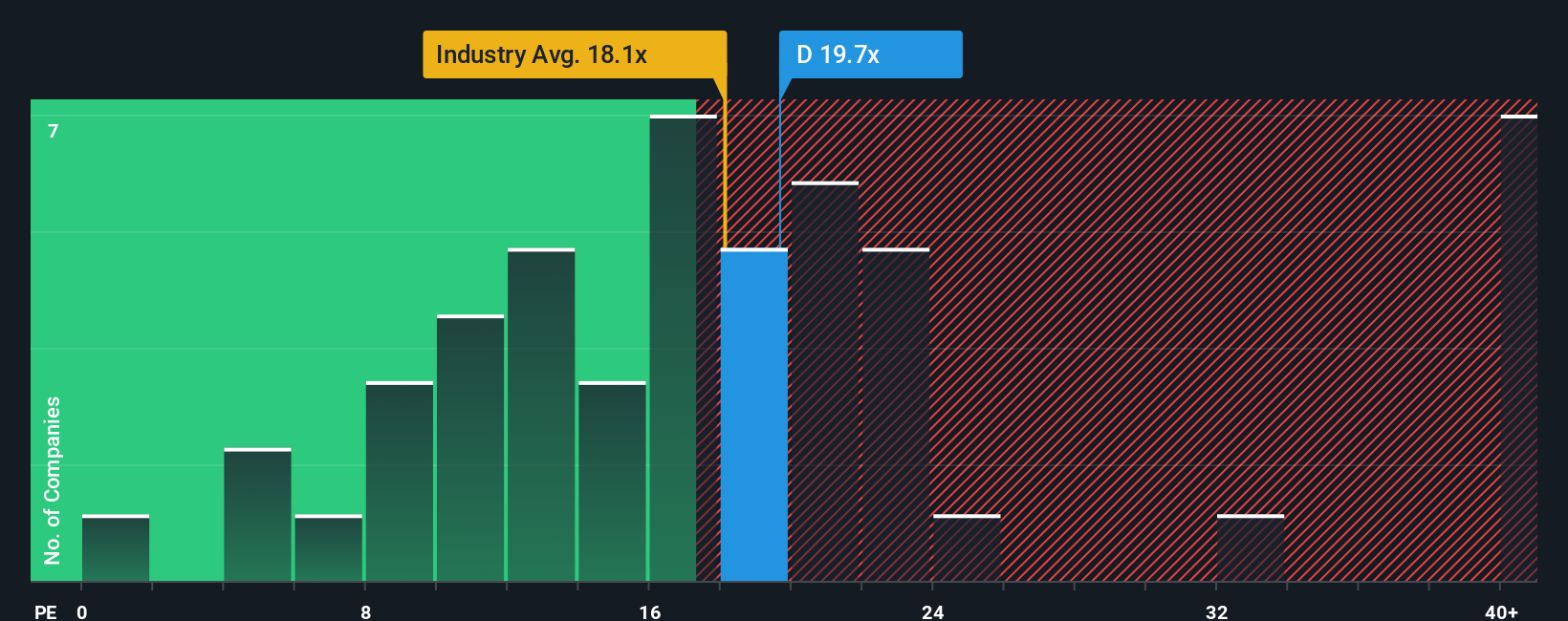

Dominion Energy currently trades at a PE ratio of 20.46x. This is slightly above the average for the integrated utilities industry at 18.56x, but just under the peer average of 22.07x. These benchmarks suggest Dominion is valued roughly in line with comparable companies, neither at a steep discount nor a clear premium.

Simply Wall St’s proprietary “Fair Ratio” model offers another perspective. Unlike simple industry or peer averages, the Fair Ratio (23.28x for Dominion Energy) factors in the company’s unique earnings outlook, risk profile, profit margins, market capitalization, and industry dynamics, providing a more nuanced view of what the company’s PE multiple should be.

Comparing Dominion’s current PE to its Fair Ratio, the gap is relatively narrow. This suggests the stock is priced about right using this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dominion Energy Narrative

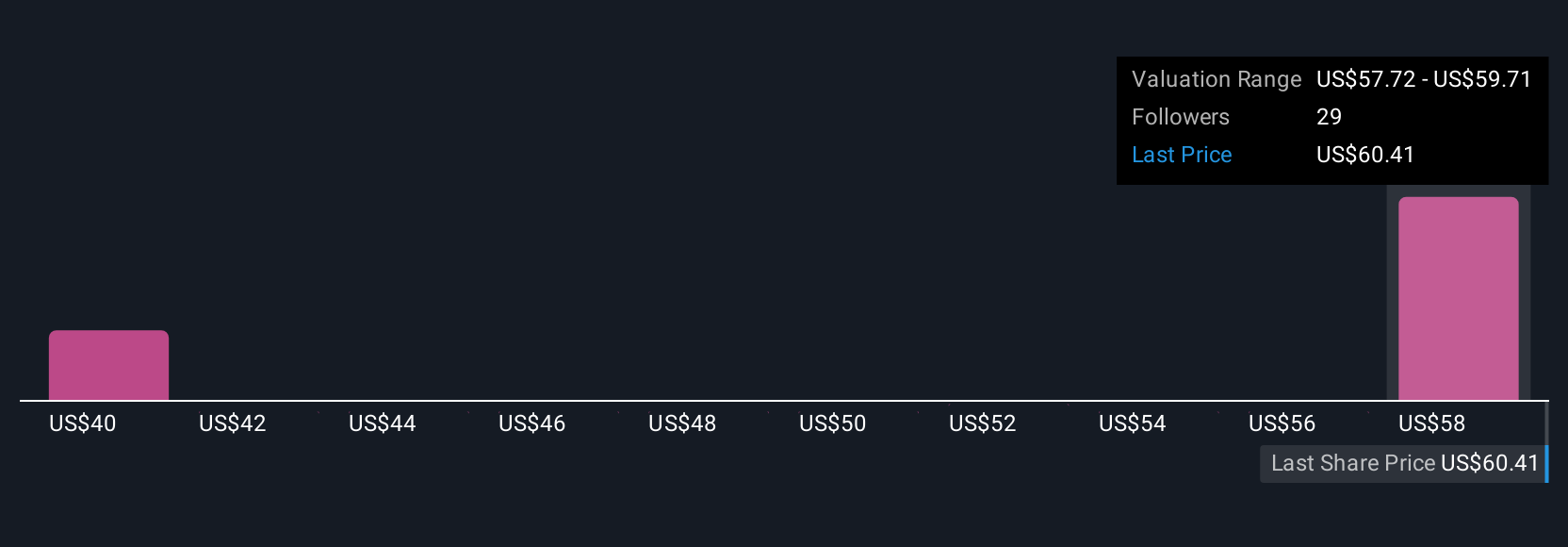

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven perspective on a company. Essentially, it is how you connect Dominion Energy’s business trends and recent news to your own forecasts for revenue, profit margins, and fair value.

Instead of only looking at numbers in isolation, Narratives help you bring together what you know about Dominion’s regulated utility focus, renewables expansion, and regulatory environment, and link that story directly to the company’s financial future. On Simply Wall St’s Community page, Narratives let you create and compare these stories in a simple, guided format used by millions of investors, making it easy to frame your buy or sell decisions based on how your fair value aligns with the market price.

Since Narratives automatically update whenever new developments arise, your decisions stay fresh and relevant. For example, an optimistic investor might build a Narrative around Dominion’s success with clean energy projects and assign a fair value of $67.00, expecting robust long-term returns, while a more cautious investor might worry about project risks and regulatory hurdles, resulting in a lower fair value estimate of $54.00. Either way, Narratives put you in control and allow you to act on your convictions rather than simply react to the market.

Do you think there's more to the story for Dominion Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.